Microsoft 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

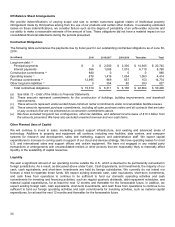

Our fiscal year 2013 effective rate decreased by 5% from fiscal year 2012 mainly due to a nonrecurring $6.2 billion non-

tax deductible goodwill impairment charge that was recorded in fiscal year 2012. The goodwill impairment charge

increased our effective tax rate by 10% in fiscal year 2012. In addition, in fiscal years 2013 and 2012, we recognized a

reduction of 18% and 21%, respectively, to the effective tax rate due to foreign earnings taxed at lower rates. The

decrease in our effective tax rate for fiscal year 2013 was primarily offset by a 1% increase related to the EU fine, which is

not tax deductible.

Changes in the mix of income before income taxes between the U.S. and foreign countries also impacted our effective tax

rates and resulted primarily from changes in the geographic distribution of and changes in consumer demand for our

products and services. We supply our Windows PC operating system to customers through our U.S. regional operating

center, while we supply the Microsoft Office system and our server products and tools to customers through our foreign

regional operations centers. Windows PC operating system revenue increased $209 million in fiscal year 2013, while

Microsoft Office system and server products and tools revenue increased $696 million and $1.2 billion, respectively,

during this same period. In fiscal years 2013 and 2012, our U.S. income before income taxes was $6.7 billion and $1.6

billion, respectively, and comprised 25% and 7%, respectively, of our income before income taxes. In fiscal years 2013

and 2012, the foreign income before income taxes was $20.4 billion and $20.7 billion, respectively, and comprised 75%

and 93%, respectively, of our income before income taxes. The primary driver for the increase in the U.S. income before

income tax in fiscal year 2013 was the goodwill impairment charge recorded during the prior year.

Tax contingencies and other tax liabilities were $9.4 billion and $7.6 billion as of June 30, 2013 and 2012, respectively,

and are included in other long-term liabilities. This increase relates primarily to transfer pricing, including transfer pricing

developments in certain foreign tax jurisdictions, primarily Denmark. While we settled a portion of the I.R.S. audit for tax

years 2004 to 2006 during the third quarter of fiscal year 2011, we remain under audit for those years. In February 2012,

the I.R.S. withdrew its 2011 Revenue Agents Report and reopened the audit phase of the examination. As of June 30,

2013, the primary unresolved issue relates to transfer pricing which could have a significant impact on our consolidated

financial statements if not resolved favorably. We do not believe it is reasonably possible that the total amount of

unrecognized tax benefits will significantly increase or decrease within the next 12 months because we do not believe the

remaining open issues will be resolved within the next 12 months. We also continue to be subject to examination by the

I.R.S. for tax years 2007 to 2012.

We are subject to income tax in many jurisdictions outside the U.S. Our operations in certain jurisdictions remain subject

to examination for tax years 1996 to 2012, some of which are currently under audit by local tax authorities. The

resolutions of these audits are not expected to be material to our consolidated financial statements.

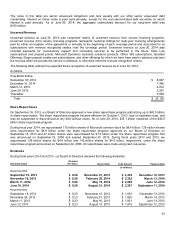

FINANCIAL CONDITION

Cash, Cash Equivalents, and Investments

Cash, cash equivalents, and short-term investments totaled $85.7 billion as of June 30, 2014, compared with $77.0 billion

as of June 30, 2013. Equity and other investments were $14.6 billion as of June 30, 2014, compared with $10.8 billion as

of June 30, 2013. Our short-term investments are primarily to facilitate liquidity and for capital preservation. They consist

predominantly of highly liquid investment-grade fixed-income securities, diversified among industries and individual

issuers. The investments are predominantly U.S. dollar-denominated securities, but also include foreign currency-

denominated securities in order to diversify risk. Our fixed-income investments are exposed to interest rate risk and credit

risk. The credit risk and average maturity of our fixed-income portfolio are managed to achieve economic returns that

correlate to certain fixed-income indices. The settlement risk related to these investments is insignificant given that the

short-term investments held are primarily highly liquid investment-grade fixed-income securities.

Of the cash, cash equivalents, and short-term investments at June 30, 2014, $77.1 billion was held by our foreign

subsidiaries and would be subject to material repatriation tax effects. The amount of cash, cash equivalents, and short-

term investments held by foreign subsidiaries subject to other restrictions on the free flow of funds (primarily currency and

other local regulatory) was $2.6 billion. As of June 30, 2014, approximately 84% of the cash equivalents and short-term

investments held by our foreign subsidiaries were invested in U.S. government and agency securities, approximately 5%

were invested in corporate notes and bonds of U.S. companies, and approximately 1% were invested in U.S. mortgage-

backed securities, all of which are denominated in U.S. dollars.