Intel 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 Annual Report

Table of contents

-

Page 1

2013 Annual Report -

Page 2

... responsibility is an enduring Intel value that delivers returns for our company, stockholders, and society. In 2013, we continued to expand education opportunities for millions of students around the world, we were again the largest voluntary purchaser of green power in the U.S., and our employees... -

Page 3

... success and stockholder return first. The challenges Intel faces are not new. Every year, nay-sayers predict that technology has reached its limits and opportunities have diminished. Yet innovation never stops, and technology continues to transform the way people go about their lives. I believe the... -

Page 4

...28, 2013, based upon the closing price of the common stock as reported by The NASDAQ Global Select Market* on such date, was $120.6 billion 4,972 million shares of common stock outstanding as of February 7, 2014 DOCUMENTS INCORPORATED BY REFERENCE Portions of the registrant's Proxy Statement related... -

Page 5

... on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information Item 5. PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 6

... and extend our manufacturing technology leadership; • extend to adjacent services such as security, cloud, and foundry; • expand platforms into adjacent market segments to bring compelling new System-on-Chip (SoC) solutions and user experiences to ultra-mobile form factors including smartphones... -

Page 7

... and platforms, our software and services, our security solutions, our customer orientation, our strategic investments, and our corporate stewardship. We believe that applying these core assets to our key objectives provides us with the scale, capacity, and global reach to establish new technologies... -

Page 8

... and technology, driven by our corporate and Intel Foundation programs, policy leadership, and collaborative engagements. In addition, we strive to cultivate a work environment in which engaged, energized employees can thrive in their jobs and in their communities. Our continued investment in... -

Page 9

... in Part II, Item 8 of this Form 10-K. Products Platforms We offer platforms that incorporate various components and technologies, including a microprocessor and chipset, a stand-alone SoC, or multichip package. Additionally, a platform may be enhanced by additional hardware, software, and services... -

Page 10

...manageability, upgradeability, energy-efficient performance, and security while lowering the total cost of ownership. We also offer Intel® Iris™ technology, which provides graphics enhancements for 4th and expected-to-be-released 5th generation Intel Core processors. We offer a range of platforms... -

Page 11

... devices and expanded to 2 in 1 systems will continue. Desktop Our strategy for the desktop computing market segment is to offer exciting new user experiences and products that provide increased manageability, security, and energy-efficient performance. We are also focused on lowering the total cost... -

Page 12

... take advantage of new platform features and capabilities; and • delivering comprehensive solutions by using software, services, and hardware to enable a more secure online experience, such as our McAfee LiveSAFE* technology platform, which provides a comprehensive security suite that offers... -

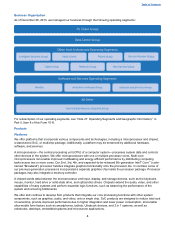

Page 13

... is presented as a percentage of our consolidated net revenue. Other IA includes ISG, Multi-Comm, the Phone Group, the Service Provider Group, the Tablet Group, the Netbook Group, and the New Devices Group operating segments. SSG includes McAfee, the Wind River Software Group, and the Software and... -

Page 14

...the market segments including other companies that make and sell microprocessors, SoCs, other silicon components, software and platforms to businesses which build and sell computing and communications devices to end-users. We also compete against others selling these goods and services to businesses... -

Page 15

...including microprocessors and chipsets, was conducted within the U.S. at our facilities in New Mexico, Arizona, Oregon, and Massachusetts. The remaining 54% of our wafer fabrication was conducted outside the U.S. at our facilities in Israel and China. Our fabrication facility in Ireland is currently... -

Page 16

... in 2013 ($10.1 billion in 2012 and $8.4 billion in 2011). Our R&D activities are directed toward the delivery of solutions consisting of hardware and software platforms and supporting services across a wide range of computing devices. We are focused on developing the technology innovations that... -

Page 17

... terms and conditions of sale typically provide that payment is due at a later date, generally 30 days after shipment or delivery. Our credit department sets accounts receivable and shipping limits for individual customers to control credit risk to Intel arising from outstanding account balances... -

