Marks and Spencer 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT &

FINANCIAL STATEMENTS

2016

Table of contents

-

Page 1

ANNUAL REPORT & FINANCIAL STATEMENTS 2016 -

Page 2

... CLOTHING & HOME REVENUE 6.8p + 11.9p1 = 18.7p+0.7p SPECIAL DIVIDEND £3.9bn-2.2% FREE CASH FLOW PRE SHAREHOLDER RETURNS 4.6p UNDERLYING GROUP EARNINGS PER SHARE BASIC EARNINGS PER SHARE £539.3m+2.9% 24.6p-17.2% 34.8p +5.1% 1. Subject to shareholder approval. ABOUT OUR REPORTING 53 WEEK YEAR... -

Page 3

... REPORT? OUR BUSINESS 02 At a glance 04 Chairman's statement 06 Chief Executive's strategic overview 10 Creating sustainable value 12 Connected value OUR PERFORMANCE 14 15 18 22 26 27 Marketplace Operating performance Key performance indicators Financial review Our people Risk management GOVERNANCE... -

Page 4

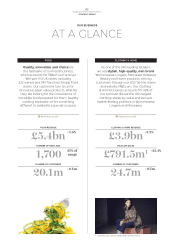

... MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR BUSINESS AT A GLANCE FOOD CLOTHING & HOME Quality, innovation and choice are the hallmarks of our Food business, which accounts for 58% of our turnover. We have 914 UK stores, including 222 owned and 349 franchise Simply Food stores. Our customers... -

Page 5

03 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 INTERNATIONAL PLAN A 2020 A We have 468 stores across Europe, Asia and the Middle East. We operate through three different business models - owned, franchise and joint venture - to bring our quality Clothing & Home collections and Food ranges to our... -

Page 6

... 75 new Simply Food stores, which are performing strongly. Our Clothing & Home business underperformed. Although it delivered signiï¬cant margin gains due to better design and sourcing skills, our sales performance was unsatisfactory. Steve's number one priority is to return Clothing & Home to... -

Page 7

05 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 THIS YEAR'S REPORT - KEY FEATURES We continue to keep the structure of our reporting suite under review, in line with our ambition to encourage more shareholders to use digital communications and to therefore reduce the number of documents we print. In... -

Page 8

06 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR BUSINESS CHIEF EXECUTIVE'S STRATEGIC UPDATE We are at our best when we are completely focused on our customers. My plan is to keep things simple by putting them at the heart of M&S - every decision starts with them. STEVE ROWE CHIEF EXECUTIVE ... -

Page 9

... CLOTHING & HOME UK STORE ESTATE CONTINUE TO GROW FOOD OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE INTERNATIONAL ORGANISATION COST REVIEW FINANCIAL PLAN our price points and reshaped the structure of our Womenswear team to better reï¬,ect the way our customers shop. This new... -

Page 10

08 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT CHIEF EXECUTIVE'S STRATEGIC UPDATE CONTINUED LOOKING AHEAD There are many areas of our business that we are still reviewing. In the autumn we will report back on future growth channels. We will also give an update on the plans for our UK store ... -

Page 11

.... Patrick Bousquet-Chavanne has become Executive Director, Customer, Marketing & M&S.com and assumed new responsibilities for M&S.com and Plan A. Helen Weir, Chief Finance Officer, has assumed responsibility for Strategy Implementation. Consequently, our International business will now report... -

Page 12

... services we offer our customers in the UK and internationally. OUR RESOURCES & RELATIONSHIPS FINANCIAL Generating returns for our stakeholders through effective management of our ï¬nancial resources OUR PRODUCT & CHANNELS Maintaining our channels and supply chain infrastructure to meet customer... -

Page 13

... RESOURCES Sourcing responsibly and using natural resources efficiently L PLAN A V DE EL SO U R CE & B U Y SOURCE & BUY Activities: A sustainable supply chain is key to creating sustainable value. Our team of 450 employees in nine regional sourcing offices in our key clothing sourcing markets... -

Page 14

... Understanding our customers' changing needs informs every product we make and service we offer. 2. Strategy & Planning Robust ï¬nancial management ensures we are able to continue to invest in our business and deliver proï¬table growth for our shareholders. 3. Develop & Design New ideas fuel... -

Page 15

...Changing consumer behaviours 3. Business transformation 7. Food safety and integrity 8. Clothing & Home ethical sourcing 9. Cyber/Information security See Risk p28-29 Non-ï¬nancial accountability BOARD Key non-ï¬nancial measures Total Food customers and average number of shops per customer Total... -

Page 16

14 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR PERFORMANCE MARKETPLACE We are operating in changing times, so it is crucial that we listen to our customers and keep a close eye on global trends. Our Customer Insight Unit (CIU) analyses responses from 60,000 customers per month. By combining ... -

