Microsoft 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

general causation on the basis of flawed scientific methodologies. The motion was heard in December 2013 and January

2014. In March 2014, defendants filed a separate motion to preclude plaintiffs’ general causation testimony on the ground

that it is pre-empted by federal law because the experts challenge the safety of all cellular handsets, including those that

comply with the FCC Guidelines. Both motions are pending.

Canadian cell phone class action

Nokia, along with other handset manufacturers and network operators, is a defendant in a 2013 class action lawsuit filed

in the Supreme Court of British Columbia by a purported class of Canadians who have used cellular phones for at least

1600 hours, including a subclass of users with brain tumors. Microsoft was served with the complaint in June 2014. The

litigation is not yet active as several defendants remain to be served.

Other

We also are subject to a variety of other claims and suits that arise from time to time in the ordinary course of our

business. Although management currently believes that resolving claims against us, individually or in aggregate, will not

have a material adverse impact on our consolidated financial statements, these matters are subject to inherent

uncertainties and management’s view of these matters may change in the future.

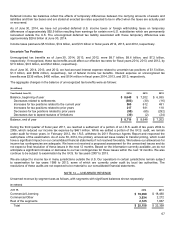

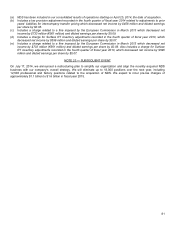

As of June 30, 2014, we had accrued aggregate liabilities of $780 million in other current liabilities and $81 million in other

long-term liabilities for all of our legal matters that were contingencies as of that date. While we intend to defend these

matters vigorously, adverse outcomes that we estimate could reach approximately $2.0 billion in aggregate beyond

recorded amounts are reasonably possible. Were unfavorable final outcomes to occur, there exists the possibility of a

material adverse impact on our consolidated financial statements for the period in which the effects become reasonably

estimable. Substantially all changes from the prior quarter in these accruals and estimates are attributable to matters

involving Nokia that we assumed as a result of the NDS acquisition.

NOTE 18 — STOCKHOLDERS’ EQUITY

Shares Outstanding

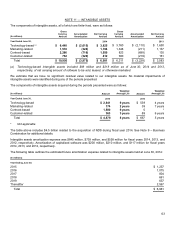

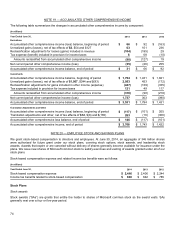

Shares of common stock outstanding were as follows:

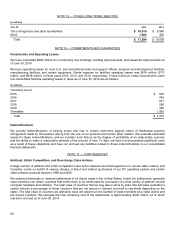

(In millions)

Y

ear Ended June 30, 2014 2013 2012

Balance, beginning of year 8,328 8,381 8,376

Issued 86 105 147

Repurchased (175) (158) (142)

Balance, end of year 8,239 8,328 8,381

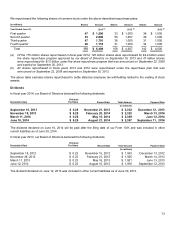

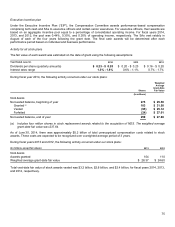

Share Repurchases

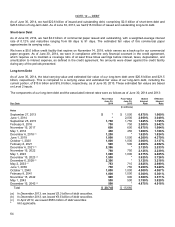

On September 16, 2013, our Board of Directors approved a new share repurchase program authorizing up to $40.0 billion

in share repurchases. The share repurchase program became effective on October 1, 2013, has no expiration date, and

may be suspended or discontinued at any time without notice. This new share repurchase program replaced the share

repurchase program that was announced on September 22, 2008 and expired on September 30, 2013. As of June 30,

2014, $35.1 billion remained of our $40.0 billion share repurchase program. All repurchases were made using cash

resources.