Isuzu 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ISUZU MOTORS LIMITED ANNUAL REPORT 2002

15

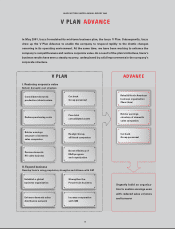

Total Assets

(Millions of Yen)

Shareholders’ Equity

(Millions of Yen)

Financial Position

Total consolidated assets as of March 31, 2002 stood at ¥1,324,144 million, a decrease of ¥567,347 million from a year

earlier. This reduction reflects the streamlining of inventories, efforts to accelerate recovery of trade receivables and

the sale of property, plant and equipment. Total current assets declined by ¥262,757 million to ¥548,941 million, reflecting

a drop in the balance of cash and cash equivalents, notes and accounts receivable and inventories. Property, plant and

equipment fell by ¥219,963 million to ¥551,179 million and investments and advances declined by ¥82,312 million. As

a result, fixed assets were ¥775,202 million, ¥304,590 million lower than a year ago.

Notes and accounts payable fell ¥65,246 million from a year earlier. Bank loans and commercial paper also decreased

¥99,128 million and ¥50,000 million, respectively. Consequently, total current liabilities dropped by ¥305,739 million to

¥872,141 million. Long-term liabilities were ¥387,236 million, a decline of ¥227,707 million. This was attributable to the

redemption of bonds and the repayment of loans as the company took steps to reduce interest-bearing debt. As of

March 31, 2002, interest-bearing debt was ¥738,734 million, down ¥329,474 million from a year ago.

Consolidated shareholders’ equity fell by ¥33,024 million to ¥61,084 million. This reflected an increase in the accu-

mulated deficit due to the net loss recorded for the year. The equity ratio thus declined from 5.0% to 4.6%.

Cash Flows

Net cash provided by operating activities increased by ¥24,184 million to ¥55,179 million due to the improvement in

the company’s net loss, the collection of trade receivables and the reduction of inventories.

Investing activities provided net cash of ¥6,283 million, a turnaround of ¥114,068 million from the previous fiscal

year. This mainly reflected the reduction in payments for leased property, and proceeds from sales of property, plant

and equipment.

Net cash used in financing activities was ¥123,530 million, compared with ¥52,788 million in net cash provided in

fiscal 2001. Cash was mainly used for repayment of debt and commercial paper and the redemption of bonds.

As a result of the above, cash and cash equivalents as of March 31, 2002 stood at ¥72,284 million, down ¥65,079

million from a year ago.

0

500,000

1,000,000

1,500,000

2,000,000

98 99 00 01 02

0

50,000

100,000

150,000

200,000

98 99 00 01 02