Page 17

... availability is key to ensuring our customers are able to buy what they want, when they want. Getting the balance right is a complex equation and this resulted in slightly higher levels of waste during the wet weather in the summer and in the run up to Christmas, when we stocked our stores in line... -

Page 18

16 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OPERATING PERFORMANCE CONTINUED A We take a rigorous approach to R maintaining strict ethical standards in our supply chain. The standards we expect from our suppliers are clearly deï¬ned and our regional teams in all the areas we source from ... -

Page 19

... online sales are still picked up in store through our Shop Your Way service. This tells us that our customers love the convenience of multi-channel shopping. R As our online business grows, the smooth running of M&S.com is essential to our success. Our software engineers can update our site daily... -

Page 20

18 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT OUR PERFORMANCE KEY PERFORMANCE INDICATORS GROUP FINANCIAL OBJECTIVES OBJECTIVE Grow Group revenue KPI GROUP REVENUE 2015/16 PERFORMANCE (52 weeks to 26 March 2016) Deï¬nition Total Group sales, including retail sales for owned businesses and ... -

Page 21

...newness and convenience alongside our Simply +1.9% Food store opening programme is encouraging more customers to shop with us more often. CLOTHING & HOME Deï¬nition Total number of UK Clothing & Home customers per year and average number of shops per customer resulting in a purchase across all UK... -

Page 22

20 MARKS AND SPENCER GROUP PLC STRATEGIC REPORT KEY PERFORMANCE INDICATORS CONTINUED Read about our Strategic Update on p06-08 Read more on Remuneration on p58 Read about our Resources & Relationships on p10-13 STRATEGIC OBJECTIVES OBJECTIVE Driving growth KPI SALES REVENUE FOOD (52 WEEKS) UK ... -

Page 23

... sales performance will deliver results, however it will take time for our customers to notice the improvements and change their shopping behaviour. Given current market conditions and our decision to invest in price and reduce promotional activity, we expect to see the same sales trend as last year... -

Page 24

...AND SPENCER GROUP PLC STRATEGIC REPORT OUR PERFORMANCE FINANCIAL REVIEW We are committed to delivering proï¬t for our shareholders by putting our customers at the heart of everything we do. HELEN WEIR CHIEF FINANCE OFFICER 53 WEEK YEAR This year we are reporting on the 53 weeks to 2nd April 2016... -

Page 25

23 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 FIND OUT MORE See our KPIs on p18-21 See our Strategic Update on p06-08 See how performance links to Remuneration on p58 Read about our operating performance on p15-17 Continuing to invest in the business growth, underpinned by strong investment ... -

Page 26

... of a c.£90m multi-year programme to improve the quality of the UK store estate, a £26.7m charge has been recognised in relation to UK store closures. A further £23.7m of asset impairments were incurred as a result of the review of our Clothing & Home strategy which meant that certain buying and... -

Page 27

...to better sites as we improved the quality of the store estate for our customers. Clothing & Home space increased by 0.4% as the full line store openings more than offset the closures. International space increased by c. 1.4%, a reduction on previous years. We continued to invest in supply chain and... -

Page 28

...robust processes we have in place around succession planning, change management and our dedicated Employee Communications team help us mitigate such risks from a people perspective. Our Business Involvement Group (BIG), M&S's network of elected employee representatives, enables us to inform, involve... -

Page 29

...be found on page 48. During 2015/16, the directors also assessed the long-term viability of the Company in the context of its principal risks. The inclusion of a Viability Statement in Annual Reports from 2016 is a new requirement under the UK Corporate Governance Code. The statement is designed to... -

Page 30

... team engaged to manage associated employee messaging. > Robust programme management practices in place. > Consultation with Business Involvement Group on changes related to our peo. 4 CLOTHING & HOME SUPPLY CHAIN AND LOGISTICS NETWORK The growth of our business and achievement of strategic... -

Page 31

... have improved signiï¬cantly in 2015/16. > Dual site M&S.com command centre operates 24/7 to monitor website availability and performance. > Social media monitored to observe and respond to trends in customer experience. > Business continuity plans, incident reporting and management procedures... -

Page 32

... on delivering an improved customer experience has underpinned a strong performance from M&S.com and delivered growth in market share. Our balance sheet remains strong and we are delivering well against our free cashï¬,ow targets, even after returning £451.7m to shareholders, via dividend payments... -

Page 33

...performance-related pay is delivered through shares. Reward Our reward framework is simple and transparent and is designed to support and drive our business strategy. We also provide insight relating to director: > Independence Maintaining the right balance of independence on the Board; internally... -

