Kentucky Fried Chicken 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Kentucky Fried Chicken annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 23

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

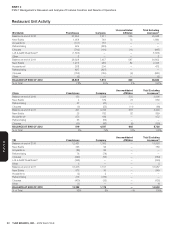

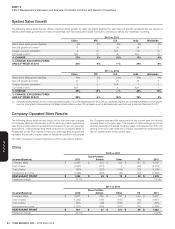

U.S. Franchisees Company

Unconsolidated

Affi liates

Total Excluding

Licensees(a)

Balance at end of 2010 14,977 2,484 — 17,461

New Builds 231 88 — 319

Acquisitions (51) 51 — —

Refranchising 404 (404) — —

Closures (407) (80) — (487)

LJS & A&W Divestitures(b) (1,286) — — (1,286)

Other (1) — — (1)

Balance at end of 2011 13,867 2,139 — 16,006

New Builds 273 96 — 369

Refranchising 468 (468) — —

Closures (312) (34) — (346)

Other (2) — — (2)

BALANCE AT END OF 2012 14,294 1,733 — 16,027

% of Total 89% 11% —% 100%

India Franchisees Company

Unconsolidated

Affi liates

Total Excluding

Licensees(a)

Balance at end of 2010 301 54 — 355

New Builds 88 29 — 117

Closures (4) (1) — (5)

LJS & A&W Divestitures(b) (1) — — (1)

Other — — — —

Balance at end of 2011 384 82 — 466

New Builds 103 35 — 138

Acquisitions (3) 3 — —

Closures (11) — — (11)

BALANCE AT END OF 2012 473 120 — 593

% of Total 80% 20% —% 100%

(a) The Worldwide, YRI and U.S. totals exclude 2,168, 126 and 2,042 licensed units, respectively, at December29, 2012.While there are no licensed units in China, we have excluded from

the Worldwide and China totals 7 Company-owned units that are similar to licensed units. There are no licensed units in India. The units excluded offer limited menus and operate in non-

traditional locations like malls, airports, gasoline service stations, train stations, subways, convenience stores, stadiums and amusement parks where a full scale traditional outlet would not

be practical or efficient.As licensed units have lower average unit sales volumes than our traditional units and our current strategy does not place a significant emphasis on expanding our

licensed units, we do not believe that providing further detail of licensed unit activity provides significant or meaningful information at this time.

(b) The reductions to Worldwide, YRI, U.S. and India totals of 1,633, 346,1,286 and 1, respectively during 2011 represent the number of LJS and A&W units as of the beginning of 2011.

Therefore, 2011 New Builds and Closures exclude any activity related to LJS and A&W.

(c) Includes 472 Little Sheep units acquired on February1, 2012.

Multibrand restaurants are included in the totals above.Multibrand conversions increase the sales and points of distribution for the second brand added

to a restaurant but do not result in an additional unit count.Similarly, a new multibrand restaurant, while increasing sales and points of distribution for

two brands, results in just one additional unit count.