LifeLock 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 LifeLock annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have built a robust technology platform that allows for seamless connectivity between our internal systems and our members, users of the LifeLock

Wallet mobile application, and enterprise customers. Our technology platform enables our enterprise customers to share transaction data with us on an ongoing

basis and allows us to deliver on-demand, proprietary risk scores and other identity risk-related metrics and reason codes for each transaction our enterprise

customers run through the LifeLock ecosystem. Direct connection to our technology platform allows our enterprise customers to determine risk associated with

a particular transaction on a sub-second basis. The technology behind our LifeLock Identity Alert system enables us to deliver alerts to our members and

provides them with the ability to confirm back to us whether or not they are participating in a transaction. Based on a member’s response regarding

participation in a transaction, we can proactively take actions designed to protect both the member and the enterprise customer from becoming victims to a

fraudulent transaction.

We are a leading provider of proactive identity theft protection services for consumers and fraud and risk solutions for enterprises.

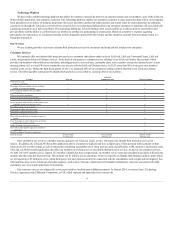

We currently offer our identity theft protection services to consumer subscribers under our basic LifeLock, LifeLock Command Center, LifeLock

Junior, and premium LifeLock Ultimate services. At the heart of our proactive consumer service offerings is our LifeLock Identity Alert system, which

provides our members with notifications and alerts, including proactive, near real-time, actionable alerts, and a response system for identity threats via text

message, phone call, or e-mail. We have continued to see success with our LifeLock Ultimate service. In 2013, more than 40% of our gross new members

enrolled in the service. During the third fiscal quarter of 2013, we surpassed 20% of our cumulative ending members enrolled in our LifeLock Ultimate

service. The following table summarizes the identity theft protection services that we currently offer to our members.

Notification of credit

and non-credit threats üüü

Monitoring of known criminal websites for illegal

trading of personal information üüü

Scans of national databases for new address

information üüü

Stolen or lost wallet remediation üüü

Removal from pre-approved credit offers üüü

Access to a dedicated remediation specialist üüü

Service guarantee with benefits provided under a zero

deductible identity theft insurance policy üüü

Surveillance of peer-to-peer networks ü ü

Monitoring of public and court records ü ü

Patrol for use of known alternate names ü ü

Monitoring of payday loans nationwide ü ü

Alerts when new checking and savings accounts are

opened ü

Scans for changes to contact information on existing

checking and savings accounts ü

Online tri-bureau credit reports and scores ü

Alerts when credit inquiries appear on a member’s

credit report ü

Monthly tracking of TransUnion credit score ü

Retail list pricing $10 per month

$110 per year

$15 per month

$165 per year

$25 per month

$275 per year

Once enrolled in our services, a member may also purchase our LifeLock Junior service, which provides identity theft protection services for

minors. In addition, the LifeLock Wallet mobile application allows consumers to replicate and store a digital copy of their personal wallet contents on their

smart device for records backup, as well as transaction monitoring and mobile use of items such as credit, identification, ATM, insurance, and loyalty cards.

The LifeLock Wallet mobile application also offers our members one-touch access to our identity theft protection services. As part of our consumer services,

we offer 24x7x365 member service support. If a member’s identity has been compromised, our member service team and remediation specialists will assist the

member until the issue has been resolved. This includes our $1 million service guarantee, which is backed by an identity theft insurance policy, under which

we will spend up to $1 million to cover certain third-party costs and expenses incurred in connection with the remediation, such as legal and investigatory fees.

This insurance also covers certain out-of-pocket expenses, such as loss of income, replacement of fraudulent withdrawals, and costs associated with child

and elderly care, travel, and replacement of documents.

Our consumer services are enhanced by services provided by our third-party fulfillment partners. In January 2014, we entered into a Technology

Services Agreement with CSIdentity Corporation, or CSI, which replaced and superseded in its entirety the

6