Page 34

... 2015, Chief Executive from 2 April 2016 Skills, competence and experience: Steve joined M&S in 1989 and progressed through a variety of roles within store management before moving to Head Office in 1993. He has worked in senior roles across various areas of the business, including Director of Home... -

Page 35

...year end) GROUP BOARD Male Female 24 May 2016 (As at date of Annual Report) GROUP BOARD Male Female 62% 38% 64% 36% EXECUTIVE Male Female EXECUTIVE 60% 40% Male Female 50% 50% OUR PERFORMANCE FINANCIAL STATEMENTS GOVERNANCE Martha Lane Fox Non-Executive Director Retired: 2 April 2016. In line... -

Page 36

... relating to strategy, ï¬nance, risk management, internal control and audit, legal, reputation and public company management. These, along with the individual roles of the Board members, are covered by the 'Schedule of Matters Reserved to the Board' in the Marks and Spencer Group plc Governance... -

Page 37

... Chief Executive Designate Steve Rowe Chief Finance Officer Helen Weir 8 (Retired 2 April 2016) 8 Strategy & Group performance 8 Food performance from April to July 2015 General Merchandise performance thereafter 8 Group Financial Performance and Ecommerce distribution 8 Marketing & International... -

Page 38

... statement, in line with the UK Corporate Governance Code. > Introduced internal Board framework > Agreed 2016/17 action plan with clear process for monitoring during the year. > Agreed a robust set of Group level risks and mitigating activities, which are regularly monitored. > Further developed... -

Page 39

... on plan, 1 behind plan. > 1 commitment cancelled. > Identiï¬ed strategic priorities for 2016/17. > Introduced 'Smarter Working' workstream to evaluate and improve use of office space. > Proposed a new approach to future pay positioning. > Review ways of working across stores and offices. Reviewed... -

Page 40

...; marketing campaigns; brand values; analyst and investor opinion; review of investor surveys; share register and voting history; key stakeholder relations including employees, customers, suppliers and service providers; opinion leaders; an overview of our remuneration policy and pensions. received... -

Page 41

39 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 BOARD EFFECTIVENESS REVIEW The assessment of the M&S Board was conducted according to the guidance set out in the UK Corporate Governance Code. The evaluation was based around a number of key areas: > Board composition, role, skills, > Strategic and ... -

Page 42

... Earlier in this report I provided detail on the Board changes during the year. Succession and director development have been key areas of focus for the Committee this year, culminating with the appointment of Steve Rowe as the new CEO, and the appointment of a non-executive director, Andrew Fisher... -

Page 43

... of key initiatives: > The annual Board evaluation process School Training. > Senior management mentoring and BOARD DIVERSITY: PROGRESS UPDATE Maintain a level of at least 30% female directors on the Board over the short to medium term. As highlighted earlier in the report, changes to the Board... -

Page 44

... without executive management being present. In addition, I regularly hold separate one-to-one meetings with the Chief Finance Officer, Director of Group Finance, Head of Internal Audit & Risk, other senior management, and with the lead audit partner. These are usually before Committee meetings as... -

Page 45

... target groups: 1. Chief Finance Officer and Director of Group Financial Control: A full questionnaire was completed, covering all areas of the audit process, and in consideration of the questionnaire completed by the Heads of Finance for Food, Clothing & Home and International. 2. Heads of Finance... -

Page 46

... Board, the Committee has considered whether, in its opinion, the 2015/16 Annual Report and Financial Statements is fair, balanced and understandable, and whether it provides the information necessary for shareholders to assess the Group's position and performance, business model and strategy. The... -

Page 47

...its review, the Committee was of the opinion that the 2016 Annual Report and Accounts is representative of the year and presents a fair, balanced and understandable overview, providing the necessary information for shareholders to assess the Group's position, performance, business model and strategy... -

Page 48

... planning and reporting, preparing consolidated accounts, capital expenditure, project governance and information security, and the Group's Code of Ethics and Behaviours. INTERNAL ASSURANCE FRAMEWORK COMMITTEES Fire, Health & Safety Plan A* ANNUAL UPDATE BY RELEVANT EXECUTIVE REPORTS Information... -

Page 49

... value in core business areas. RISK: CLOTHING & HOME TRANSFORMATION Improving product availability to customers in-store and online is a key priority and Internal Audit reviewed the process to allocate the stock available in our warehouses. Our audit found opportunities to improve the reconciliation... -

Page 50

... last year. Following a review of the draft statements prepared in 2014/15, the Board have now agreed a set of Grouplevel risk appetite statements that address key risk areas and speciï¬c business operations; they are also designed to support the business in its management of a number of principal... -

