National Oilwell Varco 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 12

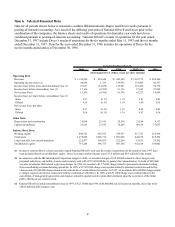

The cash and non-cash elements of the charge approximate $13 million and $1.1 million, respectively.

Approximately $11 million of direct transaction and severance costs had been spent at December 31, 2000. Facility

closure costs consist of lease cancellation costs and impairment of a closed manufacturing facility that is for sale.

The $0.4 million credit results from the settlement of lease obligations earlier than previously anticipated. All of

this charge is applicable to the Products and Technology business segment.

During 1999, a $1.8 million charge related to additional severance costs resulting from consolidating our

manufacturing operations was recorded.

During 1998, we recorded a special charge of $17.0 million related to operational changes resulting from the

depressed market for the oil and gas industry. The components of the special charge were asset impairments of

$5.4 million, severance costs of $6.2 million and facility closures and exit costs of $5.4 million.

Interest Expense

Interest expense was greater in 2000 than the prior year due to an average borrowing rate increase of 0.25 basis

points and a higher debt level throughout the year. Interest expense in 1999 was greater than the prior year due to

carrying a higher debt level for the entire year resulting from the issuance of the 6 7/8% senior notes in mid 1998.

Income Taxes

National Oilwell is subject to U.S. federal, state and foreign taxes and recorded a combined tax rate of 51% in

2000, 37% in 1999 and 35% in 1998. The 2000 effective tax rate was impacted by certain transaction costs

associated with the IRI merger and the inclusion of pre-merger IRI capital losses due to pooling-of-interests

accounting that may not be deductible. The 1999 effective tax rate was impacted by the inclusion of the pre-merger

operating results of the Dupre′ companies and the termination of its status as an S Corporation. Excluding the

impact of the IRI merger costs and capital losses and Dupre′s pre-merger results, our combined effective tax rate

for 2000 was 36%, compared to 43% in 1999 and 37% in 1998.

We have net operating loss carryforwards in the United States that could reduce future tax expense by up to $5.0

million. Additional loss carryforwards in Europe generally would reduce goodwill if realized in the future. Due to

the uncertainty of future utilization, most of the potential benefits described above have been fully reserved. During

2000, we realized a tax benefit of $0.9 million from its U.S. carryforwards.

Liquidity and Capital Resources

At December 31, 2000, National Oilwell had working capital of $480.3 million, an increase of $28.3 million from

December 31, 1999. Significant components of our current assets are accounts receivable and inventories. During

2000, accounts receivable and inventory increased by $94.8 million and $27.7 million, respectively. Accounts

payable increased $59.6 million during the year. An increased activity level resulting from the higher sustained

energy prices is the primary driver in all of these changes.

Total capital expenditures were $24.6 million during 2000, $17.5 million in 1999 and $39.2 million in 1998.

Additions and enhancements to the downhole rental tool fleet and information management and inventory control

systems represent the majority of these capital expenditures. Capital expenditures are expected to approximate $29

million in 2001. We believe we have sufficient existing manufacturing capacity to meet currently anticipated

demand through 2001 for our products and services.

On September 25, 1997, National Oilwell entered into a five-year unsecured $125 million revolving credit facility.

The credit facility is available for acquisitions and general corporate purposes. The credit facility provides for

interest at prime or LIBOR plus 0.625%, subject to downward adjustment based on our Capitalization Ratio, as

defined. The credit facility contains financial covenants and ratios regarding minimum tangible net worth,

maximum debt to capital and minimum interest coverage.

We believe cash generated from operations and amounts available under the credit facility and from other sources

of debt will be sufficient to fund operations, working capital needs, capital expenditure requirements and financing