Isuzu 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 Isuzu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ISUZU MOTORS LIMITED ANNUAL REPORT 2002

13

Financial Review

Financial Targets

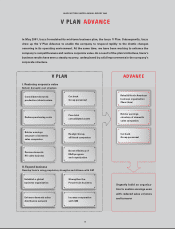

Under the Isuzu V Plan, the company’s medium-term management plan that runs through March 2004, Isuzu is target-

ing an approximate ¥350 billion reduction in total consolidated assets to ¥1,110 billion, and a decrease of roughly ¥240

billion in interest-bearing debt to ¥510 billion, excluding the finance segment. As of March 31, 2002, total consolidated

assets had fallen ¥210 billion to ¥1,250 billion, with interest-bearing debt standing at ¥680 billion, a reduction of ¥70

billion. In addition, Isuzu is pushing forward with plans to improve its cash flows.

Income Analysis

In fiscal 2002, the year ended March 31, 2002, consolidated net sales increased 1.8% year on year to ¥1,597,701 million

on strong demand for engines components, which offset lower unit sales. The cost of sales rose 0.9% to ¥1,355,190

million in line with the increase in net sales. However, the cost of sales ratio improved thanks to rationalization and

cost-saving initiatives. Despite the increase in net sales, selling, general and administrative expenses fell 10.3% to

¥227,376 million due mainly to cutbacks in the workforce and costs. As a result, the company reported operating

income of ¥15,134 million, a significant reversal from the previous year’s ¥27,316 million operating loss. Other expenses

decreased to ¥17,120 million from the ¥20,120 million recorded in fiscal 2001. In special losses, the absence of the

restructuring charges recorded in the previous fiscal year and the booking of special retirement benefits relating to a

voluntary early retirement plan meant that this item was largely unchanged. Special gains were ¥907 million less than

the previous year, despite gains on the sale of investment securities, because there was no transitional gain for

employees’ retirement benefits recorded in the previous year. As a result, net special losses amounted to ¥26,522

million. Loss before income taxes decreased from ¥73,300 million to ¥28,506 million. Net loss was ¥42,991 million,

compared with a loss of ¥66,787 million in the previous fiscal year.

0

500,000

1,000,000

1,500,000

2,000,000

98 99 00 01 02

-120,000

-80,000

-40,000

0

40,000

98 99 00 01 02

Net Income (Loss)

(Millions of Yen)

Net Sales

(Millions of Yen)