Page 51

... shareholder base. Our Investor Relations team receive independent guidance from capital markets advisory ï¬rm Makinson Cowell, which undertakes an annual audit of our major investors' views on the Company's management and performance. The results of its audit are presented to the Board each year... -

Page 52

...'s remuneration as Chief Executive Officer began after the ï¬nancial year-end. Full details for Steve's appointment were disclosed at the time and are detailed later in this report on page 68 with a starting salary in this role of £810,000. In line with the provisions in the Policy, the Committee... -

Page 53

...' remuneration policy p57 Strategic alignment of pay p58 Total single ï¬gure remuneration p58 Salary and beneï¬ts p59 Annual Bonus Scheme p60-61 REMUNERATION REPORT p58 Performance Share Plan p62-63 Directors' share interests p64-66 Non-executive directors' remuneration p69 Remuneration Committee... -

Page 54

...MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE EXECUTIVE REMUNERATION 2015/16 REMUNERATION AT A GLANCE This overview summarises our Policy in action and shows the alignment between our remuneration framework, the Company's performance and payments to directors for 2015/16. STRATEGIC PAY... -

Page 55

53 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 KEY PERFORMANCE MEASURES GROUP REVENUE UNDERLYING PBT RETURN ON CAPITAL EMPLOYED EARNINGS PER SHARE FREE CASH FLOW (PRE SHAREHOLDER RETURNS) £10.4bn £684.1m 15.0% Performance Share Plan (PSP) 34.8p Annual Bonus Scheme £539.3m ALIGNED TO ... -

Page 56

... for up to three years after the payment date, for payments made after July 2015. Total maximum annual bonus opportunity is capped at 200% of salary for each executive director. Performance Share Plan (PSP) To encourage long-term shareholding, to retain directors and to provide greater alignment... -

Page 57

... six months' notice. OUR PERFORMANCE FINANCIAL STATEMENTS GOVERNANCE > Salaries are set by the Committee, taking into consideration a number of factors including the current pay for other executive directors, the experience, skill and current pay level of the individual and external market forces... -

Page 58

... of share schemes in the event of a change of control or winding-up of the Company and some legacy long-term incentive plans which the Company operates. No current executive director holds unexercised awards under these legacy plans. Base salary, beneï¬ts and pension beneï¬ts Annual Bonus Scheme... -

Page 59

... REPORT AND FINANCIAL STATEMENTS 2016 SUMMARY NON-EXECUTIVE DIRECTORS' REMUNERATION POLICY (AS APPROVED ON 8 JULY 2014) OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE The table below summarises our Policy for the operation of non-executive director fees and beneï¬ts at the Company... -

Page 60

... indicators which are integrated in to the directors' incentive schemes. This ensures that directors are clearly aligned and motivated to deliver the strategy. FIGURE 8: STRATEGIC ALIGNMENT OF PAY FINANCIAL OBJECTIVES KPI INCENTIVE SCHEME See KPIs on p18-21 Grow Group revenue Increase earnings... -

Page 61

... the Annual Bonus Scheme and Performance Share Plan are measured on a 52 week basis. SALARY (audited) When reviewing salary levels, the Committee takes into account a number of internal and external factors, including Company performance during the year, external market data and the salary review... -

Page 62

... SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE REMUNERATION REPORT CONTINUED EXECUTIVE DIRECTORS' REMUNERATION CONTINUED ANNUAL BONUS SCHEME ANNUAL BONUS SCHEME 2015/16 (audited) Annual performance for 2015/16 was measured against Underlying PBT (30% of awards) and either business unit operating... -

Page 63

... TARGETS 2016/17 CORPORATE TARGETS GROUP PBT Director % bonus LOCAL FINANCIAL % bonus CUSTOMER % bonus INDIVIDUAL OBJECTIVES INDIVIDUAL % bonus Measure Steve Rowe 70% 10% 10% 10% Clothing & Home UK LFL sales Organisational development Patrick Bousquet-Chavanne 70% 10% 10% 10% Business Unit... -

Page 64

... MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE REMUNERATION REPORT CONTINUED EXECUTIVE DIRECTORS' REMUNERATION CONTINUED PERFORMANCE SHARE PLAN (PSP) The Committee believes that long-term share awards reward executives for the delivery of long-term business goals and make annual awards... -

Page 65

...sufficient time to develop M&S's long-term business plan. This will ensure that PSP targets are rigorously reviewed in the context of this new leadership, rewarding stretching yet achievable performance designed to deliver increased shareholder value. Such awards will vest three years after the date... -

Page 66

64 MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE REMUNERATION REPORT CONTINUED EXECUTIVE DIRECTORS' REMUNERATION CONTINUED FIGURE 19: DIRECTORS' SHAREHOLDINGS (audited) The table below sets out the total number of shares held at 2 April 2016 or date of retirement by each executive ... -

