Marks and Spencer 2016 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2016 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

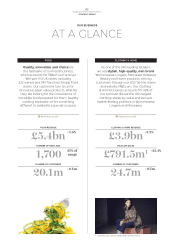

GROUP PERFORMANCE (52 WEEKS) STRATEGIC PRIORITIES FOR THE YEAR

FINANCIAL OVERVIEW

£5.4bn

£3.9bn

£539.3m

55.1%

34.8p

6.8p + 11.9p1 = 18.7p

£684.1m

4.6p

£483.3m

CLOTHING & HOME

GROSS MARGIN

UK CLOTHING & HOME

REVENUE

FREE CASH FLOW

PRE SHAREHOLDER RETURNS

UK FOOD REVENUE

24.6p

£10.4bn

GROUP REVENUE

+0.8% +3.6%

+245bps

-2.2%+0.7p

+5.1% -17.2%

+3.5% -19.5%

UNDERLYING PROFIT BEFORE TAX

SPECIAL DIVIDEND

UNDERLYING GROUP EARNINGS PER SHARE

INTERIM AND FINAL DIVIDEND

GROUP PROFIT BEFORE TAX

BASIC EARNINGS PER SHARE

53 WEEK YEAR This year we are reporting

on the 53 weeks to 2nd April 2016,

as every six years an additional week

is included to ensure that the year-

end date stays in line with the end of

March. In order to provide a meaningful

comparison with last year’s 52 week

period, all fi nancial movements are

reported on a 52 week basis, and

excluding the 53rd week, unless

otherwise noted. All balance sheet

and cash fl ow information is reported

as at the year-end date.

Full details of the 53 week results can be

found in the Financial Review p23

INTEGRATED REPORTING We have set out

to produce an Annual Report that meets

the guiding principles of the Integrated

Reporting Council framework by

developing our reporting in several key

areas. These include: improvements to

our business model to better show the

e ective use of the resources and

relationships relevant to M&S; a new,

more detailed look at our business

model and how it drives value creation

through the interdependencies within

our business; mapping our principal risks

against our business model to

demonstrate the connectivity between

the two; and the continued linkage

between our KPIs and remuneration.

ONLINE INFORMATION We provide

comprehensive company information

for our shareholders on our website,

including digital versions of all our

Annual Reports. We encourage all our

shareholders to receive information

electronically as it enables us to keep

them informed about company news and

trading updates throughout the year.

Follow the ‘Electronic Shareholder

Communication’ link at

marksandspencer.com/investors

INVESTOR RELATIONS APP We have

upgraded our Investor Relations app so

that it is now optimised for use across

all devices and on all operating systems,

including iOS and Android. The app

displays the latest share price information

and corporate news and contains fi nancial

reports, presentations and videos.

NAVIGATING THE REPORT In this document

you will see a series of icons that

demonstrate how we’ve integrated

information about our business model

and performance with details of our

principal risks, remuneration and Plan A.

The icons also tell you where to look for

further information, either in this report

or in our 2016 Plan A Report.

Our Plan A Report can be viewed at

marksandspencer.com/plana2016

ABOUT OUR REPORTING

READ

MORE LINKED TO

REMUNERATION

PLAN A

A

RISK

R

LOOKING

AHEAD

+2.9%

1. Subject to shareholder approval.