McKesson 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 McKesson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Brochure Title May Be Stacked If Long Lorem

Ipsum Dolor Sit Amet

This set-up line one is for example only.

This set-up line two is for example only.

This set-up line three is for example only.

McKesson solution copy for example only. All type is shown

in black for position

only. See examples

in the guidelines for cor-

rect color usage.

Imagery area

Business Unit Name (optional)

Note: Volume 10 imag-

ery may use

1.5 or 2 grid units

for the imagery area.

Annual Report

FISCAL YEAR 2008

Table of contents

-

Page 1

... Long Lorem Ipsum Dolor Sit Amet Annual Report FISCAL YEAR 2008 Note: Volume 10 imagery may use 1.5 or 2 grid units for the imagery area. Imagery area This set-up line one is for example only. This set-up line two is for example only. This set-up line three is for example only. McKesson solution... -

Page 2

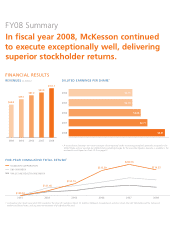

...United States and our earnings per diluted share, excluding charges for the securities litigation reserves, is available in the enclosed Annual Report on Form 10-K on page 37. FIVE-YEAR CUMULATIVE TOTAL RETURN †McKESSON CORPORATION S&P 500 INDEX VALUE LINE HEALTH CARE INDEX $240.76 $213.39 $216... -

Page 3

... share (EPS) grew at a compound annual growth rate exceeding 8%. Over that time, McKesson's stock price more than doubled, outperforming both the S&P 500 Index and the Value Line Health Care Index. McKesson's stock price has also outperformed the shares of all other major pharmaceutical wholesalers... -

Page 4

... group purchasing organization. On the Technology Solutions side of our business, 18 McKesson products were rated in the top three in their categories in the 2007 "Year-End Top 20: Best in KLAS Awards" report issued by KLAS Enterprises, an independent monitor of healthcare information technology... -

Page 5

... chain and mail order customers. We support all pharmacy customers with a robust infrastructure that includes Supply Management Online, our customer Internet portal that accounts for more than $2 billion in pharmaceutical orders each month. Our RelayHealth intelligent network processes 70% of all... -

Page 6

... capable." and practice management software, to outsourced billing and collections services. A portion of the assets we acquired from Per-Se helped us form RelayHealth, McKesson's "connectivity" business, which provides powerful capabilities to each one of our customer segments. In the physician... -

Page 7

... outsourcing business, McKesson Medication Management, the bulk of which we divested in April 2008. We regularly review our portfolio of assets to determine the optimal mix for future value creation. Our portfolio approach to capital deployment has included an aggressive share repurchase program... -

Page 8

...2008 OR Â... TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 1-13252 McKESSON CORPORATION A Delaware Corporation I.R.S. Employer Identification Number 94-3207296 McKesson Plaza One Post Street, San Francisco, CA 94104 Telephone (415) 983... -

Page 9

... with Accountants on Accounting and Financial Disclosure...Controls and Procedures...Other Information...PART III 10. 11. 12. Directors, Executive Officers and Corporate Governance ...Executive Compensation...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 10

... pharmacies. The McKesson Technology Solutions segment delivers enterprise-wide clinical, patient care, financial, supply chain, and strategic management software solutions, pharmacy automation for hospitals, as well as connectivity, outsourcing and other services. Our Payor group of businesses... -

Page 11

... - Strategic planning, merchandising and price maintenance program that helps independent pharmacies maximize store profitability. McKesson Home Health Care - Comprehensive line of more than 1,800 home health care products, including durable medical equipment, diabetes supplies, self-care supplies... -

Page 12

..., clinics and surgery centers (primary care), long-term care, occupational health facilities and homecare sites (extended care). Through a variety of technology products and services geared towards the supply chain, our Medical-Surgical distribution business is focused on helping its customers... -

Page 13

... data repository, clinical decision support/physician order entry, point-ofcare documentation with bar-coded medication administration, enterprise laboratory, radiology, pharmacy, surgical management, an emergency department solution and an ambulatory EHR system. Horizon Clinicals® also includes... -

Page 14

... processing, business office administration and major system conversions. Payor Group: The following suite of services and software products is marketed to payors, employers and government organizations to help manage the cost and quality of care Disease management programs to improve the health... -