Page 67

.../conditional shares shown under the Performance Share Plan is the maximum (100%) number that could be receivable by the executive director if the performance conditions are fully met. The 2012 award vested in June 2015 at 4.7% (December 2015 for Patrick Bousquet-Chavanne). 4.8% of the 2013 award... -

Page 68

66 MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: GOVERNANCE REMUNERATION REPORT CONTINUED EXECUTIVE DIRECTORS' REMUNERATION CONTINUED FIGURE 23: EXECUTIVE DIRECTORS' INTERESTS IN THE COMPANY'S SHARE SCHEMES (audited) (continued) Maximum receivable at 29 March 2015 Date (or date of of grant ... -

Page 69

... to shareholders by way of dividend payments and share buyback. Total employee pay is the total pay for all Group employees. Underlying Group Proï¬t Before Tax has been used as a comparison as this is the key ï¬nancial metric which the Board consider when assessing Company performance. 2014/15... -

Page 70

... 2016. Date of appointment Notice period/unexpired term Steve Rowe Patrick Bousquet-Chavanne Laura Wade-Gery Helen Weir 01/10/2012 10/07/2013 04/07/2011 01/04/2015 12 months/6 months 12 months/6 months 12 months/6 months 12 months/6 months EXECUTIVE CHANGES TO THE BOARD DURING 2015/16 Directors... -

Page 71

... FINANCIAL STATEMENTS 2016 NON-EXECUTIVE DIRECTORS' REMUNERATION FIGURE 29: NON-EXECUTIVE DIRECTORS' TOTAL SINGLE FIGURE REMUNERATION (audited) Basic fees Director Year £000 Additional fees £000 Beneï¬ts £000 Total £000 Non-executive directors receive fees reï¬,ective of the time commitment... -

Page 72

... account the total value of all awards made under this plan. > Half year and year end review of all share Policy prior to seeking formal shareholder approval in July 2017. > Review senior management plan performance against targets. > Approval of the vesting level of the remuneration regularly... -

Page 73

... seeks internal support from the CEO, Group Secretary, Director of Human Resources and Head of Reward & Global Mobility as necessary. All may attend the Committee meetings by invitation but are not present for any discussions that relate directly to their own remuneration. The Committee also reviews... -

Page 74

... also receives presentations from the Chief Finance Officer after the Group's Year End and Half Year results. The scheme is a signatory to the UN Principles for Responsible Investment and the Financial Reporting Council's UK Stewardship Code. It has partnered with a specialist engagement service... -

Page 75

... law. For information on our approach to social, environmental and ethical matters please refer to our Plan A Report, available to view online at marksandspencer.com/plana2016. Other information to be disclosed in the Directors' Report is given in this section. Chief Finance Officer Non-executive... -

Page 76

... 15 July 2016 to shareholders whose names are on the Register of Members at the close of business on 3rd June 2016. SHARE CAPITAL The Company's issued ordinary share capital as at 2 April 2016 comprised a single class of ordinary share. Each share carries the right to one vote at general meetings of... -

Page 77

... committed to employee involvement throughout the business. Employees are kept well informed of the performance and strategy of the Group through personal brieï¬ngs, regular meetings, email and broadcasts by the Chief Executive and members of the Board at key points in the year to all head office... -

Page 78

... pension schemes. Employees are updated from time to time with any pertinent information on their pension savings as appropriate. EQUAL OPPORTUNITIES The Group is committed to an active equal opportunities policy from recruitment and selection, through training and development, performance reviews... -

Page 79

... 2016 AGM. ANNUAL GENERAL MEETING The AGM of Marks and Spencer Group plc will be held at Wembley Stadium, London on 12 July 2016 at 11am. The Notice of Meeting is given, together with explanatory notes, in a booklet which accompanies this report. DIRECTORS' RESPONSIBILITIES The Board is of the view... -

Page 80

... OF MARKS AND SPENCER GROUP PLC OPINION ON FINANCIAL STATEMENTS OF MARKS AND SPENCER GROUP PLC IN OUR OPINION: The ï¬nancial statements give a true and fair view of the state of the Group's and of the parent Company's a airs as at 2 April 2016 and of the Group's proï¬t for the 53 weeks then ended... -

Page 81

79 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 OUR ASSESSMENT OF RISKS OF MATERIAL MISSTATEMENT 1 2 Presentation of non-GAAP measures Impairment of property, plant and equipment, and intangible assets Inventory valuation and provisions Revenue recognition - customer returns Supplier rebates ... -

Page 82

... applied to new store shelter periods, and no additional impairments were identiï¬ed from the work performed above. in the impairment models through our knowledge of the business gained through reviewing trading plans, strategic initiatives, and meeting with senior trading managers from key... -

