Lockheed Martin 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOCKHEED MARTIN CORPORATION

2008 ANNUAL REPORT

Table of contents

-

Page 1

LOCKHEED MARTIN CORPORATION 2008 ANNUAL REPORT -

Page 2

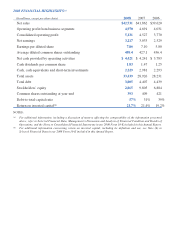

... business segments Consolidated operating profit Net earnings Earnings per diluted share Average diluted common shares outstanding Net cash provided by operating activities Cash dividends per common share Cash, cash equivalents and short-term investments Total assets Total debt Stockholders' equity... -

Page 3

... of programs, and the company's ability to win new business across the board, has sustained the momentum and ï¬nancial strength built through years of adhering to a strategy of disciplined growth. A focus on cash, operational excellence, and strategically placed acquisitions has served us well... -

Page 4

... year 2009 budget, we do see continued growth in key areas that are important to Lockheed Martin's global security business. Acquisitions and the successful pursuit of new business opportunities have established and enhanced our position in logistics, sustainment, and advanced warfare capabilities... -

Page 5

...Innovation presented by the president of the United States. Global Security At The Leading Edge Lockheed Martin's technology edge is the result of our efforts to conduct research in areas that can bring new products and advancements to the market. Some of the breathtaking achievements we saw in 2008... -

Page 6

... Development and Operations Contract consecutive launch, a record unmatched by NASA at the Johnson Space Center, by any other large ballistic missile or supporting training, ï¬,ight planning, space launch vehicle. and operations for human space ï¬,ight programs. LOCKHEED MARTIN CORPORATION 4 2008... -

Page 7

... magazine, which ranked Lockheed Martin as among the "100 Best Corporate Citizens'' for 2008. Lockheed Martin's success as the world's leading global security company has been built around an uncompromising adherence to innovation, ï¬nancial discipline, talent development, and a clear understanding... -

Page 8

... Ofï¬cer Lockheed Martin Corporation James R. Ukropina Chief Executive Ofï¬cer Directions, LLC (A Management and Consulting Firm) EXECUTIVE OFFICERS James B. Comey Senior Vice President and General Counsel Linda R. Gooden Executive Vice President Information Systems & Global Services Ralph... -

Page 9

... 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 Commission file number 1-11437 LOCKHEED MARTIN CORPORATION (Exact name of registrant as specified in its charter) Maryland (State or other jurisdiction... -

Page 10

... ...Consolidated Balance Sheet ...Consolidated Statement of Cash Flows ...Consolidated Statement of Stockholders' Equity ...Notes to Consolidated Financial Statements ...1. Significant Accounting Policies ...2. Earnings Per Share ...3. Other Income (Expense), Net ...4. Information on Business... -

Page 11

... Income Taxes ...9. Debt ...10. Postretirement Benefit Plans ...11. Stockholders' Equity ...12. Stock-Based Compensation ...13. Legal Proceedings, Commitments and Contingencies ...14. Acquisitions and Divestitures ...15. Fair Value Measurements ...16. Leases ...17. Summary of Quarterly Information... -

Page 12

... 1. BUSINESS General Lockheed Martin Corporation is a global security company that is principally engaged in the research, design, development, manufacture, integration, and sustainment of advanced technology systems and products. We also provide a broad range of management, engineering, technical... -

Page 13

... 2008, MS2 achieved program milestones and new order bookings consistent with Electronic Systems' growth strategy, which encompasses expanding core businesses; selling products developed for domestic customers internationally; pursuing adjacent market opportunities that leverage core engineering... -

Page 14

...We now own 100% of that business. The company specializes in systems engineering, software development, system integration, testing, and support of large, complex, leading-edge systems. In September 2008, we completed our acquisition of Aculight Corporation, based in Bothell, Washington. Aculight is... -

Page 15

...federal services, Information Technology (IT) solutions and advanced technology expertise across a broad spectrum of applications and customers. IS&GS provides full life-cycle support and highly specialized talent in the areas of software and systems engineering, including capabilities in space, air... -

Page 16

... Solutions Information Systems 26% 29% Global Services In 2008, U.S. Government customers accounted for approximately 93% of the segment's total net sales. Mission Solutions Mission Solutions provides intelligence, defense and civil agency customers with research, development, and engineering... -

