Microsoft 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 58

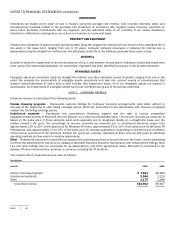

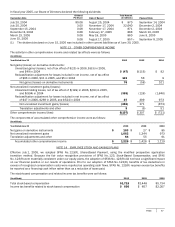

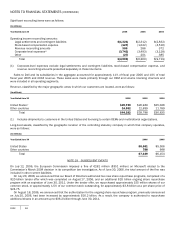

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

Employee Stock Purchase Plan. We have an employee stock purchase plan for all eligible employees. Compensation expense

for the employee stock purchase plan is recognized in accordance with SFAS No. 123(R). The administrative committee under

the plan approved a change to the common stock purchase discount and approved the elimination of the related look back

period and a change to quarterly purchase periods that became effective July 1, 2004. As a result, beginning in fiscal year

2005, shares of our common stock may presently be purchased by employees at three-month intervals at 90% of the fair

market value on the last day of each three-month period. Employees may purchase shares having a value not exceeding 15% of

their gross compensation during an offering period. During fiscal year 2006 employees purchased 17.2 million shares at an

average price of $23.02 per share. At June 30, 2006, 141.9 million shares were reserved for future issuance. During fiscal year

2005 employees purchased 16.4 million shares at average prices of $23.33 per share.

Under the plan in effect previous to fiscal year 2005, shares of our common stock could be purchased at six month intervals

at 85% of the lower of the fair market value on the first or the last day of each six-month period. Employees could purchase

shares having a value not exceeding 15% of their gross compensation during an offering period. During fiscal year 2004

employees purchased 16.7 million shares at average prices of $22.74 per share.

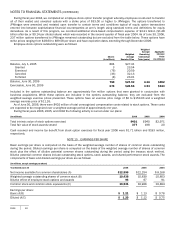

Savings Plan. We have a savings plan in the United States that qualifies under Section 401(k) of the Internal Revenue Code,

and a number of savings plans in international locations. Participating U.S. employees may contribute up to 50% of their pretax

salary, but not more than statutory limits. We contribute fifty cents for each dollar a participant contributes in this plan, with a

maximum contribution of 3% of a participant’s earnings. Matching contributions for all plans were $178 million, $154 million,

and $141 million in fiscal years 2006, 2005, and 2004, respectively. Matching contributions are invested proportionate to each

participant’s voluntary contributions in the investment options provided under the plan. Investment options in the U.S. plan

include Microsoft common stock, but neither participant nor our matching contributions are required to be invested in Microsoft

common stock.

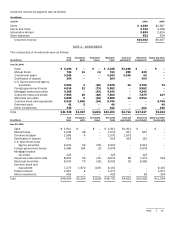

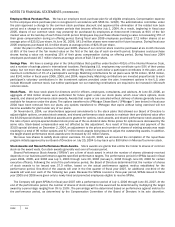

Stock Plans. We have stock plans for directors and for officers, employees, consultants, and advisors. At June 30, 2006, an

aggregate of 812 million shares were authorized for future grant under our stock plans, which cover stock options, stock

awards, and shared performance stock awards. Awards that expire or are canceled without delivery of shares generally become

available for issuance under the plans. The options transferred to JPMorgan Chase Bank (“JPMorgan”) (see below) in fiscal year

2004 have been removed from our plans; any options transferred to JPMorgan that expire without being exercised will not

become available for grant under any of our plans.

On November 9, 2004, our shareholders approved amendments to the stock plans that allowed our Board of Directors to

adjust eligible options, unvested stock awards, and shared performance stock awards to maintain their pre-dividend value after

the $3.00 special dividend. Additional awards were granted for options, stock awards, and shared performance stock awards by

the ratio of post- and pre-special dividend stock price as of the ex-dividend date. Strike prices for options were decreased by the

same ratio. Stock-based compensation was not affected by this adjustment. As a result of this approval and payment of the

$3.00 special dividend on December 2, 2004, an adjustment to the prices and number of shares of existing awards was made

resulting in a total of 96 million options and 6.7 million stock awards being issued to adjust the outstanding awards. In addition,

the target shared performance stock awards were increased by 3.5 million shares.

We issue new shares to satisfy stock option exercises. On July 20, 2006, we announced the completion of the repurchase

program initially approved by our Board of Directors on July 20, 2004 to buy back up to $30 billion in Microsoft common stock.

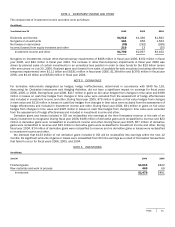

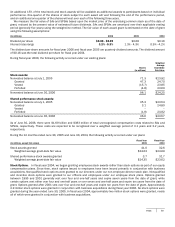

Stock Awards and Shared Performance Stock Awards. Stock awards are grants that entitle the holder to shares of common

stock as the award vests. Our stock awards generally vest over a five-year period.

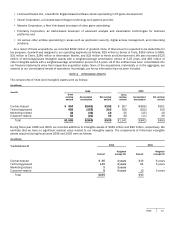

Shared Performance Stock Awards (“SPSAs”) are a form of stock award in which the number of shares ultimately received

depends on our business performance against specified performance targets. The performance period for SPSAs issued in fiscal

years 2004, 2005, and 2006 was July 1, 2003 through June 30, 2006 (January 1, 2004 through June 30, 2006 for certain

executive officers). Following the end of the performance period, the Board of Directors determined that the number of shares

of stock awards to be issued was 37.0 million, based on the actual performance against metrics established for the

performance period. One-third of the awards will vest in the first quarter of fiscal year 2007. An additional one-third of the

awards will vest over each of the following two years. Because the SPSAs covered a three-year period, SPSAs issued in fiscal

year 2005 and 2006 were given only to newly hired and promoted employees eligible to receive SPSAs.

The Company will grant SPSAs for fiscal year 2007 with a performance period of July 1, 2006 through June 30, 2007. At the

end of the performance period, the number of shares of stock subject to the award will be determined by multiplying the target

award by a percentage ranging from 0% to 150%. The percentage will be determined based on performance against metrics for

the performance period, as determined by the Compensation Committee of the Board of Directors in its sole discretion.