Isuzu 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

«

Isuzu Motors Limited Annual Report 2005

Results of Operations

Significant accounting policies

The consolidated financial statements of the Isuzu group are prepared in

accordance with the generally accepted accounting principles of Japan. In the

preparation of these statements, the amounts recorded for items including bad

debt allowance, inventory, investments, income taxes, retirement benefits, and

provisions for product warranties are estimates that reflect the judgment of

management. Because of the uncertain nature of estimates, in some cases ac-

tual results may vary from initial estimates, and this may have a negative impact

on earnings results.

Sales

In fiscal 2005 (ended March 31, 2005) Isuzu’s consolidated-basis sales rose

4.4% from the previous year to ¥1,493,567 million, as worldwide vehicle unit

sales increased 20.9% to 339,162 units.

Although the Japanese economy made a gradual recovery on improved capi-

tal expenditure and corporate earnings trends, the outlook was clouded in the

second half by rising raw material prices and the impact of yen appreciation.

In the commercial vehicle market, overall demand for standard trucks declined

15.0% from the previous fiscal year to 99,584 units and demand for 2–3 ton

trucks fell a sharp 22.4% to 114,176 units as demand associated with the intro-

duction of new emissions regulations ran its course. In this environment, Isuzu

gained market share through aggressive sales initiatives to capture 27.4% share

of the standard truck market (up 2.5 percentage points from the previous year)

and 38.4% share of the 2–3 ton truck market, an increase of 2.3 percentage

points from the previous year. As a result, domestic sales declined a marginal

0.3% to ¥625,749 million.

Sales in Asia grew 11.3% from the previous fiscal year to ¥374,172 mil-

lion from the impact of consolidating Thai manufacturing operations including

Isuzu Motors Co., (Thailand) Ltd. and brisk sales in China and the ASEAN region

where Isuzu pioneered its business ahead of competitors. In the Thai market,

where pickup trucks account for around 60% of the total, Isuzu pickup trucks

held 38% market share, sustaining steady sales growth despite intensifying

competition.

North American sales fell 15.0% to ¥213,901 million as we withdrew from

local SUV production and shifted emphasis to profit.

Sales in other regions grew a sharp 30.0% to ¥279,744 million, mainly be-

cause of increasing exports of pickup trucks produced in Thailand to other

regions.

Operating income

Operating income for fiscal 2005 was a record ¥87,214 million, up 3.2% from

a year earlier. Rationalization, including raw material expense reduction, contribut-

ed ¥12,600 million, consolidation of manufacturing operations in Thailand added

¥5,000 million, and lower depreciation and other expense cuts had a ¥4,000 mil-

lion positive impact on operating income, offset against ¥12,700 million negative

impact from increased expenses, ¥3,800 million from a worsening sales mix, and

¥2,400 million due to foreign exchange fluctuations.

Looking at each of our key business areas, operating income at the parent

company declined ¥6,400 million from the previous year to ¥60,500 million, be-

cause rationalization such as raw material cost savings and expense cuts could

not fully compensate for a fall in gross profit on lower domestic vehicle sales

and increases in raw materials prices, and selling and R&D expenses.

Consolidated sales subsidiaries in Japan posted an operating income of

¥6,000 million, down ¥1,500 million from the previous year. Lower domestic

demand weighed on profits despite efforts to improve efficiency such as review-

ing sales bases.

In North America, the operating loss shrank ¥1,000 million to ¥400 million

as a result of progress with structural reform, including withdrawal from local

SUV production.

In ASEAN, operating income grew ¥8,000 million to ¥15,200 million due

largely to the consolidation of Thai manufacturing operations and sustained

brisk pickup truck sales in Thailand.

(The figures shown for each of our key business areas above reflect the sim-

ple addition of the profits and losses of the parent company and consolidated

subsidiaries, grouped according to the characteristics of each unit.)

As a result, our operating margin contracted 0.1 percentage point from

5.9% in fiscal 2004 to 5.8% in fiscal 2005.

Note: operating income yen amounts are then rounded down in thousands

Non-operating gains/losses

In fiscal 2005 we posted a non-operating profit of ¥4,340 million, an im-

provement of ¥7,152 million from the previous year.

Equity-method profit increased ¥5,449 million to ¥15,811 million because of

continuing strong performance of engine manufacturing operations in North

America and Poland (both equity-method companies) and group companies in

Japan.

Progress with reduction of interest-bearing debt resulted in a ¥700 million

improvement in net interest (interest received minus interest paid) to ¥10,500

million. We posted a foreign exchange gain of ¥500 million in fiscal 2005, an

improvement of ¥2,700 million from fiscal 2004.

Extraordinary gains/losses

In fiscal 2004, we posted an extraordinary loss of ¥26,321 million, mainly

associated with the overhaul of our domestic sales network such as disposal

of fixed assets in the process of adjustments to our real estate holdings, and

the restructuring of our North American business. In fiscal 2005, the extraordi-

nary loss improved ¥3,532 million to ¥22,788 million. Main extraordinary loss

items were associated with consolidation and reorganization of the domestic

sales network and disposal of fixed assets accompanying the relocation of the

Kawasaki plant.

Taxes

In fiscal 2004, Isuzu’s net tax expense, including corporate income taxes, mu-

nicipal taxes, and business taxes and after adjustments was a ¥77 million gain,

but in fiscal 2005 it was a net expense of ¥6,245 million because of increased

corporate tax payments at the parent and ASEAN subsidiaries.

Minority Interests

Minority interests consist primarily of profits returned to the minority share-

holders of our locally incorporated subsidiaries in ASEAN and North America.

The figure increased from ¥720 million on fiscal 2004 to ¥2,484 million in fiscal

2005.

Management’s Discussion and Analysis of Financial Condition and Results of Operation

700

600

500

400

300

200

100

0North America Asia Others

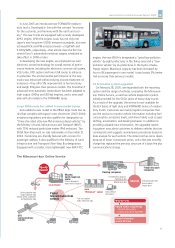

Geographical Segment Information — Sales

FY2003

FY2004

FY2005

378

252

214 211

336

374

Ja

p

an

215

280

287

474

627 626

(Billions of yen)

11 65

80

60

40

20

0

-20

-40

486

-24

-1 -0

3710

-2

1

Parent Japanese

DLRs

North America ASEAN Others Eliminations

Business Areas Segment Information — Operating Income

(Billions of yen)

FY2003

FY2004

FY2005

67 61

1313 15