McKesson 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 McKesson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and practice management software, to outsourced billing and

collections services.

A portion of the assets we acquired from Per-Se helped us

form RelayHealth, McKesson’s “connectivity” business, which

provides powerful capabilities to each one of our customer

segments. In the physician segment, RelayHealth facilitates

ePrescribing and online patient-doctor consultations known

as webVisits®, innovations that provide cost and effi ciency

benefi ts to physicians and improve patient care.

Strengthening our position in the fast-growing specialty

pharmaceutical market, the OTN acquisition expanded our

physician customer base by almost 6,000 oncologists, rheu-

matologists and other providers. We also gained OTN’s

state-of-the-art Lynx® technology platform that automates

practice management for oncologists and other physicians.

Helping payors provide their members

with the best, most cost-effective care

In our payor business, we offer a range of services to the public

and private sectors that help manage the cost and quality

of care. We are the largest provider of disease management

programs to state Medicaid agencies, helping millions of people

with chronic diseases lead longer, healthier lives. In the private

sector, we provide clinical decision support tools to health plans,

employers and large medical groups that help create better

health outcomes for their members.

We renewed all expiring disease management contracts in fi scal

year 2008, a strong validation of the value we deliver to both

payors and patients. For example, working with the Illinois

Department of Healthcare and Family Services, we helped

the state of Illinois achieve nearly $34 million in net savings in

one year.

On the software side of our payor business, the contracts we

signed with Aetna and CIGNA were the two largest in the

history of that business. Altogether we serve more than 85% of

payors and continue to sell these customers new products and

services that strengthen the relationships we have with them.

Hospitals also use these products. Last year, 300 hospitals

signed contracts to use InterQual® Criteria, our suite of industry-

leading clinical decision support tools. This represents a 40%

increase over the previous year.

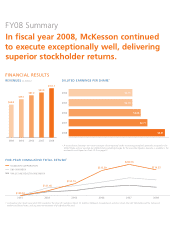

Executing our strategy for stockholder

value creation

Our strong operating performance has produced signifi cant

cash fl ow from operations, strengthening our balance sheet

and enabling us to pursue a more aggressive strategy for

stockholder value creation. Taking a portfolio approach to

capital deployment over the past three years, we have spent

$8 billion to reshape the organization in a manner that is

consistent with our evolving strategy.

From fi scal year 2006 through 2008, we completed a total of

$3.1 billion in strategic acquisitions. Many of these were smaller

acquisitions that enhanced our value proposition to customers

in both distribution and information technology. Our larger

acquisitions, including D&K, OTN and Per-Se, created opportu-

nities for us to broaden our portfolio of innovative solutions and

deliver them to an expanded customer base.

Recently, we announced two new acquisitions that advance

our long-term strategy. In May, we acquired McQueary

Brothers Drug Company, a regional distributor to more than

400 independent and regional chain pharmacies in the

Midwest. This acquisition expands McKesson’s distribution

footprint in the independent pharmacy segment and provides

fertile, new ground for growing the Health Mart franchise and

expanding the McKesson OneStop Generics program. And in

Technology Solutions, we acquired Rosebud Solutions (Rosebud),

a provider of software to track and manage instruments, endo-

scopes, tissue implants and other hospital assets. Rosebud’s

“As we move into fi scal year 2009 and beyond, McKesson has never been

stronger or more capable.”