Page 18

... horizon under which price protection is granted. The right of return granted generally consists of a stock rotation program in which distributors are able to exchange certain products based on the number of qualified purchases made by the distributor. We have the option to grant credit for, repair... -

Page 19

... programs with customers to promote our brands and to identify products containing genuine Intel components. We also protect details about our processes, products, and strategies as trade secrets, keeping confidential the information that we believe provides us with a competitive advantage... -

Page 20

...reports on our web site that outline our performance with respect to corporate responsibility, including EHS compliance. We use our Investor Relations web site, www.intc.com, as a routine channel for distribution of important information, including news releases, analyst presentations, and financial... -

Page 21

..., GM, Software and Services Group VP, Developer Programs • Joined Intel in 1981 • Member of Vodafone Group plc Board of Directors • Joined Intel in 1988 Thomas M. Kilroy, age 56 • 2013 - present, • 2010 - 2013, • 2009 - 2010, • 2005 - 2009, Executive VP, GM, Sales and Marketing Group... -

Page 22

...changes in market conditions, including changes in government borrowing, taxation, or spending policies; the credit market; or expected inflation, employment, and energy or other commodity prices; • the level of customers' inventories; • competitive and pricing pressures, including actions taken... -

Page 23

... market segments may impact our revenue and gross margin. For example, our PC client platforms that are incorporated in notebook and desktop computers tend to have lower average selling prices and gross margin than our data center platforms that are incorporated in servers, workstations and storage... -

Page 24

... or other processes, products and services. We are also a target of malicious attackers who attempt to gain access to our network or data centers or those of our customers or end users; steal proprietary information related to our business, products, employees and customers; or interrupt our systems... -

Page 25

... or unauthorized use or publication of third party trade secrets and other confidential business information that we obtain in conducting our business might lead to third-party claims against us related to the loss of the confidential or proprietary information or end-user data. Any such incidents... -

Page 26

... models. The companies in which we invest may fail because they are unable to secure additional funding, obtain favorable terms for future financings, or participate in liquidity events such as public offerings, mergers, and private sales. If any of these companies fail, we could lose all or part... -

Page 27

... results of operations and financial condition due to a change in the scope of our operations include: • timing and execution of plans and programs subject to local labor law requirements, including consultation with work councils; • changes in assumptions related to severance and postretirement... -

Page 28

... in our consolidated statements of income include changes in fixedincome, equity, and credit markets; foreign currency exchange rates; interest rates; credit standing of financial instrument counterparties; our cash and investment balances; and our indebtedness. There are inherent limitations on the... -

Page 29

...assembly and test facilities are located in Malaysia, China, Costa Rica, and Vietnam. In addition, we have sales and marketing offices worldwide that are generally located near major concentrations of customers. We believe that the facilities described above are suitable and adequate for our present... -

Page 30

... PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Information regarding the principal U.S. market in which Intel common stock is traded, including the market price range of Intel common stock and dividend information... -

Page 31

... that $100 was invested on December 26, 2008 (the last day of trading for the fiscal year ended December 27, 2008) in each of our common stock, the Dow Jones U.S. Technology Index, and the S&P 500 Index, and that all dividends were reinvested. Cumulative total stockholder returns for our common... -

Page 32

...revenue Operating income Net income Earnings per common share Basic Diluted Weighted average diluted common shares outstanding Dividends per common share Declared Paid Net cash provided by operating activities Additions to property, plant and equipment Repurchase of common stock Payment of dividends... -

Page 33

... • Results of Operations. An analysis of our financial results comparing 2013 to 2012 and comparing 2012 to 2011. • Liquidity and Capital Resources. An analysis of changes in our balance sheets and cash flows, and discussion of our financial condition and potential sources of liquidity. • Fair... -

Page 34

...$2.1 billion of common stock through our common stock repurchase program. We purchased $10.7 billion in capital assets as we continued making investments in new architectures and product offerings. In January 2014, the Board of Directors declared a cash dividend of $0.225 per common share to be paid... -

