National Oilwell Varco 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one)

[ü] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, 2000 OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-12317

NATIONAL-OILWELL, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction

of incorporation or organization)

76-0475815

(IRS Employer

Identification No.)

10000 Richmond Avenue

4th Floor

Houston, Texas

77042-4200

(Address of principal executive offices)

(713) 346-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $.01

(Title of Class)

New York Stock Exchange

(Exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ✓ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and

will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

As of February 22, 2001, 80,610,233 common shares were outstanding. Based upon the closing price of these shares on the

New York Stock Exchange and, excluding solely for purposes of this calculation 7,229,833 shares beneficially owned by

directors and executive officers, the aggregate market value of the common shares of National-Oilwell, Inc. held by non-

affiliates was approximately $3 billion.

Documents Incorporated by Reference

Portions of the Proxy Statement in connection with the 2001 Annual Meeting of Stockholders are incorporated in Part III of

this report.

National-Oilwell, Inc. is distributing this Report on Form 10-K for the year ended

December 31, 2000 to the Company’s shareholders in lieu of a separate annual report.

Table of contents

-

Page 1

... NATIONAL-OILWELL, INC. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 76-0475815 (IRS Employer Identification No.) 10000 Richmond Avenue 4th Floor Houston, Texas 77042-4200 (Address of principal executive offices... -

Page 2

-

Page 3

... rental and sale of high-performance drilling motors and downhole tools. Building on Information Technology and Process Improvement Strategy National Oilwell has developed an integrated information technology and process improvement strategy to enhance procurement, inventory management and logistics... -

Page 4

... Products and Technology National Oilwell designs, manufactures and sells drilling systems and components for both land and offshore drilling rigs as well as complete land drilling and well servicing rigs. The major mechanical components include drawworks, mud pumps, top drives, SCR houses, solids... -

Page 5

...new technologies and products and improved availability and delivery. We compete with a large number of companies, none of which are dominant. Manufacturing and Backlog National Oilwell has manufacturing facilities located in the United States, Canada and Norway. The manufacture of parts or purchase... -

Page 6

... sell. Engineering National Oilwell maintains a staff of engineers and technicians to: - design and test new products, components and systems for use in drilling and pumping applications; - enhance the capabilities of existing products; and - assist our sales organization and customers with special... -

Page 7

... introductions; and - improvements in availability and delivery. We compete with many companies. Some of these companies may possess greater financial resources or offer certain products that we do not have. National Oilwell Faces Potential Product Liability and Warranty Claims Customers use some of... -

Page 8

... or plan to engage in any significant hedging or currency trading transactions designed to compensate for adverse currency fluctuations. National Oilwell May Not Be Able to Successfully Manage Its Growth National Oilwell acquired three companies in 1997, five in 1998, three in 1999, five in 2000 and... -

Page 9

...Location Pampa, Texas Houston, Texas Houston, Texas Sugarland, Texas Galena Park, Texas Houston, Texas Edmonton, Alberta, Canada Tulsa, Oklahoma McAlester, Oklahoma Houston, Texas Stavanger, Norway Victoria, Texas Marble Falls, Texas Nisku, Alberta, Canada Stavanger, Norway Edmonton, Alberta, Canada... -

Page 10

Part II Item 5. Market for Registrant's Common Equity and Related Stockholder Matters Market Information National Oilwell common stock is listed on the New York Stock Exchange (ticker symbol: NOI). The following table sets forth the stock price range during the past three years: 2000 Quarter First ... -

Page 11

... of management agreements and expenses related to special incentive plans that terminated upon the occurrence of the initial public offering of our common stock. (3) National Oilwell recorded extraordinary losses in 1997 of $2,135,000 and 1996 of $4,000,000, net of income tax benefits, due... -

Page 12

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations Introduction National Oilwell is a worldwide leader in the design, manufacture and sale of drilling systems, drilling equipment and downhole products as well as the distribution to the oil and gas industry ... -