Page 83

... management compared to the current purchasing strategy and ranging plans. 4 Revenue recognition - gift cards, loyalty schemes and returns RISK DESCRIPTION As described in the Accounting Policies in note 1 to the Financial Statements, the Group's revenue recognition policies require the directors... -

Page 84

... pension plan for its UK employees, which was closed to new entrants with effect from 1 April 2002, and a funded deï¬ned beneï¬t pension scheme in the Republic of Ireland, where no new beneï¬ts have accrued since 31 October 2013. At 2 April 2016, the Group recorded a net retirement beneï¬t asset... -

Page 85

83 ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 OUR APPLICATION OF MATERIALITY in the international business - £32 million charge; > Impairment of goodwill in OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE We determined materiality for the Group to be £30 million. We reported all ... -

Page 86

... centre and 18 retail store visits in the UK to understand the current trading performance and, at certain locations, perform tests of internal controls and validate levels of inventory held. As part of our ï¬rst year audit, last year a senior member of the Group audit team visited each of the... -

Page 87

...of the Corporate Governance Statement relating to the company's compliance with certain provisions of the UK Corporate Governance Code. We have nothing to report arising from our review. Our duty to read other information in the Annual Report Under International Standards on Auditing (UK and Ireland... -

Page 88

86 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS CONSOLIDATED INCOME STATEMENT 53 weeks ended 2 April 2016 Notes Underlying £m Non-underlying £m Total £m 52 weeks ended 28 March 2015 Underlying £m Non-underlying £m Total £m Revenue Operating proï¬t Finance income Finance costs Proï¬t ... -

Page 89

... ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 CONSOLIDATED STATEMENT OF FINANCIAL POSITION Notes As at 2 April 2016 £m As at 28 March 2015 £m Deferred tax assets Current assets Inventories Other ï¬nancial assets Trade and other receivables Derivative ï¬nancial instruments Current tax assets... -

Page 90

88 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Ordinary share capital £m Share Capital premium redemption account reserve £m £m Hedging reserve £m Other reserve¹ £m Retained earnings² £m Total £m Noncontrolling interest £m Total £m... -

Page 91

... to the Marks & Spencer UK Pension Scheme Equity dividends paid Shares issued on exercise of employee share options Purchase of own shares held by employee trust Share buyback Net cash used in ï¬nancing activities Net cash inï¬,ow from activities Effects of exchange rate changes Opening net... -

Page 92

90 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS > IFRS 15 'Revenue from Contracts with Customers' is effective for 1 ACCOUNTING POLICIES General information The current ï¬nancial statements are prepared for the 53 week period ended 2 April 2016, whereas the ... -

Page 93

... Company's shareholders. Interim dividends are recorded in the period in which they are approved and paid. Pensions Funded pension plans are in place for the Group's UK employees and some employees overseas. For deï¬ned beneï¬t pension schemes, the difference between the fair value of the assets... -

Page 94

...year end exchange rates. The resulting exchange differences are booked into reserves and reported in the consolidated statement of comprehensive income. Transactions denominated in foreign currencies are translated at the exchange rate at the date of the transaction. Foreign currency monetary assets... -

Page 95

...ed to the income statement only on disposal of the net investment. GOVERNANCE FINANCIAL STATEMENTS OUR PERFORMANCE OUR BUSINESS the cash ï¬,ows of a recognised asset or liability (a cash ï¬,ow hedge); > A hedge of the exposure to change in the fair value of a recognised asset or liability (a fair... -

Page 96

...and note 12 for critical judgements associated with the Marks & Spencer UK Pension Scheme interest in the Marks and Spencer Scottish Limited Partnership. E. Refunds, gift cards and loyalty scheme accruals: Accruals for sales returns, deferred income in relation to loyalty scheme redemptions and gift... -

Page 97

... UK retail business and UK franchise operations. The International segment consists of Marks & Spencer owned businesses in the Republic of Ireland, Europe and Asia, together with international franchise operations. OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE The executive directors... -

Page 98

... MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS CONTINUED 3 EXPENSE ANALYSIS 2016 Total £m 2015 Total £m Revenue Cost of sales Gross proï¬t Selling and administrative expenses Other operating income Underlying operating proï¬t Non-underlying items (see note... -

Page 99

... of £3.2m relating to property and store design projects for closed/impaired international stores have been written off during the year. FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE Net M&S Bank charges incurred in relation to the insurance mis-selling provision The Group has an economic... -

Page 100

... from the Statement of Financial Position, resulting in a one-off cost of £21.7m. Refer to note 25 for more detail on this business combination. 6 FINANCE INCOME/COSTS 2016 £m 2015 £m Bank and other interest receivable Pension net ï¬nance income (see note 11) Finance income Interest on... -