Page 17

... combat and air mobility aircraft, unmanned air vehicles, and related technologies. Our customers include the military services and various government agencies of the United States and allied countries around the world. In 2008, net sales at Aeronautics of $11.5 billion represented 27% of our total... -

Page 18

...for a total of 17 aircraft. Advanced procurement funding for the fourth LRIP production lot of 30 U.S. airplanes was also approved, including funding for the CV configuration. Given the size of the F-35 program, we anticipate that there will be a number of studies related to the program schedule and... -

Page 19

.... Advanced communication links also have given the F-16 network-centric warfare capabilities. Other Combat Aircraft We also participate in joint production of the F-2 fighter aircraft for Japan, and are a co-developer of the Korean T-50 supersonic jet trainer aircraft. Air Mobility In Air Mobility... -

Page 20

... on performance-based logistics, to provide an affordable total air system life-cycle sustainment solution for the aircraft's multiple variants and worldwide customer base. Our support of the F-22 continues to receive accolades from our DoD customer, winning the Contractor-Military Collaboration of... -

Page 21

...-stop supply chain services provider supporting U.S. military, international government, and commercial customers with operational field sites and a knowledgeable, experienced staff. Under our integrated prime vendor contract with the Defense Logistics Agency, we provide parts to the U.S. Air Force... -

Page 22

... sales. Satellites Our Satellites business designs, develops, manufactures, and integrates advanced technology satellite systems for government and commercial applications. We are responsible for various classified systems and services in support of vital national security systems. The Space-Based... -

Page 23

...for launch. United Launch Alliance, LLC (ULA) performs the engineering, production, test and launch operations associated with U.S. Government launches of the Atlas and Delta families of launch vehicles. We continue to market commercial Atlas launch services. Competition U.S. Government purchases of... -

Page 24

...cost-based U.S. Government contracts; and restrict the use and dissemination of information classified for national security purposes and the export of certain products and technical data. Government contracts are conditioned upon the continuing availability of legislative appropriations. Long-term... -

Page 25

.... The operating results of these classified programs are included in our consolidated financial statements. The business risks associated with classified programs, as a general matter, do not differ materially from those of our other government programs. Backlog At December 31, 2008, our total... -

Page 26

... we may not be able to grow our sales and profitability at the rates we anticipate or may have deployed financial and management resources sub-optimally. We provide a wide range of defense, homeland security and information technology products and services to the U.S. Government. Although we believe... -

Page 27

...satellites, intelligence systems and homeland security applications that operate in extreme, high demand or high risk conditions; Designing, developing, integrating, producing, sustaining and supporting products to collect, archive, retrieve, fuse, distribute and analyze various types of information... -

Page 28

... insurance for some business risks, it is not possible to obtain coverage to protect against all operational risks and liabilities. We generally seek, and in certain cases have obtained, limitation of potential liabilities related to the sale and use of our homeland security products and services... -

Page 29

... relating to financial market and other economic conditions. Changes in key economic indicators can result in changes in the assumptions we use. The key year-end assumptions used to estimate pension expense for the following year are the discount rate, the expected long-term rate of return on plan... -

Page 30

... future sales and financial condition or increase our costs and expenses. Our business may be impacted by disruptions including, but not limited to, threats to physical security, information technology attacks or failures, damaging weather or other acts of nature and pandemics or other public health... -

Page 31

... must attract and retain key employees. Our business has a continuing need to attract large numbers of skilled personnel, including personnel holding security clearances, to support the growth of the enterprise and to replace individuals who have terminated employment due to retirement or for other... -

Page 32

... conditions and trends, including interest rates, government budgets and inflation, can and do affect our businesses. For a discussion identifying additional risk factors and important factors that could cause actual results to vary materially from those anticipated in the forward-looking statements... -

Page 33

...Mexico; Owego and Syracuse, New York; Akron, Ohio; Grand Prairie, Texas; and Manassas, Virginia. • Information Systems & Global Services-Goodyear, Arizona; San Jose and Sunnyvale, California; Colorado Springs and Denver, Colorado; Gaithersburg and Rockville, Maryland and other locations within the... -

