Nikon 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nikon Medium Term Management Plan

NEW DIRECTION:

IN PURSUIT OF A STRONGER NIKON

Background

The business environment surrounding Nikon is changing at a

fast rate. There has been further shrinkage of semiconductor

devices and the market has expanded through diverse prod-

ucts that use semiconductors. Meanwhile, LCD panels continue

to get larger. The digital SLR camera market keeps growing

and competition intensifying, while there is continued advance-

ment in digital networks. Expansion of the bioscience market is

another key characteristic of the modern era.

To keep pace, Nikon has formulated a three-year medium

term management plan that will run until the end of the

year ending March 31, 2009. Building on the improvement

in business performance in the years ended March 31, 2005

and 2006, the plan aims to further accelerate expansion

of profi t-earning capacity and to create a strong business

structure that can generate sustainable growth.

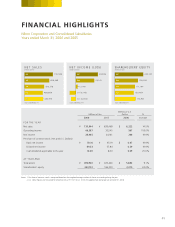

Based on the plan, consolidated targets for the year end-

ing March 31, 2009 include net sales of ¥900 billion, oper-

ating income of ¥90 billion, an operating income ratio to

net sales of 10% and a debt-equity ratio under 30%.

CONSOLIDATED FINANCIAL TARGET

Consolidated operating income ratio 2009 : 10%

(millions of yen)

Net Sales

Operating Income 66,587

730,944

90,000

900,000

2006 2009

D/E Ratio 74% Under 30%

05

Years ended and ending March 31