Page 15

...own internal needs, supply management capabilities provided by the segment. Price, quality of service, and in some cases, convenience to the customer are generally the principal competitive elements in this segment. Our Technology Solutions segment experiences substantial competition from many firms... -

Page 16

... expenditures is important to the long-term success of this business. Additional information regarding our development activities is included in Financial Note 1 to the consolidated financial statements, "Significant Accounting Policies," appearing in this Annual Report on Form 10-K. Environmental... -

Page 17

... making capital expenditures materially higher than historical levels. Information as to material lease commitments is included in Financial Note 12 to the consolidated financial statements, "Lease Obligations," appearing in this Annual Report on Form 10-K. Item 3. Legal Proceedings Certain legal... -

Page 18

... 2006. Service with the Company - 8 years. Executive Vice President, Chief Information Officer since July 2005; Senior Vice President, Chief Process Officer, McKesson Provider Technologies from April 2003 to July 2005; Senior Vice President, Imaging, Technology and Business Process Improvement from... -

Page 19

... action by the Board. (d) Share Repurchase Plans: The following table provides information on the Company' s share repurchases during the fourth quarter of 2008: Share Repurchases (1) Total Number of Shares Purchased As Part of Publicly Announced Average Price Paid Program Per Share Approximate... -

Page 20

... total stockholder return on the Company' s common stock for the periods indicated with the Standard & Poor' s 500 Index and the Value Line Healthcare Sector Index (composed of 154 companies in the health care industry, including the Company). $300.00 McKesson Corporation S&P 500 Index Value Line... -

Page 21

... Reporting Management' s report on the Company' s internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) in the Exchange Act), and the related report of our independent registered public accounting firm, are included on page 58 and page 59 of this Annual... -

Page 22

... our Web site under the Governance tab. Copies of these documents may be obtained from: Corporate Secretary McKesson Corporation One Post Street, 35th Floor San Francisco, CA 94104 (800) 826-9360 The Company intends to disclose required information regarding any amendment to or waiver under the Code... -

Page 23

McKESSON CORPORATION The following table sets forth information as of March 31, 2008 with respect to the plans under which the Company' s common stock is authorized for issuance: Number of securities remaining available for future issuance under equity compensation plans (excluding securities ... -

Page 24

...Review section of this Annual Report on Form 10-K and Financial Note 20, "Related Party Balances and Transactions," to the consolidated financial statements. Item 14. Principal Accounting Fees and Services Information regarding principal accounting fees and services is set forth under the heading... -

Page 25

McKESSON CORPORATION PART IV Item 15. Exhibits and Financial Statement Schedule (a) Financial Statements, Financial Statement Schedule and Exhibits Page Consolidated Financial Statements and Report of Independent Registered Public Accounting Firm. See "Index to Consolidated Financial Information... -

Page 26

... and Chief Financial Officer (Principal Financial Officer) * Nigel A. Rees Vice President and Controller (Principal Accounting Officer) * Andy D. Bryant, Director * Wayne A. Budd, Director * Alton F. Irby III, Director Jane E. Shaw, Director /s/ Laureen E. Seeger Laureen E. Seeger *Attorney-in-Fact... -

Page 27

McKESSON CORPORATION SCHEDULE II SUPPLEMENTARY CONSOLIDATED FINANCIAL STATEMENT SCHEDULE VALUATION AND QUALIFYING ACCOUNTS For the Years Ended March 31, 2008, 2007 and 2006 (In millions) Additions Balance at Beginning of Year Charged to Costs and Expenses Charged to Other Accounts... accounts...Total... -

Page 28

... Agreement of Settlement between Lead Plaintiff and Defendants McKesson HBOC, Inc. and HBO & Company) thereto in connection with the consolidated securities class action. 10.2* McKesson Corporation 1999 Stock Option and Restricted Stock Plan, as amended through May 26, 2004. 10.3* Statement of Terms... -

Page 29

...16* McKesson Corporation Stock Purchase Plan, as amended through July 31, 2002. 10.17* Statement of Terms and Conditions Applicable to Certain Stock Options Granted on January 27, 1999. 10.18* Form of Restricted Stock Unit Agreement under the 2005 Stock Plan. 10.19* Statement of Terms and Conditions... -

Page 30

...as CoDocumentation Agents, and The Other Lenders Party Hereto Banc of America Securities LLC, as sole lead arranger and sole book manager. 10.28 Purchase Agreement, dated as of December 31, 2002, between McKesson Capital Corp. and General Electric Capital Corporation. 10.29 Services Agreement, dated... -