Page 35

...private companies, which range from early-stage companies that are often still defining their strategic direction to more mature companies with established revenue streams and business models. The carrying value of our non-marketable equity investment portfolio, excluding equity derivatives, totaled... -

Page 36

... the assets' new, shorter useful lives. Based on our analysis, impairments and accelerated depreciation of our property, plant, and equipment was $172 million in 2013 ($73 million in 2012 and $100 million in 2011). Goodwill Goodwill is recorded when the purchase price for an acquisition exceeds the... -

Page 37

... needs as part of our capital budgeting process, and for long-term and short-term business planning and forecasting. We test the reasonableness of the inputs and outcomes of our discounted cash flow analysis against available comparable market data. The market method is based on financial multiples... -

Page 38

... in 2013 ($540 million in 2012 and $46 million in 2011). Inventory is valued at the lower of cost or market based upon assumptions about future demand and market conditions. Product-specific facts and circumstances reviewed in the inventory valuation process include a review of our customer base... -

Page 39

...well as higher ISG platform average selling prices. Our overall gross margin dollars for 2013 decreased by $1.6 billion, or 5%, compared to 2012. The decrease was due in large part to $1.8 billion of higher factory start-up costs primarily for our next-generation 14nm process technology. To a lesser... -

Page 40

... factory start-up costs and no impact in 2012 for a design issue related to our Intel 6 Series Express Chipset family. We derived a substantial majority of our overall gross margin dollars in 2012 and 2011 from the sale of platforms in the PCCG and DCG operating segments. PC Client Group The revenue... -

Page 41

... higher platform revenue. Other Intel Architecture Operating Segments The revenue and operating income (loss) for the other Intel architecture operating segments, including ISG, MultiComm, the Tablet Group, the Phone Group, the Service Provider Group, the Netbook Group, and the New Devices Group for... -

Page 42

...higher compensation expenses mainly due to annual salary increases, additional expenses for acquisitions made in Q1 2011, and higher costs related to the development of 450mm wafer technology. Marketing, General and Administrative. MG&A expenses increased by $31 million in 2013 compared to 2012, and... -

Page 43

... by the end of 2014. These targeted reductions will enable the company to better align our resources in areas providing the greatest benefit in the changing market. Restructuring and asset impairment charges for each period were as follows: (In Millions) 2013 2012 2011 Employee severance and... -

Page 44

... of Contents MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) Share-Based Compensation Share-based compensation totaled $1.1 billion in 2013 ($1.1 billion in 2012 and $1.1 billion in 2011). Share-based compensation was included in cost of sales and... -

Page 45

... credit that was not reinstated during 2012. Liquidity and Capital Resources Dec 28, 2013 Dec 29, 2012 (Dollars in Millions) Cash and cash equivalents, short-term investments, and marketable debt instruments included in trading assets Other long-term investments, and reverse repurchase agreements... -

Page 46

Table of Contents MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) Sources and Uses of Cash (In Millions) 41 -

Page 47

... lower inventories due to the sell-through of older-generation products, partially offset by the ramp of 4th generation Intel Core Processor family products. For 2013, our three largest customers accounted for 44% of our net revenue (43% in 2012 and 2011), with HewlettPackard Company accounting for... -

Page 48

... authorization limit. We base our level of common stock repurchases on internal cash management decisions, and this level may fluctuate. Proceeds from the sale of shares through employee equity incentive plans totaled $1.6 billion in 2013 compared to $2.1 billion in 2012. Our total dividend payments... -

Page 49

... as Level 1 because the valuations were based on quoted prices for identical securities in active markets. Our assessment of an active market for our marketable equity securities generally takes into consideration the number of days that each individual equity security trades over a specified period... -

Page 50

... other long-term liabilities recorded on our consolidated balance sheets, including the short-term portion of these long-term liabilities. Expected required contributions to our U.S. and non-U.S. pension plans and other postretirement benefit plans of $62 million to be made during 2014 are also... -

Page 51

.... During 2012, we entered into a series of agreements with ASML intended to accelerate the development of 450mm wafer technology and EUV lithography. Intel agreed to provide R&D funding totaling â,¬829 million over five years and committed to advance purchase orders for a specified number of tools... -

