Lockheed Martin 1996 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 1996 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

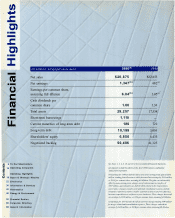

Highlights

Financial

To Our Shareholders

Operating Companies

Operating Highlights

Space & Strategic Missiles

Electronics

Information & Services

Aeronautics

Energy & Environment

Financial Section

Corporate Directory

General Information

See Notes 1, 2, 4, 8, 10 and 14 to the Consolidated Financial Statements.

(a) Amounts include the effects of the April 1996 business combination

with Loral Corporation.

(b) Earnings for 1996 include the effects of a nonrecurring pretax gain of $365

million resulting from divestitures which increased net earnings by $351 million,

or $1.58 per common share assuming full dilution. The gain was substantially

offset by nonrecurring pretax charges, net of state income tax benefits, of

$307 million, approximately one-half of which related to the Corporation's

conservative strategy toward its environmental remediation business, with the

remainder related to a number of other corporate actions to improve efficiency,

increase competitiveness and focus on core businesses. These charges decreased

net earnings by $209 million, or $.94 per common share assuming full dilution.

(c) Earnings for 1995 include the effects of pretax charges totaling $690 million

for merger related and consolidation expenses. These charges reduced net

earnings by $436 million, or $1.96 per common share assuming full dilution.

Contents

2

10

16

22

30

40

46

50

86

88

Net sales

Net earnings

Earnings per common share,

assuming full dilution

Cash dividends per

common share

Total assets

Short-term borrowings

Current maturities of long-term debt

Long-term debt

Shareholders' equity

Negotiated backlog

$26,875

1,347(b)

6.04(b)

1.60

29,257

1,110

180

10,188

6,856

50,406

$22,853

682(c)

3.05(c)

1.34

17,558

—

722

3,010

6,433

41,125

(In millions, except per share data)

1996(a)

1995