Page 31

...Exhibit Description Number 10.33* Amended and Restated Employment Agreement, dated as of November 1, 2006, by and between the Company and its Executive Vice President and Group President. 10.34* McKesson Corporation Change in Control Policy for Selected Executive Employees, effective as of November... -

Page 32

McKESSON CORPORATION INDEX TO CONSOLIDATED FINANCIAL INFORMATION Page 26 27 58 59 60 61 62 63 64 Five-Year Highlights Financial Review Management' s Annual Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Financial Statements: ... -

Page 33

... Position Working capital Days sales outstanding for: (1) Customer receivables Inventories Drafts and accounts payable Total assets Total debt, including capital lease obligations Stockholders' equity Property acquisitions Acquisitions of businesses, net Common Share Information Common shares... -

Page 34

... margin Technology Solutions products and an improvement in our Distribution Solutions' segment margin. The increase in our 2007 gross profit margin primarily reflects improvement in our U.S. pharmaceutical distribution business, including a decrease in our receipt of antitrust class action lawsuits... -

Page 35

... & services U.S. pharmaceutical sales to customers' warehouses Subtotal Canada pharmaceutical distribution & services Medical-Surgical distribution & services Total Distribution Solutions Technology Solutions Services Software and software systems Hardware Total Technology Solutions Total Revenues... -

Page 36

... customers purchase products through both the Company' s direct and warehouse distribution methods, the latter of which has significantly lower gross profit margin due to the low cost-to-serve model. When evaluating and pricing customer contracts, we do so based on our assessment of total customer... -

Page 37

... supplies, health management services and quality management programs to the home care market. Technology Solutions revenues increased in 2008 primarily due to the acquisition of Per-Se and increased services revenues, primarily reflecting the segment' s expanded customer bases and clinical software... -

Page 38

... product categories, which resulted in minimal overall price changes in those years. Additional information regarding our LIFO accounting is included under the caption "Critical Accounting Policies" included in this Financial Review. In 2007, our Distribution Solutions segment' s gross profit margin... -

Page 39

... rates. As a result, the actual future share-based compensation expense may differ from historical levels of expense. Information regarding our share based payments is included in Financial Note 19 to the consolidated financial statements, "Share-Based Payment," appearing in this Annual Report... -

Page 40

... Solutions and Technology Solutions segments, and $13 million in Corporate expenses, $15 million of severance restructuring expense primarily to reallocate product development and marketing resources and to realign one of the international businesses within our Technology Solutions segment... -

Page 41

...including Per-Se, investments in research and development activities and additional sharebased compensation. Share-based compensation expense for this segment was $35 million and $19 million for 2008 and 2007. Operating profit as a percentage of revenues in our Technology Solutions segment decreased... -

Page 42

...of long-term debt issued in the fourth quarter of 2007 to fund our acquisition of Per-Se. Refer to our discussion under the caption "Credit Resources" within this Financial Review for additional information regarding our financing for the Per-Se acquisition. Income Taxes: Our reported tax rates were... -

Page 43

...of goodwill, as further described below. In connection with the divestiture, we allocated a portion of our Distribution Solutions Medical-Surgical business' goodwill to the Acute Care supply business as required by SFAS No. 142, "Goodwill and Other Intangible Assets." The allocation was based on the... -

Page 44

McKESSON CORPORATION FINANCIAL REVIEW (Continued) In 2005, our Acute Care business entered into an agreement with a third party vendor to sell the vendor' s proprietary software and services. The terms of the contract required us to prepay certain royalties. During the third quarter of 2006, we ... -

Page 45

... to goodwill. Included in the purchase price allocation are acquired identifiable intangibles of $119 million representing customer relationships with a weightedaverage life of 9 years, developed technology of $3 million with a weighted-average life of 4 years and trademarks and trade names of... -

Page 46

... is based in Moorestown, New Jersey. Sterling is a national provider and distributor of disposable medical supplies, health management services and quality management programs to the home care market. This segment also acquired a medical supply sourcing agent. The total cost of these two entities... -

Page 47

...cardiac image and information management services to healthcare providers. Approximately $60 million of the purchase price was assigned to goodwill and $20 million was assigned to intangibles which represent technology assets and customer lists which have an estimated weighted-average useful life of... -

