Lockheed Martin 1996 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1996 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

O

ur first full year operating

as Lockheed Martin was

virtually all that we had

hoped. We began the year by announcing

our strategic combination with Loral and

ended by posting our 13th half-billion-

dollar-plus program win of the year. Along

the way, we defied the skeptics — and the

odds — by rapidly restructuring, achieving

major efficiencies, and successfully inte-

grating 17 business cultures into a world-

class team that, through synergy, achieved

a strong track record.

In less than two years, we have

moved into the front ranks of the industry's

consolidation and put some huge chal-

lenges behind us to create a leading diver-

sified global technology company. But

perhaps the most meaningful measure is

how these successes have translated into

increased shareholder value.

Shareholder Value

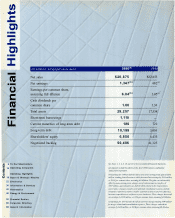

A good place to start is with the numbers:

In 1996 stock in your company rose in

value from $79 to $91.50 per share, at

year end, a 16 percent increase. And if you

reinvested the $1.60 payout of dividends,

your annual return was 18 percent. This

brings total returns for Lockheed Martin,

since it began trading March 16, 1995, to

39 percent — which stacks up pretty well

against Standard & Poor's 500 Stock

Index performance of 27 percent for the

same period.

We will never rest on our laurels. Our

goal is to consistently deliver shareholder

returns better than the overall market

performance. Our employees are both

committed and incentivized to maximize

shareholder returns since they own

approximately 17 percent of Lockheed

Martin's outstanding shares. Add to

that, our aggressive stock ownership

guidelines for nearly 2,000 individuals in

our management ranks; we expect our

management team to maintain holdings

of two times to five times annual salary,

depending on position.

Supporting this market performance,

Lockheed Martin's fully diluted earnings

in 1996 were $6.04 per share, versus

$3.05 in 1995. Earnings per share, exclud-

ing nonrecurring items in both years,

increased 8 percent to $5.40 in 1996,

versus $5.01 in 1995. Our continued

emphasis on strong cash management

yielded $1 billion in free cash flow during

1996, after expending $244 million of

cash payments and $150 million of capital

outlays for our integration and consolida-

tion program. On the sales front, we

recorded $26.9 billion in 1996, compared

with $22.9 billion in 1995. During the

year, we brought in nearly $30 billion in

new orders, and at year end, backlog stood

at more than $50 billion — an impressive

number, though we constantly remind

ourselves that we need to add $1 million

of new business every four working

minutes just to sustain our revenues.

Enhanced

Competitiveness

If our shareholders already have benefited

in the near-term from our consolidation

activities, so too will our employees and

customers over the longer term. Through

our increased competitiveness, we have

achieved one of the most significant

new business win-streaks in the history

of our industry, and are now beginning to

hire (and re-hire) a substantial number

of employees to fill the new jobs that have

been created.

In addition, through our consolidation

and restructuring actions, Lockheed

Martin expects to generate over $6 billion

in savings through 1999, most of which

is attributable to the Lockheed and Martin

Marietta merger. The real payoff comes

after 1999, when all up-front costs have

abated, and we expect to sustain approxi-

mately $2.6 billion in annual savings

or $13 billion over every five-year period

thereafter — savings in which both our

customers and shareholders will share. The

portion that goes to our U.S. government

customers, alone, is enough to fund the

purchase of 2 Titan IV Centaur rockets,

10 Trident II missiles, 800 Hellfire

missiles, 3 C-130Js, 8 F-16s and 100 Army

Tactical Missile Systems... all incidentally,

Lockheed Martin products!

As noted, the outlook for our employ-

ees has brightened, too. We are now hiring

at a number of Lockheed Martin operating

companies where we won major programs

last year — at least partly due to enhanced

competitiveness from our consolidation

activities and synergy from our combined

strengths and ongoing cost-cutting efforts.

It doesn't take a rocket scientist,

although we have lots of them, to figure

out that these consolidation activities are

a "win-win" for all concerned. But it does,

in our case, take a whole lot of talent

across every imaginable discipline to make

these changes a reality.

Dear Fellow Shareholders