Lockheed Martin 2008 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2008 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

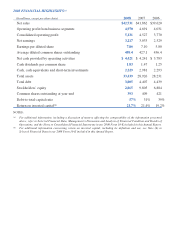

2008 FINANCIAL HIGHLIGHTS(a)

(In millions, except per share data) 2008 2007 2006

Net sales $42,731 $41,862 $39,620

Operating profit from business segments 4,970 4,691 4,031

Consolidated operating profit 5,131 4,527 3,770

Net earnings 3,217 3,033 2,529

Earnings per diluted share 7.86 7.10 5.80

Average diluted common shares outstanding 409.4 427.1 436.4

Net cash provided by operating activities $ 4,421 $ 4,241 $ 3,783

Cash dividends per common share 1.83 1.47 1.25

Cash, cash equivalents and short-term investments 2,229 2,981 2,293

Total assets 33,439 28,926 28,231

Total debt 3,805 4,407 4,439

Stockholders’ equity 2,865 9,805 6,884

Common shares outstanding at year-end 393 409 421

Debt-to-total-capital ratio 57% 31% 39%

Return on invested capital(b) 21.7% 21.4% 19.2%

NOTES:

(a) For additional information, including a discussion of matters affecting the comparability of the information presented

above, refer to Selected Financial Data, Management’s Discussion and Analysis of Financial Condition and Results of

Operations, and the Notes to Consolidated Financial Statements in our 2008 Form 10-K included in this Annual Report.

(b) For additional information concerning return on invested capital, including its definition and use, see Note (h) to

Selected Financial Data in our 2008 Form 10-K included in this Annual Report.