Page 48

... estimated quantities of slow-moving inventory by reviewing on-hand quantities, outstanding purchase obligations and forecasted sales. Shifts in market trends and conditions, changes in customer preferences due to the introduction of generic drugs or new pharmaceutical products or the loss of... -

Page 49

... guideline companies and when considering the income approach, include the required rate of return used in the discounted cash flow method, which reflects capital market conditions and the specific risks associated with the business. Other estimates inherent in the income approach include long-term... -

Page 50

... the ultimate realization of future benefits is uncertain. Changes in tax laws and rates could also affect recorded deferred tax assets and liabilities in the future. Management is not aware of any such changes that could have a material effect on the Company' s results of operations, cash flows... -

Page 51

...2007 benefited from improved accounts receivable management, reflecting changes in our customer mix, our termination of a customer contract and an increase in accounts payable associated with improved payment terms. These benefits were partially offset by increases in inventory needed to support our... -

Page 52

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Operating activities for 2006 benefited from improved working capital balances for our U.S. pharmaceutical distribution business as purchases from certain of our suppliers became better aligned with customer demand and as a result, net financial ... -

Page 53

... well as long-term debt). Our ratio of net debt to net capital employed increased in 2007 primarily due to our issuance of $1.0 billion of long-term debt in relation to the Per-Se acquisition. The Company has paid quarterly cash dividends at the rate of $0.06 per share on its common stock since the... -

Page 54

... for pension and postretirement plans. We define a purchase obligation as an arrangement to purchase goods or services that is enforceable and legally binding on the Company. These obligations primarily relate to inventory purchases, capital commitments and service agreements. At March 31, 2008... -

Page 55

...In addition, upon occurrence of both a change of control and a ratings downgrade of the notes to non-investment-grade levels, we are required to make an offer to redeem the notes at a price equal to 101% of the principal amount plus accrued interest. We utilized net proceeds, after offering expenses... -

Page 56

...Information regarding our related party balances and transactions is included in "Critical Accounting Policies and Estimates" appearing within this Financial Review and Financial Note 20, "Related Party Balances and Transactions," to the accompanying consolidated financial statements. NEW ACCOUNTING... -

Page 57

... suppliers' , pricing, selling, inventory, distribution or supply policies or practices, or changes in our customer mix could also significantly reduce our revenues and net income. Due to the diverse range of healthcare supply management and healthcare information technology products and services... -

Page 58

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Pedigree Tracking. There have been increasing efforts by various levels of government agencies, including state boards of pharmacy and comparable government agencies, to regulate the pharmaceutical distribution system in order to prevent the ... -

Page 59

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Reimbursements. Both our own profit margins and the profit margins of our customers may be adversely affected by laws and regulations reducing reimbursement rates for pharmaceuticals and/or medical treatments or services or changing the methodology ... -

Page 60

... (which include disease management programs and our nurse triage services) and the provision of products that assist clinical decision-making and relate to patient medical histories and treatment plans. If customers assert liability claims against our products and/or services, any ensuing litigation... -

Page 61

... business delivers enterprise-wide clinical, patient care, financial, supply chain, strategic management software solutions and pharmacy automation to hospitals, physicians, homecare providers, retail and mail order pharmacies and payors. Challenges in integrating Technology Solutions software... -

Page 62

... data residing in our service center, exposing us to significant costs. We provide remote hosting services that involve operating both our software and the software of third-party vendors for our customers. The ability to access the systems and the data that we host and support on demand is critical... -

Page 63

... Federal Health Insurance Portability and Accountability Act of 1996 ("HIPAA"), evolving laws and regulations in this area could restrict the ability of our customers to obtain, use or disseminate patient information or could require us to incur significant additional costs to re-design our products... -

Page 64

...the tax laws and regulations of the United States federal, state and local governments and of many international jurisdictions. From time to time, various legislative initiatives may be proposed that could adversely affect our tax positions. There can be no assurance that our effective tax rate will... -

Page 65

...Touche LLP, an independent registered public accounting firm, audited the financial statements included in this Annual Report on Form 10-K, and has also audited the effectiveness of the Company' s internal control over financial reporting as of March 31, 2008. This audit report appears on page 59 of... -

Page 66

...statements and financial statement schedule, and an opinion on the Company' s internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 67

McKESSON CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) Years Ended March 31, 2007 $ 92,977 88,645 4,332 673 771 284 1,346 (6) 3,068 1,264 (99) 132 1,297 (329) 968 (5) (50) 913 $ 2008 Revenues Cost of Sales Gross Profit Operating Expenses Selling ... -