Page 13

... from lower oil and gas prices. Sales of all types of capital equipment, rig packages and drilling spares were $370 million below 1998 levels. Sales of pumps and expendable pump parts were $23 million lower than in the previous year and downhole tools revenue declined $50 million. Primarily due... -

Page 14

...$1.1 million, respectively. Approximately $11 million of direct transaction and severance costs had been spent at December 31, 2000. Facility closure costs consist of lease cancellation costs and impairment of a closed manufacturing facility that is for sale. The $0.4 million credit results from the... -

Page 15

...IPS manufactures, sells and services SCR units primarily used on land-based drilling rigs and is a complementary fit to our existing SCR product line. Goodwill of approximately $4 million was recorded in conjunction with this purchase. On January 5, 2001, we completed the acquisition of the stock of... -

Page 16

... Risk Incorporated by reference to Item 7 above, "Market Risk Disclosure." Item 8. Financial Statement and Supplementary Data Attached hereto and a part of this report are financial statements and supplementary data listed in Item 14. Item 9. Changes in and Disagreements with Accountants on... -

Page 17

... 10. Directors and Executive Officers of the Registrant Incorporated by reference to the definitive Proxy Statement for the 2001 Annual Meeting of Stockholders. Item 11. Executive Compensation Incorporated by reference to the definitive Proxy Statement for the 2001 Annual Meeting of Stockholders... -

Page 18

... of Voting and Exchange Trust Agreement by and between National-Oilwell, Inc., Dreco Energy Services Ltd. and Montreal Trust Company of Canada (Annex G) (3) Employment Agreement dated as of January 16, 1996 between Joel V. Staff and the Company with similar agreements with Jerry N. Gauche and Steven... -

Page 19

... the quarter ended December 31, 2000. * Compensatory plan or arrangement for management or others Filed as an Exhibit to Registration Statement No. 333-11051 on Form S-1, as amended, initially filed on August 29, 1996. Filed with the Proxy Statement for the 1999 Annual Meeting of Stockholders... -

Page 20

... Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. NATIONAL-OILWELL, INC. Date: February 28, 2001 By: /s/ Steven W. Krablin Steven W. Krablin Vice President and Chief Financial Officer Pursuant to the requirements of... -

Page 21

... our opinion. In our opinion, based on our audits and the report of other auditors, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of National-Oilwell, Inc., at December 31, 2000 and 1999, and the consolidated results of its... -

Page 22

NATIONAL-OILWELL, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except share data) December 31, 2000...assets Property, plant and equipment, net Deferred income taxes Goodwill, net Property held for sale Other assets $ 42,459 ... Accounts payable Customer prepayments Accrued compensation Other accrued ... -

Page 23

NATIONAL-OILWELL, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) 2000 Revenues Cost of revenues: Cost of products and services sold Merger related inventory write-offs Gross profit Selling, general, and administrative Special charge Operating income Interest and ... -

Page 24

... on receivables Provision for deferred income taxes Gain on sale of assets Foreign currency transaction (gain) loss Special charge Merger related inventory write-offs Changes in assets and liabilities, net of acquisitions: Marketable securities Receivables Inventories Income taxes receivable Prepaid... -

Page 25

...December 31, 1999 Net income Currency translation adjustments Unrealized gains on securities Comprehensive income Stock issued for acquisition Stock options exercised Tax benefit of options exercised Other Balance at December 31, 2000 $ 79 9 671 Additional Paid-in Capital 376,847 Retained Earnings... -

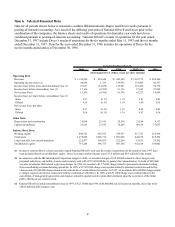

Page 26

... business involves the manufacture of drilling rigs and equipment as well as the manufacture, sales and service of downhole rental tools. All prior periods have been restated. Revenues, net income before special charges, and net income of the separate companies for the periods preceding the merger... -

Page 27

... business designs, manufactures and markets braking systems and large synchronous generators used on drilling rigs. This transaction was accounted for as a purchase effective October 1, 2000 and generated goodwill of approximately $5 million. Pro-forma information for Hitec ASA, Wheatley Gaso and... -