Page 34

... of security holders during the fourth quarter of 2008. ITEM 4(a). EXECUTIVE OFFICERS OF THE REGISTRANT Our executive officers are listed below, as well as information concerning their age at December 31, 2008, positions and offices held with the Corporation, and principal occupation and business... -

Page 35

... as Executive Vice President and Chief Financial Officer since September 2007. He previously served as Vice President of Finance and Business Operations for Aeronautics from April 2006 to August 2007, and Vice President of Finance and Business Operations for Electronic Systems from May 2002 to March... -

Page 36

... MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES At January 31, 2009, we had 38,956 holders of record of our common stock, par value $1 per share. Our common stock is traded on the New York Stock Exchange, Inc. (NYSE) under the symbol LMT. Information concerning the stock prices as reported on the... -

Page 37

...about our equity compensation plans that authorize the issuance of shares of Lockheed Martin common stock to employees and directors. The information is provided as of December 31, 2008. Number of securities to be issued upon exercise of outstanding options, warrants, and rights Number of securities... -

Page 38

...immediately preceding the date of grant of the award, calculated in a manner consistent with the method used for calculating outstanding shares for reporting in the Annual Report. Employees may defer Management Incentive Compensation Plan ("MICP") and Long-Term Incentive Performance ("LTIP") amounts... -

Page 39

... Taxes Income Tax Expense Net Earnings EARNINGS PER COMMON SHARE Basic Diluted CASH DIVIDENDS PER COMMON SHARE CONDENSED BALANCE SHEET DATA Cash and Cash Equivalents Short-Term Investments Other Current Assets Property, Plant and Equipment, Net Goodwill Purchased Intangibles, Net Prepaid Pension... -

Page 40

... net earnings plus after-tax interest expense divided by average invested capital (stockholders' equity plus total debt), after adjusting stockholders' equity by adding back adjustments related to postretirement benefit plans. We believe that reporting ROIC provides investors with greater visibility... -

Page 41

... Lockheed Martin is a global security company that principally is engaged in the research, design, development, manufacture, integration, and sustainment of advanced technology systems and products. We provide a broad range of management, engineering, technical, scientific, logistic, and information... -

Page 42

... accounting/revenue recognition Postretirement benefit plans Environmental matters Goodwill Stock-based compensation Discussion of business segments Liquidity and cash flows Capital structure and resources Legal proceedings, commitments and contingencies Income taxes Location(s) Page 38 and page... -

Page 43

... e-Government solutions for our customers, including the Social Security Administration and the EPA, as well for the DoD. We also provide program management, business strategy and consulting, complex systems development and maintenance, complete life-cycle software support, information assurance and... -

Page 44

... use of information technology and knowledge-based solutions, and improved levels of network and cybersecurity, all appear to be priorities in our non-DoD business as well. Homeland security, critical infrastructure protection, and improved service levels for civil government agencies also appear... -

Page 45

... the production, engineering, test and launch operations associated with U.S. Government launches on Atlas and Delta launch vehicles, and a 50% equity interest in United Space Alliance, LLC (USA), which provides ground processing and other operational services to the Space Shuttle program. In... -

Page 46

... II Joint Strike Fighter development and low-rate initial production contracts, and the THAAD missile defense program. Most of our long-term contracts are denominated in U.S. dollars, including contracts for sales of military products and services to foreign governments conducted through the... -

Page 47

... recognizing sales and profits, see our discussion under "Sales and earnings" in Note 1 to the financial statements. Postretirement Benefit Plans Most of our employees are covered by defined benefit pension plans, and we provide certain health care and life insurance benefits to eligible retirees... -

Page 48

... income for the following calendar year are the discount rate and the expected long-term rate of return on plan assets for all postretirement benefit plans; the rates of increase in future compensation levels for our defined benefit pension plans; and the health care cost trend rates for our retiree... -

Page 49

... a direct correlation between a change in the discount rate and the changes in stockholders' equity and pension expense. The long-term rate of return assumption represents the expected average rate of earnings on the funds invested, or to be invested, to provide for the benefits included in the plan... -

Page 50

...as general and administrative costs. Under existing government regulations, these and other environmental expenditures relating to our U.S. Government business, after deducting any recoveries received from insurance or other PRPs, are allowable in establishing prices of our products and services. As... -