Page 68

...Net Capitalized Software Held for Sale Goodwill Intangible Assets, Net Other Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Drafts and accounts payable Deferred revenue Current portion of long-term debt Consolidated Securities Litigation Action Other accrued Total Other... -

Page 69

...loss on investments, net of tax of $1 Repurchase of common stock Cash dividends declared, $0.24 per common share Adjustment to initially apply FASB Statement No. 158, net of tax of $37 Other Balances, March 31, 2007 Issuance of shares under employee plans Share-based compensation Tax benefit related... -

Page 70

... of debt, net Repayment of debt Capital stock transactions: Issuances Share repurchases Excess tax benefits from share-based arrangements ESOP notes and guarantees Dividends paid Other Net cash provided by (used in) financing activities Effect of exchange rate changes on cash and cash equivalents... -

Page 71

...on net income. Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires that we make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent... -

Page 72

...: Development costs for software held for sale, which primarily pertain to our Technology Solutions segment, are capitalized once a project has reached the point of technological feasibility. Completed projects are amortized after reaching the point of general availability using the straight-line... -

Page 73

McKESSON CORPORATION FINANCIAL NOTES (Continued) The revenues for the Distribution Solutions segment include large volume sales of pharmaceuticals to a limited number of large customers who warehouse their own product. We order bulk product from the manufacturer, receive and process the product ... -

Page 74

McKESSON CORPORATION FINANCIAL NOTES (Continued) Our Technology Solutions segment also includes revenues from disease management programs provided to various states' Medicaid programs. These service contracts include provisions for achieving certain cost-savings and clinical targets. If the targets ... -

Page 75

... generally set equal to the market price on the date of the grant, we did not record any expense to the income statement related to the grants of stock options, unless certain original grant-date terms were subsequently modified. See Financial Note 19, "Share-Based Payment," for the pro forma effect... -

Page 76

McKESSON CORPORATION FINANCIAL NOTES (Continued) Subsequent to the issuance of the Company' s 2007 Annual Report on Form 10-K, it was determined that we incorrectly presented the adjustment to initially apply SFAS No. 158 of $63 million, net, as a reduction of ... -

Page 77

McKESSON CORPORATION FINANCIAL NOTES (Continued) 2. Acquisitions and Investments In 2008, we made the following acquisition: âˆ' On October 29, 2007, we acquired all of the outstanding shares of Oncology Therapeutics Network ("OTN") of San Francisco, California for approximately $531 million, ... -

Page 78

... LLC ("Sterling") which is based in Moorestown, New Jersey. Sterling is a national provider and distributor of disposable medical supplies, health management services and quality management programs to the home care market. This segment also acquired a medical supply sourcing agent. The total... -

Page 79

...cardiac image and information management services to healthcare providers. Approximately $60 million of the purchase price was assigned to goodwill and $20 million was assigned to intangibles which represent technology assets and customer lists which have an estimated weighted-average useful life of... -

Page 80

... not material to our consolidated financial statements and the TSA was completed as of March 31, 2007. In 2005, our Acute Care business entered into an agreement with a third party vendor to sell the vendor' s proprietary software and services. The terms of the contract required us to prepay certain... -

Page 81

...âˆ' During 2007, we recorded $15 million of restructuring expenses, of which $8 million pertained to employee severance costs associated with the reallocation of product development and marketing resources and the realignment of an international business within our Technology Solutions segment. 74 -

Page 82

... other liabilities of $6 million relating to employee severance costs. In connection with our Per-Se acquisition within our Technology Solutions segment, we recorded a total of $19 million of employee severance costs and $5 million of facility exit and contract termination costs in 2008 and 2007. In... -

Page 83

..., net of tax Income from continuing operations - diluted Discontinued operations Discontinued operations - gain (loss) on sales, net Net income - diluted Weighted average common shares outstanding: Basic Effect of dilutive securities: Options to purchase common stock Convertible junior subordinated... -

Page 84

..., 2007 Goodwill acquired, net of purchase price adjustments Translation adjustments Balance, March 31, 2008 Information regarding intangible assets is as follows: $ $ Total 1,637 1,322 16 2,975 341 29 3,345 March 31, (In millions) Customer lists Technology Trademarks and other Gross intangibles... -

Page 85

...In addition, upon occurrence of both a change of control and a ratings downgrade of the notes to non-investment-grade levels, we are required to make an offer to redeem the notes at a price equal to 101% of the principal amount plus accrued interest. We utilized net proceeds, after offering expenses... -