Page 101

... OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE 2016 £m 2015 £m Proï¬t before tax Notional taxation at standard UK corporation tax rate of 20% (last year 21%) Depreciation and other amounts in relation to ï¬xed assets that do not qualify for tax relief Other income and expenses... -

Page 102

... timing differences are ignored below. 2016 £m 2015 £m Proï¬t before taxation Notional taxation at standard UK corporation tax rate of 20% (last year: 21%) Disallowable accounting depreciation and other similar items Deductible capital allowances Allowable deductions for employee share schemes... -

Page 103

... June 2016. The Group has a progressive dividend policy with dividends covered broadly twice by earnings as explained in the Financial Review on page 23. OUR PERFORMANCE Proï¬t attributable to equity shareholders of the Company Add/(less) (net of tax): Net M&S Bank charges incurred in relation to... -

Page 104

... GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS CONTINUED 10 EMPLOYEES A. Aggregate remuneration The aggregate remuneration and associated costs of Group employees (including executive directors) were: 2016 Total £m 2015 Total £m Wages and salaries Social security costs Pension... -

Page 105

... Group. A. Pensions and other post-retirement liabilities 2016 £m Total market value of assets Present value of scheme liabilities Net funded pension plan asset Unfunded retirement beneï¬ts Post-retirement healthcare Net retirement beneï¬t asset Analysed in the statement of ï¬nancial position... -

Page 106

..., as measured on the Trustees' funding assumptions which use a discount rate derived from gilt yields. The fair value of the total plan assets at the end of the reporting period for each category, are as follows: 2016 £m 2015 £m Debt investments - government bonds net of repurchase agreements1... -

Page 107

... 2016 £m 2015 £m Fair value of scheme assets at start of year Interest income based on discount rate Actual return on scheme assets excluding amounts included in net interest income¹ Employer contributions Beneï¬ts paid Administration costs Exchange movement Fair value of scheme assets at end... -

Page 108

... Remuneration Report on pages 50 to 71. A. Save As You Earn Scheme Sharesave, the Company's Save As You Earn (SAYE) Scheme, was approved by shareholders at the 2007 AGM. Under the terms of the scheme, the Board may offer options to purchase ordinary shares in the Company once in each ï¬nancial year... -

Page 109

... business. The Plan operates for senior managers below executive director level. Awards vest at the end of the restricted period (typically between one and three years) subject to the participant still being in employment of the Group on the relevant vesting date. The value of any dividends earned... -

Page 110

... GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS CONTINUED 14 INTANGIBLE ASSETS Goodwill £m Brands £m Computer software £m Computer software under development £m Total £m At 29 March 2014 Cost or valuation Accumulated amortisation and impairment Net book value Year ended... -

Page 111

... these changes, two modules within the new supply chain management system will no longer be used and as a result investment in those modules has been written off, resulting in a one-off charge of £23.7m. The values attributed to the key assumptions are as follows: Long-term growth rate 2016 % 2015... -

Page 112

...last year £1.2m) of money market deposits held by Marks and Spencer plc in an escrow account. 3.0 19.1 3.0 11.6 Non-current unlisted investments are carried as available-for-sale assets. Other ï¬nancial assets are measured at fair value with changes in their value taken to the income statement. -

Page 113

...OUR PERFORMANCE FINANCIAL STATEMENTS GOVERNANCE The effective interest rate on short-term bank deposits is 0.51% (last year 0.48%). These deposits have an average maturity of 48 days (last year 42 days). 19 TRADE AND OTHER PAYABLES 2016 £m 2015 £m Current Trade and other payables Social security... -

Page 114

... investments. The treasury function is managed as a cost centre and does not engage in speculative trading. Financial risk management The principal ï¬nancial risks faced by the Group are liquidity and funding, interest rate, foreign currency and counterparty risks. The policies and strategies... -

Page 115

... to the Marks & Spencer UK pension £m Total borrowings and other ï¬nancial liabilities £m Total derivative assets and liabilities £m OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE Syndicated bank facility £m Derivative assets1 £m Derivative liabilities1 £m Timing of cash... -

Page 116

... taking into account the hedging derivatives entered into by the Group, the currency and interest rate exposure of the Group's ï¬nancial liabilities excluding short-term payables and the liability to the Marks & Spencer UK Pension Scheme is set out below: 2016 Fixed rate £m Floating rate £m Total... -

Page 117

...%) of the Group's gross borrowings. 2015 % OUR BUSINESS FINANCIAL STATEMENTS GOVERNANCE OUR PERFORMANCE The effective interest rates at the balance sheet date were as follows: 2016 % Committed and uncommitted borrowings Medium term notes Finance leases Derivative ï¬nancial instruments 2016 Assets... -