Page 51

... of the fair value of each reporting unit. We estimate the fair value of each reporting unit using a discounted cash flow methodology which requires significant judgment. Forecasts of future cash flows are based on our best estimate of future sales and operating costs, based primarily on existing... -

Page 52

... our consolidated net sales and operating profit for 2008, 2007 and 2006. We follow an integrated approach for managing the performance of our business, and generally focus the discussion of our results of operations around major lines of business versus distinguishing between products and services... -

Page 53

... business. We expect continued strong growth in providing information technology solutions to government agencies. Aeronautics is engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of advanced military aircraft, including combat and air mobility... -

Page 54

..., as well as other miscellaneous Corporate activities. This table shows net sales and operating profit of the business segments and reconciles to the consolidated total. (In millions) Net Sales Electronic Systems Information Systems & Global Services Aeronautics Space Systems Total Operating Profit... -

Page 55

... other programs. In our discussion of comparative results, changes in net sales and operating profit are generally expressed in terms of volume and/or performance. Volume refers to increases (or decreases) in sales resulting from varying production activity levels, deliveries or services levels on... -

Page 56

... transportation and security solutions programs, as well as mission and combat support solutions activities. Global Services operating profit increased $42 million primarily due to volume and improved performance on mission services programs and other international activities. In Information Systems... -

Page 57

... in Other Aeronautics Programs and Air Mobility. In Combat Aircraft, operating profit declined $86 million mainly due to lower volume on F-16 programs and lower volume and the decline in 2008 of the amount of favorable inception-to-date performance adjustments on the F-22 program. There was a $34... -

Page 58

... programs. In Space Transportation, the decline of $18 million in 2007 operating profit from 2006 was mainly due to a charge recognized by ULA in the third quarter of 2007 for an asset impairment on Delta II medium lift launch vehicles. The decline also reflects benefits recognized in 2006 from risk... -

Page 59

... of many companies to access capital in the debt and equity markets. Over the past few years, we have generated strong cash flows, and generally have funded our operations, debt service and repayments, capital expenditures, share repurchases, dividends, acquisitions, retirement plan funding, and... -

Page 60

...Systems facilities that are as much as 50 years old. We also incur capital expenditures for IT to support programs and general enterprise IT infrastructure. We have a balanced cash deployment and disciplined growth strategy to enhance shareholder value and position ourselves to take advantage of new... -

Page 61

..., 2008, we had repurchased a total of 124.3 million shares under the program, and there remained approximately 33.7 million shares that may be repurchased in the future. The payment of dividends on our common shares is one of the key components of our balanced cash deployment strategy. Shareholders... -

Page 62

... the unamortized discount under the caption "Long-term Debt, Net." The expenses associated with the exchange, net of state income tax benefits, totaled $16 million and were recorded in other non-operating income (expense), net. They reduced net earnings in 2006 by $11 million ($0.03 per share). Our... -

Page 63

...of December 31, 2008. Such amounts mainly include expected payments under deferred compensation plans, non-qualified pension plans, environmental liabilities and business acquisition agreements. Obligations related to environmental liabilities represent our estimate of obligations for sites at which... -

Page 64

... as purchasing supplies from in-country vendors, providing financial support for in-country projects, and building or leasing facilities for in-country operations. We do not commit to offset agreements until orders for our products or services are definitive. Offset programs generally extend... -

Page 65

...below. Those activities also included the acquisition of, among others, Management Systems Designers, Inc., a provider of information technology (IT) and scientific solutions supporting government life science, national security, and other civil agency missions. We used approximately $1.1 billion in... -

Page 66

... sufficient credit resources. Our main exposure to market risk relates to interest rates, foreign currency exchange rates and market prices on certain equity securities. Our financial instruments that are subject to interest rate risk principally include fixed-rate long-term debt. Our long-term debt... -

Page 67

... common stock and certain market indices. Changes in the value of the deferred compensation liabilities are recognized in the caption "Unallocated Corporate Costs." The current portion of the deferred compensation plan liabilities is on our Balance Sheet in salaries, benefits, and payroll taxes, and... -