Page 86

... were purchased by McKesson Financing Trust (the "Trust") with proceeds from its issuance of four million shares of preferred securities to the public and 123,720 common securities to us. The Debentures represented the sole assets of the Trust and bore interest at an annual rate of 5%, payable... -

Page 87

...employee' s plan compensation and creditable service accrued to that date. The Company has made no annual contributions since this plan was frozen. The benefits for this defined benefit retirement plan are based primarily on age of employees at date of retirement, years of service and employees' pay... -

Page 88

McKESSON CORPORATION FINANCIAL NOTES (Continued) Information regarding the changes in benefit obligations and plan assets for our pension plans is as follows: March 31, (In millions) 2008 $ 552 7 31 (8) (47) 8 543 $ 2007 485 7 27 19 (29) 37 6 552 Change in benefit obligations Benefit obligation ... -

Page 89

...return on plan assets Benefit obligation Discount rates Rate of increase in compensation Expected long-term rate of return on plan assets Other Defined Benefit Plans Under various U.S. bargaining unit labor contracts, we make payments into multi-employer pension plans established for union employees... -

Page 90

McKESSON CORPORATION FINANCIAL NOTES (Continued) The ESOP has purchased an aggregate of 24 million shares of the Company' s common stock since its inception. These purchases were financed by 10 to 20 year loans from or guaranteed by us. The ESOP' s outstanding borrowings are reported as long-term ... -

Page 91

... income tax returns for 2000 to 2002 resulting in a signed Revenue Agent Report ("RAR"), which was approved by the Joint Committee on Taxation during the third quarter. The IRS and the Company have agreed to certain adjustments, primarily related to transfer pricing and income tax credits... -

Page 92

... tax benefits arising primarily from settlements and adjustments with various taxing authorities and research and development investment tax credits from our Canadian operations. In 2006, we made a $960 million payment into an escrow account relating to the Consolidated Securities Litigation Action... -

Page 93

..., interest and penalties, accounting in interim periods, disclosure and transition. At April 1, 2007, our "unrecognized tax benefits," defined as the aggregate tax effect of differences between tax return positions and the benefits recognized in our financial statements, amounted to $465... -

Page 94

...31, 2007 Additions based on tax positions related to current year Reductions based on settlements Balance at March 31, 2008 Of the total $496 million in unrecognized tax benefits at March 31, 2008, $318 million would reduce income tax expense and the effective tax rate if recognized. We continue to... -

Page 95

... method of accounting for software installation services within these contracts. In addition, most of our customers who purchase our software and automation products also purchase annual maintenance agreements. Revenue from these maintenance agreements is recognized on a straight-line basis over... -

Page 96

... re McKesson HBOC, Inc. Securities Litigation, (No. C-99-20743 RMW) (the "Consolidated Securities Litigation Action"). In general, we agreed to pay the settlement class a total of $960 million in cash. On February 24, 2006, the Honorable Ronald M. Whyte signed a Final Judgment and Order of Dismissal... -

Page 97

... order granting final approval to the Bear Stearns settlement. II. Average Wholesale Price Litigation On June 2, 2005, a civil class action complaint was filed against the Company in the United States District Court, District of Massachusetts captioned: New England Carpenters Health Benefits Fund... -

Page 98

... set of operative facts as the New England Carpenters I action. The Complaint purports to state claims against the Company for violation of the Sherman Act, 15 U.S.C. § 1, California Business & Professions Code § 16700 et seq., and Antitrust Laws for Indirect Purchasers for seventeen individual... -

Page 99

McKESSON CORPORATION FINANCIAL NOTES (Continued) III. Product Liability Litigation The Company is a defendant in approximately 575 cases alleging that the plaintiffs were injured by Vioxx, an anti-inflammatory drug manufactured by Merck & Company ("Merck"). The cases typically assert causes of ... -

Page 100

... the U.S. Attorney' s Office ("USAO") in Massachusetts seeking documents relating to the Company' s business relationship with a long-term care pharmacy organization; (2) we have responded to a request from the Federal Trade Commission for certain documents as part of a non-public investigation to... -

Page 101

... disclosed claims by the Drug Enforcement Administration ("DEA") and six USAOs that between 2005 and 2007, certain of our pharmaceutical distribution centers fulfilled customer orders for select controlled substances, which orders were not adequately reported to the DEA. The settlements were... -