Page 28

... time of purchase. The carrying values of these financial instruments approximate their respective fair values. Inventories Inventories consist of oilfield products, manufactured equipment, manufactured specialized drilling products and downhole motors and spare parts for manufactured equipment and... -

Page 29

...for certain international sales. Reserves are maintained for potential credit losses and such credit losses have historically been within management's expectations. Stock-Based Compensation National Oilwell uses the intrinsic value method in accounting for its stock-based employee compensation plans... -

Page 30

...244,944 $ 348,024 Raw materials and supplies Work in process Finished goods and purchased products Total As a result of the merger with IRI International, the Company conducted a comprehensive review of its operations and decided to exit a non-core business and certain product lines. These actions... -

Page 31

...) subject to adjustment based on National Oilwell's Capitalization Ratio, as defined. The credit facility contains financial covenants and ratios regarding minimum tangible net worth, maximum debt to capital and minimum interest coverage. At December 31, 2000, the Company was in compliance with all... -

Page 32

... defined benefit plans. In addition, certain U.S. employees participate in defined benefit health care plans that provide postretirement medical and life insurance benefits. Active employees only participate in the plan providing life insurance benefits. The change in benefit obligation, plan assets... -

Page 33

... interest cost components in 2000 Effect on postretirement benefit obligation at year-end 2000 $67 ($628) 1% Point Decrease $39 ($744) The Company's subsidiaries in the United Kingdom have a defined benefit pension plan whose participants are primarily retired and terminated employees who are no... -

Page 34

...was $12.6million, $14.3 million and $13.1 million. National Oilwell's minimum rental commitments for operating leases at December 31, 2000, excluding future payments applicable to facilities closed as part of the 1998 and 2000 Special Charge, were as follows: 2001 - $8.5 million; 2002 - $6.5 million... -

Page 35

... of $.01 par value preferred stock, none of which is issued or outstanding. National Oilwell's stock plans collectively authorize the grant or options to purchase up to 6,038,733 shares of National Oilwell's common stock to officers, key employees, non-employee directors and other persons. Options... -

Page 36

... $0.03 for 2000, 1999 and 1998, respectively, from the amounts reported. These pro forma results may not be indicative of future effects. The Company evaluates annually the grant of options to eligible participants and in February 2001, 961,009 options to purchase shares of common stock were granted... -

Page 37

..., 2000 Federal income tax at statutory rate Foreign income tax rate differential State income tax, net of federal benefit S Corporation earnings Tax benefit of foreign sales corporation Unutilized foreign operating losses Nondeductible expenses Amortization of negative goodwill Foreign dividends net... -

Page 38

... benefit of these net operating losses. Also in the United States, the Company has $9.3 million of capital loss carryforwards as of December 31, 2000, which expire at various dates through 2004. These capital loss carryforwards can only be used to offset future capital gains generated by the Company... -

Page 39

... of direct transaction and severance costs had been spent at December 31, 2000. Facility closure costs consist of lease cancellation costs and impairment of a closed manufacturing facility that is for sale. All of this charge is applicable to the Products and Technology business segment. During... -

Page 40

13. Business Segments and Geographic Areas National Oilwell's operations consist of two segments: Products and Technology and Distribution Services. The Products and Technology segment designs and manufactures a variety of oilfield equipment for use in oil and gas drilling, completion and ... -

Page 41

...financial information is as follows (in thousands): Business Segments Products and Technology December 31, 2000 Revenues from: Unaffiliated customers Intersegment sales Total revenues Operating income (loss) Capital...loss of Corporate includes a special charge of $14,082 for 2000, $1,779 for 1999 and ... -

Page 42

... $ (81,142) (81,142) $ 1,149,920 1,149,920 1,278,894 Canada Norway United Kingdom Other Eliminations Total 14. Quarterly Financial Data (Unaudited) Summarized quarterly results as restated to reflect the merger with IRI International and Dupre′ were as follows (in thousands, except per share data... -

Page 43

-

Page 44