Page 68

... Statements and Internal Control Over Financial Reporting The management of Lockheed Martin is responsible for the consolidated financial statements and all related financial information contained in this Annual Report on Form 10-K. The consolidated financial statements, which include amounts based... -

Page 69

...consolidated balance sheets of Lockheed Martin Corporation as of December 31, 2008 and 2007, and the related consolidated statements of earnings, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2008 of Lockheed Martin Corporation and our report dated... -

Page 70

...Financial Statements Board of Directors and Stockholders Lockheed Martin Corporation We have audited the accompanying consolidated balance sheets of Lockheed Martin Corporation as of December 31, 2008 and 2007, and the related consolidated statements of earnings, stockholders' equity, and cash flows... -

Page 71

Lockheed Martin Corporation Consolidated Statement of Earnings (In millions, except per share data) Net Sales Products Services Cost of Sales Products Services Unallocated Corporate Costs Year ended December 31, 2008 2007 2006 $34,809 7,922 42,731 30,874 7,147 61 38,082 4,649 482 5,131 341 (88) 4,... -

Page 72

Lockheed Martin Corporation Consolidated Balance Sheet (In millions, except per share data) Assets Current Assets Cash and Cash Equivalents Short-term Investments Receivables Inventories Deferred Income Taxes Other Current Assets Total Current Assets Property, Plant and Equipment, Net Goodwill ... -

Page 73

Lockheed Martin Corporation Consolidated Statement of Cash Flows (In millions) Operating Activities Net earnings Adjustments to reconcile net earnings to Net Cash Provided by Operating Activities Depreciation and amortization of plant and equipment Amortization of purchased intangibles Stock-based ... -

Page 74

Lockheed Martin Corporation Consolidated Statement of Stockholders' Equity Accumulated CompreAdditional Other Total hensive Common Paid-In Retained Comprehensive Stockholders' Income Stock Capital Earnings Income (Loss) Other Equity (Loss) $432 $ 1,724 $ 7,278 $(1,553) $ (14) $ 7,867 - - 2,529 - - ... -

Page 75

... Financial Statements December 31, 2008 Note 1 - Significant Accounting Policies Organization - Lockheed Martin Corporation is a global security company engaged in the research, design, development, manufacture, integration, operation and sustainment of advanced technology systems and products... -

Page 76

... value. Costs on long-term contracts and programs in progress represent recoverable costs incurred for production or contract-specific facilities and equipment, allocable operating overhead, advances to suppliers and, in the case of contracts with the U.S. Government, research and development... -

Page 77

...products and services to agencies of the U.S. Government. Assets recorded at December 31, 2008 and 2007 for deferred costs related to various consolidation and restructuring activities were not material. Impairment of certain long-lived assets - Generally, we review the carrying values of long-lived... -

Page 78

... and penalties related to income taxes as a component of income tax expense in our consolidated financial statements. Comprehensive income (loss) - Comprehensive income (loss) and its components are presented in the Statement of Stockholders' Equity. Accumulated other comprehensive income (loss... -

Page 79

... impact on our results of operations, financial position or cash flows. We adopted FAS 157, Fair Value Measurements, effective January 1, 2008, as it relates to financial assets and liabilities (see Note 15). FAS 157 defines fair value, establishes a market-based framework or hierarchy for measuring... -

Page 80

... January 1, 2009. The new standard replaces existing guidance and significantly changes accounting and reporting relative to business combinations in consolidated financial statements, including requirements to recognize acquisition-related transaction and post-acquisition restructuring costs in our... -

Page 81

... Segments We operate in four principal business segments: Electronic Systems, Information Systems & Global Services, Aeronautics, and Space Systems. We organize our business segments based on the nature of the products and services offered. In the following tables of financial data, the total of the... -

Page 82

... and civil government agencies in the U.S. and abroad. • Aeronautics - Engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies... -

Page 83

... Financial Data by Business Segment (In millions) Net sales Electronic Systems Information Systems & Global Services Aeronautics Space Systems Total Operating profit (a) Electronic Systems Information Systems & Global Services Aeronautics Space Systems Total business segments Unallocated Corporate... -

Page 84

... in management's evaluation of segment operating performance, see Notes 3 and 14 to the consolidated financial statements. (c) (d) We have no significant long-lived assets located in foreign countries. Assets primarily include cash and cash equivalents, short-term investments, deferred income taxes... -

