Microsoft 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 29

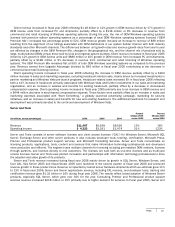

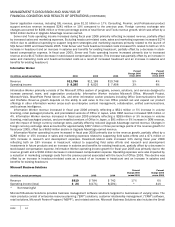

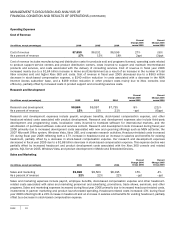

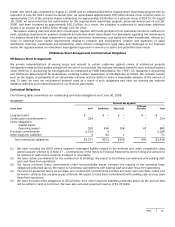

Operating Income / (Loss)

For the quarter ended

For the quarter ended

(In millions)

Fiscal

Y

ear

2006

June 30,

2006

March 31,

2006

December

31,

2005

S

eptember

30,

2005

Fiscal

Y

ear

2005

June

30,

2005

March 31,

2005

December

31,

2004

S

eptember

30,

2004

S

egments

Client

$10,182

$2,504

$2,471

$2,638

$2,569

$9,403

$2,172

$2,331

$2,513

$2,387

Server and Tools

3,017

903

746

762

606

2,109

479

515

660

455

Online Services

Business (77)

(190)

(26) 58

81

411

101

101

130

79

Microsoft Business

Division 9,675

2,544

2,414

2,466

2,251

9,116

2,285

2,316

2,355

2,160

Entertainment and

Devices (1,337)

(437)

(422) (296)

(182)

(607)

(235)

(198) 28

(202

)

Corporate-Level Activity

(4,988)

(1,443)

(1,295)

(971)

(1,279)

(5,871)

(1,813)

(1,736)

(937)

(1,385

)

Total operating

income $16,472

$3,881

$3,888

$4,657

$4,046

$14,561

$2,989

$3,329

$4,749

$3,494

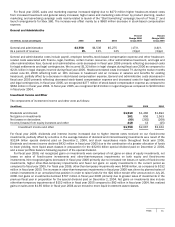

Our outlook for fiscal year 2007 based on the five operating segments is as follows:

Client We expect revenue to grow reflecting improvement in the commercial and retail portion of the business due to our

upcoming launch of Windows Vista. We expect revenue generated from OEMs to grow slower than the PC hardware market due

to increased concentration among larger OEMs, consumer hardware shipments growing faster than business shipments, and

relatively faster growth in emerging markets. We expect PC shipments to grow 8% to 10% for fiscal year 2007. We believe that

PC unit growth rates will be higher in the consumer segment than in the business segment and higher in emerging markets than

in mature markets.

Server and Tools We expect continued momentum from recent product launches and the expansion of our products in

security, management and designer tools will help drive our overall revenue growth in fiscal year 2007. We estimate overall

server hardware unit shipments will grow 10% to 12% in fiscal year 2007. However, we face competition from Linux-based, Unix,

and other server operating systems as well as competition in server applications.

Online Services Business We expect increased growth in display advertising revenue as the portals, channels, and

communications services continue to expand globally and the overall Internet advertising industry continues to expand. Our

search revenue is expected to grow in fiscal year 2007 as a result of continued ramp up of adCenter. We expect revenue from

narrowband Internet Access to continue to decline in fiscal year 2007.

Microsoft Business Division We expect Microsoft Business Division revenue to grow in fiscal year 2007. We feel that our

customers’ continued preference to purchase annuity contracts indicates enthusiasm for the 2007 Microsoft Office system. We

also expect continued demand for our Dynamics products, building on the fiscal 2006 momentum.

Entertainment and Devices Division We expect revenue to increase from fiscal year 2006 due to the increased availability of

the Xbox 360 console unit during the entire fiscal year, including the second holiday season after the launch in fiscal year 2006.

In fiscal year 2007, we expect to introduce a music and entertainment device, the first in a new family of hardware and software

products for the consumer market. The availability of a commercial IPTV product is expected to drive significant growth in MSTV

revenue across several geographies. Revenue from existing mobility and embedded devices is expected to increase due to unit

volume increases of Windows Mobile software driven by increased market demand for phone-enabled devices and Windows

Embedded operating systems. Short product life cycles in product lines such as Windows Mobile software may impact our

continuing revenue streams. Xbox 360 console unit costs are expected to decline.

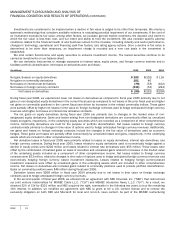

As we implement our long-term growth strategy, we expect to increase our level of spending in four key areas in fiscal year

2007: increased product costs associated with Xbox consoles; marketing and field sales spending including launch costs;

quickening the pace of development in growth areas such as business intelligence, security, management and unified

communications (including acquisitions); and increased costs to execute on our online services strategy. While these

investments will translate into increased operating expenses in fiscal year 2007, we believe they will help lay the groundwork for

future growth and profitability.