Navy Federal Credit Union 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report 5

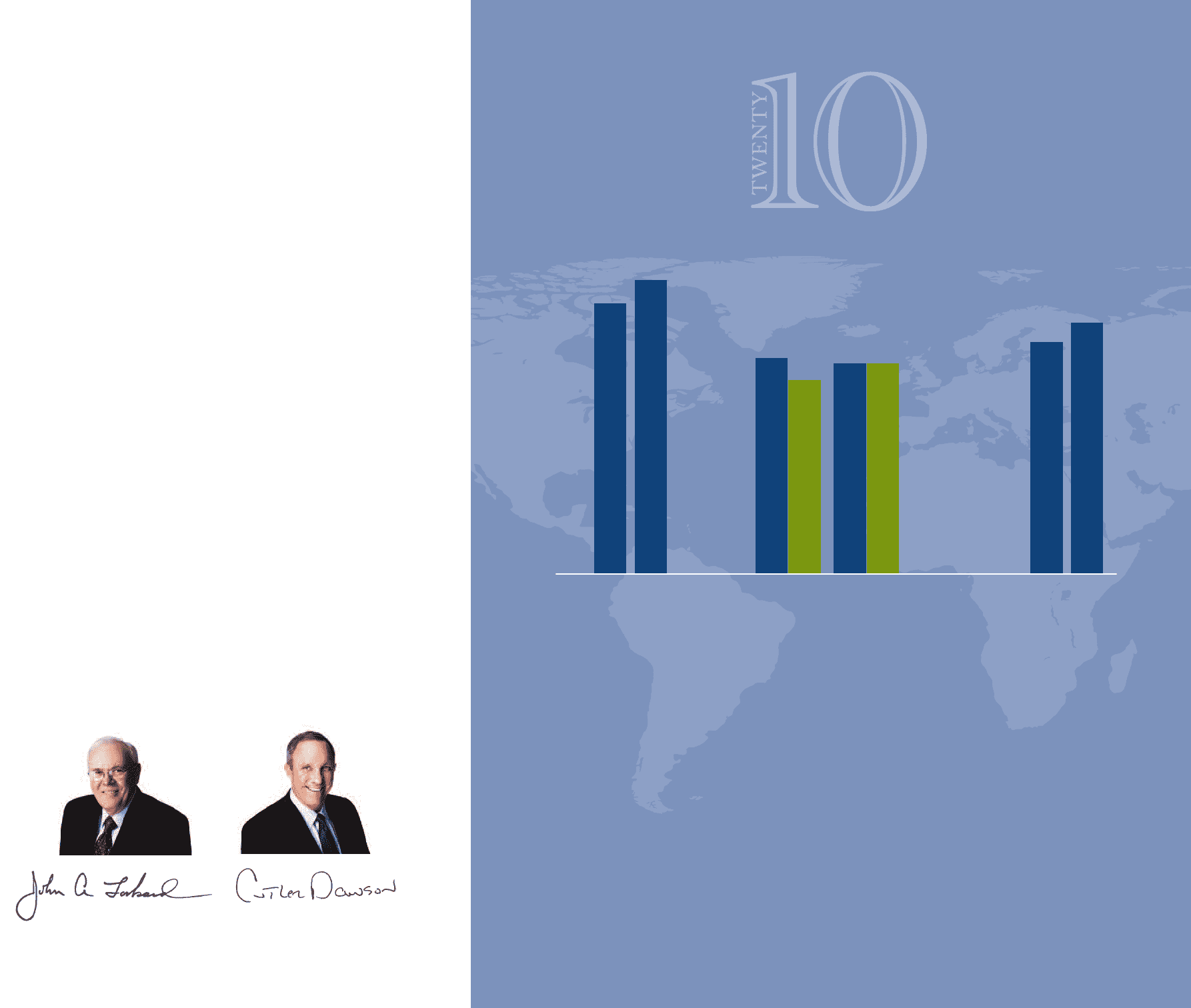

Assets Loans / Savings Members

$44.2 $31.2/$31.2 3,637,213

(Dollars in Billions) (Dollars in Billions)

$39.6

5

10

15

20

25

30

35

2009

$44.2

2010

40

$31.4

$28.4

$31.2

$31.2

5

10

15

20

25

30

3,408,432

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,637,213

3,500,000

2009 2010 2009 2010

Navy Federal Credit Union

4

John A. Lockard Cutler Dawson

Chairman President

Navy Federal had an outstanding year in 2010, despite the lingering economic challenges facing the

nation at large. At a time when many financial institutions were reluctant to extend credit, introduce

new services, or invest in improving service, Navy Federal did all that and much more.

Membership grew by over 220,000 in 2010, bringing total membership to more than 3.6 million, an increase

of nearly 7%. Assets increased $4.6 billion to end the year at $44.2 billion, up 11.6% from the previous

year. Total savings increased $2.8 billion to reach $31.2 billion. Net worth, a key indicator of safety and

soundness, stood at 9.78%, positioning Navy Federal for continued strong financial performance.

Loan growth was particularly impressive in 2010. Navy Federal originated $5.5 billion in consumer loans,

an increase of 11% over 2009. This can be attributed to stronger new and used auto loan demand, which

was fueled by rates as low as 1.99% APR. Credit card balances grew by 9% to reach $5 billion at year-

end. A strong 2.99% APR balance transfer promotion and the continued popularity of Navy Federal’s

cashRewards credit card helped spur growth in the portfolio. And, despite continued uncertainty in

the housing market, Navy Federal closed over $5.3 billion in mortgage loans. Fourth quarter 2010 volume

was the highest on record as members looked to take advantage of historically low mortgage rates.

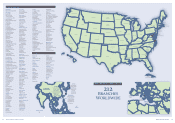

Members had more branch access with the opening of 14 new branches. Of these, 10 are located near

Army and Air Force installations. We are particularly proud of our new location inside the Pentagon.

Navy Federal now has a total of 212 branches worldwide. Our improved service also reached into the

Contact Center, as representatives handled over 17.5 million calls. And, Navy Federal Online® Account

Access subscribers grew to over 3 million, a 13% increase. Also, in January 2010, mobile banking was

introduced. Enrollment stood at 364,000 users at year-end, far surpassing anticipated take-up.

2010 was also the year that we welcomed the members of USA Federal Credit Union to the Navy Federal

family. This merger resulted in the acquisition of 19 new branches in Korea, Japan, and San Diego, as

well as 45,000 new members.

This past decade has been one of unparalleled success for Navy Federal. Looking ahead, we face the

future with confidence that Navy Federal and its members will continue to thrive, and that together,

we can build a strong financial future for the credit union and its members.

C

HAIRMAN AND THE

P

RESIDENT

Report from the