Page 102

... of acquisition. 2000 Employee Stock Purchase Plan (the "ESPP"): The Company also has an ESPP under which 11 million shares have been authorized for issuance. On July 25, 2007, the Company' s stockholders approved an amendment to the ESPP under which the number of shares of common stock reserved for... -

Page 103

... is applied in establishing the beginning APIC pool balance as well as determining the future impact on the APIC pool and our consolidated statements of cash flows relating to the tax effects of share-based compensation. The election of this accounting policy did not have a material impact on our... -

Page 104

...amounts) RSU and RS (1) PeRSUs (2) Stock options Employee stock purchase plan Share-based compensation expense Tax benefit for share-based compensation expense (3) Share-based compensation expense, net of tax (4) Impact of share-based compensation: Earnings per share Diluted Basic $ $ 2008 50 22... -

Page 105

... the same contractual life and vesting schedule as 2008 option grants. Stock options under the Legacy Plans, which are substantially vested, generally have a ten-year contractual life. Compensation expense for stock options is recognized on a straight-line basis over the requisite service period and... -

Page 106

McKESSON CORPORATION FINANCIAL NOTES (Continued) Weighted-average assumptions used to estimate the fair value of employee stock options were as follows: Years Ended March 31, 2007 27% 0.5% 5% 5 Expected stock price volatility Expected dividend yield Risk-free interest rate Expected life (in years)... -

Page 107

...date of grant. The fair value of RS and RSUs under our stock plans is determined by the product of the number of shares that are expected to vest and the grant date market price of the Company' s common stock. The Compensation Committee determines the vesting terms at the time of grant. These awards... -

Page 108

... to the purchase of the shares, and any amounts accumulated during that period are refunded. The 15% discount provided to employees on these shares is included in compensation expense. The funds outstanding at the end of a quarter are included in the calculation of diluted weighted average shares... -

Page 109

McKESSON CORPORATION FINANCIAL NOTES (Continued) 20. Related Party Balances and Transactions Notes receivable outstanding from certain of our current and former officers and senior managers totaled $16 million and $25 million at March 31, 2008 and 2007. These notes related to purchases of common ... -

Page 110

... Provider Technologies segment) delivers enterprise-wide clinical, patient care, financial, supply chain, strategic management software solutions, pharmacy automation for hospitals, as well as connectivity, outsourcing and other services, to healthcare organizations. We have added our Payor group of... -

Page 111

... to customers' warehouses Subtotal Canada pharmaceutical distribution & services Medical-Surgical distribution & services Total Distribution Solutions Technology Solutions Services Software and software systems Hardware Total Technology Solutions Total Operating profit (2) Distribution Solutions... -

Page 112

... Total International operations primarily consist of our operations in Canada, the United Kingdom, Ireland, other European countries, Asia Pacific and Israel. We also have an equity-held investment (Nadro) in Mexico. Net revenues were attributed to geographic areas based on the customers... -

Page 113

...Income after income taxes Continuing operations Discontinued operations Total Earnings per common share Diluted Continuing operations Discontinued operations Total Basic Continuing operations Discontinued operations Total Cash dividends per common share Market prices per common share High Low Fiscal... -

Page 114

... into an agreement to acquire McQueary Brothers Drug Company, Inc. ("McQueary Brothers"), of Springfield, Missouri for approximately $190 million. McQueary Brothers is a regional distributor of pharmaceutical, health, and beauty products to independent and regional chain pharmacies in the Midwestern... -

Page 115

...2002 I, John H. Hammergren, certify that: 1. 2. I have reviewed this annual report on Form 10-K of McKesson Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 116

... I, Jeffrey C. Campbell, certify that: 1. 2. I have reviewed this annual report on Form 10-K of McKesson Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the... -

Page 117

... of Section 18 of the Securities Exchange Act of 1934, as amended. A signed original of this written statement required by Section 906 has been provided to McKesson Corporation and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request. -

Page 118

... and October. McKesson Corporation's Dividend Reinvestment Plan offers stockholders the opportunity to reinvest dividends in common stock and to purchase additional shares of common stock. Stock in an individual's Dividend Reinvestment Plan is held in book entry at the Company's transfer agent, BNY... -

Page 119

McKesson Corporation One Post Street San Francisco, CA 94104 www.mckesson.com ©2008 McKesson Corporation. All rights reserved. CORP-02161-06-08