Page 85

... Financial Data by Business Segment (continued) Net Sales by Customer Category (In millions) U.S. Government Electronic Systems Information Systems & Global Services Aeronautics Space Systems Total Foreign governments (a) (b) Electronic Systems Information Systems & Global Services Aeronautics Space... -

Page 86

... for the products and services we sell to the U.S. Government. Therefore, a substantial portion of state income taxes is included in our net sales and cost of sales. As a result, the impact of certain transactions on our operating profit and other matters disclosed in these financial statements is... -

Page 87

... retroactively extended the research and development tax credit from January 1, 2008 to December 31, 2009. As a result, we recognized a tax benefit, which reduced our income tax expense in the fourth quarter of 2008 by $36 million ($0.09 per share). In 2007, we closed IRS examinations which included... -

Page 88

...non-domestic income tax issues will be resolved. Resolution of these matters is expected to change our unrecognized tax benefit balance, but due to the current stage of the examination, we are not able to estimate the impact on our consolidated results of operations, financial position or cash flows... -

Page 89

... credit facility discussed below. In March 2008, we issued $500 million of long-term notes. The notes have a fixed coupon interest rate of 4.12% and are due in 2013. In August 2006, we issued $1,079 million of new 6.15% Notes due 2036 (the Notes) in exchange for a portion of our then outstanding... -

Page 90

... Sheet net of the unamortized discount under the caption "Long-term Debt, Net". The expenses associated with the exchange, net of state income tax benefits, totaled $16 million and were recorded in other non-operating income (expense), net. They reduced net earnings by $11 million ($0.03 per share... -

Page 91

...end of year Unfunded status of the plans Amounts recognized in the Balance Sheet Prepaid pension asset Accrued postretirement benefit liabilities Accumulated other comprehensive (income) loss (pre-tax) related to: Unrecognized net actuarial losses Unrecognized prior service cost (credit) 12,574 467... -

Page 92

... to be recognized in net pension cost during 2009 is a loss of $303 million ($196 million net of income tax benefits) for our qualified defined benefit pension plans, a loss of $42 million ($27 million net of income tax benefits) for our retiree medical and life insurance plans, and a loss of $22... -

Page 93

... in net pension cost during 2009 is a cost of $81 million ($52 million net of income tax benefits) for our qualified defined benefit pension plans and a credit of $23 million ($15 million net of income taxes) for our retiree medical and life insurance plans. The amounts of prior service cost for the... -

Page 94

..., were as follows: Defined Benefit Pension Plans 2008 2007 Asset category: Equity securities Debt securities Other 49% 36 15 100% 61% 30 9 100% Retiree Medical and Life Insurance Plans 2008 2007 56% 40 4 100% 59% 38 3 100% Lockheed Martin Investment Management Company (LMIMCo), our wholly-owned... -

Page 95

...than 0.03% of total plan assets) of our issued and outstanding common stock at December 31, 2008 and 2007. We generally refer to U.S. Government Cost Accounting Standards (CAS) and Internal Revenue Code rules in determining funding requirements for our defined benefit pension plans. In 2008, we made... -

Page 96

... ($0.16 per share). Stock-Based Compensation Plans We had two stock-based compensation plans in place at December 31, 2008: the Lockheed Martin Amended and Restated 2003 Incentive Performance Award Plan (the Award Plan) and the Lockheed Martin Directors Equity Plan (the Directors Plan). Under the... -

Page 97

... expected life on the contractual term of the stock option, historical trends in employee exercise activity, and post-vesting employment termination trends. We base the risk-free interest rate on U.S. Treasury zero-coupon issues with a remaining term equal to the expected life assumed at the date of... -

Page 98

... million from stock-based compensation activities during 2008, 2007, and 2006. Consistent with FAS 123(R), we classified $92 million, $124 million, and $129 million of those benefits as a financing cash inflow with a corresponding operating cash outflow in the Statement of Cash Flows. The remainder... -

Page 99

... company stock funds to hold cash for liquidity thus reducing the return on those funds. The plaintiffs further allege that we or LMIMCo failed to disclose information appropriately relating to the fees associated with managing the Plans. In August 2008, plaintiffs filed an amended complaint, adding... -