Page 118

... (liabilities)/assets set o £m Net ï¬nancial assets/(liabilities) per statement of ï¬nancial position £m Related amounts not set o in the statement of ï¬nancial position £m Net £m At 2 April 2016 Trade and other receivables Derivative ï¬nancial assets Cash and cash equivalents 31.6 146... -

Page 119

..., return capital to shareholders, issue new shares or sell assets to reduce debt. OUR BUSINESS Assets measured at fair value Financial assets at fair value through proï¬t or loss - Trading derivatives Derivatives used for hedging Embedded derivatives (see note 5) Short-term investments... -

Page 120

118 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS CONTINUED 22 PROVISIONS Property £m Restructuring £m Other £m 2016 £m 2015 £m At 28 March 2015 Provided in the year Released in the year Utilised during the year Exchange differences Discount rate unwind ... -

Page 121

...a commitment to purchase property, plant and equipment which is currently owned and operated by the warehouse operators on the Group's behalf (at values ranging from historical net book value to market value). See note 12 for details on the partnership arrangement with the Marks & Spencer UK Pension... -

Page 122

... of cash ï¬,ows Current ï¬nancial assets (see note 16) Debt ï¬nancing Bank loans, and overdrafts treated as ï¬nancing (see above) Medium-term notes (see note 20) Finance lease liabilities (see note 20) Partnership liability to the Marks & Spencer UK Pension Scheme (see note 12) Debt ï¬nancing... -

Page 123

... and related notes Cash and cash equivalents (see note 18) Current ï¬nancial assets (see note 16) Bank loans and overdrafts (see note 20) Medium-term notes - net of hedging derivatives Finance lease liabilities (see note 20) Partnership liability to the Marks & Spencer UK Pension Scheme (see notes... -

Page 124

122 MARKS AND SPENCER GROUP PLC FINANCIAL STATEMENTS COMPANY STATEMENT OF FINANCIAL POSITION Notes As at 2 April 2016 £m As at 28 March 2015 £m Assets Non-current assets Investments in subsidiary undertakings Total assets Liabilities Current liabilities Amounts owed to subsidiary undertakings... -

Page 125

... statement or statement of comprehensive income. C2 EMPLOYEES The Company had no employees during the current or prior year. Directors received emoluments in respect of their services to the Company during the year of £956,000 (last year £960,000). The Company did not operate any pension schemes... -

Page 126

... Finance plc Name Amethyst Leasing (Holdings) Limited Hedge End Park Limited Registered Office: 33 Holborn, London, EC1N 2HT M&S Limited Manford (Textiles) Limited Marks & Spencer Company Archive CIC Marks & Spencer Outlet Limited Marks & Spencer Simply Foods Limited Marks and Sparks Limited Marks... -

Page 127

...100 0 Marks and Spencer Clothing Textile Trading L.L.C Marks & Spencer Services Inc. Marks & Spencer Ventures Finance LLC 100 Supreme Tradelinks Private Limited Aprell Limited India INR 10 Ordinary Ireland â,¬1.25 Ordinary 100 100 NOTE: A number of the companies listed are legacy companies which... -

Page 128

... SPENCER GROUP PLC FINANCIAL STATEMENTS GROUP FINANCIAL RECORD 2016 53 weeks £m 2015 52 weeks £m 2014 52 weeks £m 2013 52 weeks £m 2012 52 weeks £m Income statement Revenue¹ UK International Operating proï¬t/(loss)¹ UK International Total operating proï¬t Net interest payable Pension... -

Page 129

...ed by email whenever we release trading updates to the London Stock Exchange, which are not mailed to shareholders. To ï¬nd out more information about the services offered by Shareview and to register, please visit shareview.co.uk. ANNUAL GENERAL MEETING 2016 This year's AGM will be held at Wembley... -

Page 130

128 MARKS AND SPENCER GROUP PLC DIRECTORS' REPORT: FINANCIAL STATEMENTS SHAREHOLDER INFORMATION CONTINUED CHANGING YOUR ADDRESS You should inform Equiniti of your new address as soon as possible to avoid missing important correspondence relating to your shareholding. If you hold 1,500 shares or ... -

Page 131

...'s report Annual General Meeting B Board Borrowing facilities Business model C Capital commitments Capital expenditure Clothing & Home Conï¬,icts of interest Corporate governance Cost of sales Critical accounting estimates and judgements D Page 90 73 42 43 123 78 127 E Earnings per share Employees... -

Page 132

we we INSPIRE our customers INNOVATE together we act with we're INTEGRITY IN TOUCH