Page 100

..., the level of funding required for ULA to make such payments. Such capital contributions would not exceed the aggregate amount of the dividend we received in 2008 and any others we may receive through June 1, 2009. We currently believe that ULA will have sufficient operating cash flows and credit... -

Page 101

...of, among others, Management Systems Designers, Inc., a provider of information technology (IT) and scientific solutions supporting government life science, national security, and other civil agency missions. Purchase accounting adjustments recorded related to business acquisitions completed in 2007... -

Page 102

... for segment reporting purposes (see Note 4) since its activities are closely aligned with the operations of Space Systems. In October 2008, we received a $100 million dividend payment from ULA, which was recorded as a reduction of our investment balance. Our investment in ULA totaled $428 million... -

Page 103

... to fund certain of our non-qualified deferred compensation plans. The Rabbi Trust is included in other assets. Investments in the trust that are categorized as Level 1 are marketable equity securities and fixed income securities with the U.S. Government, both of which are valued using quoted market... -

Page 104

Note 17 - Summary of Quarterly Information (Unaudited) (In millions, except per share data) Net sales Operating profit Net earnings Basic earnings per share Diluted earnings per share (b) First (c) $9,983 1,178 730 1.80 1.75 2008 Quarters (a) Second (d) Third (e) $11,039 $10,577 1,363 1,242 882 782 ... -

Page 105

..., by contacting Investor Relations, Lockheed Martin Corporation, 6801 Rockledge Drive, Bethesda, Maryland 20817. We are required to disclose any change to, or waiver from, our Code of Ethics and Business Conduct for our Chief Executive Officer and senior financial officers. We use our website to... -

Page 106

... Report on Form 10-Q for the quarter ended September 30, 2002). Lockheed Martin Corporation Directors Deferred Compensation Plan, as amended. Resolutions relating to Lockheed Martin Corporation Financial Counseling Program and personal liability and accidental death and dismemberment benefits... -

Page 107

... Death Benefit Plan for Elected Officers, as amended June 28, 2007 (incorporated by reference to Exhibit 99.1 to Lockheed Martin Corporation's Current Report on Form 8-K filed with the SEC on July 3, 2007). Deferred Performance Payment Plan of Lockheed Martin Corporation Space & Strategic... -

Page 108

...Exhibit 99.4 of Lockheed Martin Corporation's Current Report on Form 8-K filed with the SEC on February 2, 2006). Forms of Long-Term Incentive Performance Award Agreements (2008-2010 performance period), Forms of Stock Option Award Agreements and Forms of Restricted Stock Unit Award Agreements under... -

Page 109

...15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. LOCKHEED MARTIN CORPORATION MARTIN T. STANISLAV Vice President and Controller (Chief Accounting Officer) Date: February 26, 2009 101 -

Page 110

... Chief Financial Officer Director Director Director Director Director Director Director Director Director Director Director Director Date February 26, 2009 February 26, 2009 February 26, 2009 February 26, 2009 February 26, 2009 February 26, 2009 February 26, 2009 February 26, 2009 February 26, 2009... -

Page 111

Exhibit 31.1 I, Robert J. Stevens, Chairman, President and Chief Executive Officer, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Lockheed Martin Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a ... -

Page 112

... 31.2 I, Bruce L. Tanner, Executive Vice President and Chief Financial Officer, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Lockheed Martin Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 113

... with the Annual Report of Lockheed Martin Corporation (the "Corporation") on Form 10-K for the period ended December 31, 2008 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Robert J. Stevens, Chairman, President and Chief Executive Officer of the... -

Page 114

... with the Annual Report of Lockheed Martin Corporation (the "Corporation") on Form 10-K for the period ended December 31, 2008 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Bruce L. Tanner, Executive Vice President and Chief Financial Officer of the... -

Page 115

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 116

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 117

...REINVESTMENT PLAN Lockheed Martin Direct Invest, our direct stock purchase and dividend reinvestment plan, provides new investors and current stockholders with a convenient, cost-effective way to purchase Lockheed Martin common stock, increase holdings and manage the investment. For more information... -

Page 118

Lockheed Martin Corporation 6801 Rockledge Drive Bethesda, MD 20817 www.lockheedmartin.com Printed on recycled paper