Page 52

... management program may include equity derivatives with or without hedge accounting designation that utilize warrants, equity options, or other equity derivatives. We also utilize total return swaps to offset changes in liabilities related to the equity market risks of certain deferred compensation... -

Page 53

... public offerings, mergers, and private sales. These types of investments involve a great deal of risk, and there can be no assurance that any specific company will grow or become successful; consequently, we could lose all or part of our investment. Our non-marketable equity investments, excluding... -

Page 54

... Consolidated Statements of Income Consolidated Statements of Comprehensive Income Consolidated Balance Sheets Consolidated Statements of Cash Flows Consolidated Statements of Stockholders' Equity Notes to Consolidated Financial Statements Reports of Independent Registered Public Accounting Firm... -

Page 55

Table of Contents INTEL CORPORATION CONSOLIDATED STATEMENTS OF INCOME Three Years Ended December 28, 2013 (In Millions, Except Per Share Amounts) 2013 2012 2011 Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and asset ... -

Page 56

Table of Contents INTEL CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Three Years Ended December 28, 2013 (In Millions) 2013 2012 2011 Net income Other comprehensive income, net of tax: Change in net unrealized holding gains (losses) on available-forsale investments Change in net... -

Page 57

...-term investments Trading assets Accounts receivable, net of allowance for doubtful accounts of $38 ($38 in 2012) Inventories Deferred tax assets Other current assets Total current assets Property, plant and equipment, net Marketable equity securities Other long-term investments Goodwill Identified... -

Page 58

... short-term debt, net Proceeds from government grants Excess tax benefit from share-based payment arrangements Issuance of long-term debt, net of issuance costs Repayment of debt Proceeds from sales of shares through employee equity incentive plans Repurchase of common stock Payment of dividends to... -

Page 59

...) Total comprehensive income Proceeds from sales of shares through employee equity incentive plans, net tax deficiency, and other Assumption of equity awards in connection with acquisitions Share-based compensation Repurchase of common stock Cash dividends declared ($0.7824 per common share) Balance... -

Page 60

...2012 were 52-week years. Fiscal year 2011 was a 53-week year. The next 53-week year will end on December 31, 2016. Our consolidated financial statements include the accounts of Intel Corporation and our subsidiaries. We have eliminated intercompany accounts and transactions. We use the equity method... -

Page 61

... or gains on the related derivative instruments and balance sheet remeasurement, are recorded in interest and other, net. We also designate certain floating-rate securitized financial instruments, primarily asset-backed securities, as trading assets. Available-for-Sale Investments We consider all... -

Page 62

... consider specific adverse conditions related to the financial health of, and the business outlook for, the investee, which may include industry and sector performance, changes in technology, operational and financing cash flow factors, and changes in the investee's credit rating. We record other... -

Page 63

... in the line item on the consolidated statements of income most closely associated with the related exposures, primarily in interest and other, net and gains (losses) on equity investments, net. As part of our strategic investment program, we also acquire equity derivative instruments, such as... -

Page 64

... lives of the assets. We record capitalrelated government grants earned as a reduction to property, plant and equipment. Goodwill We record goodwill when the purchase price of an acquisition exceeds the fair value of the net tangible and identified intangible assets as of the date of acquisition... -

Page 65

... 28, 2013, were as follows: Estimated Useful Life (In Years) Acquisition-related developed technology Acquisition-related customer relationships Acquisition-related trade names Licensed technology and patents 4 5 4 5 - - - - 9 8 8 17 We perform a quarterly review of finite-lived identified... -

Page 66

... commissions, are deferred and amortized over the same period that the related revenue is recognized. We record deferred revenue offset by the related cost of sales on our consolidated balance sheets as deferred income. Advertising Cooperative advertising programs reimburse customers for marketing... -

Page 67

... INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Note 3: Accounting Changes 2012 In the first quarter of 2012, we adopted amended standards that increase the prominence of items reported in other comprehensive income. These amended standards eliminate the option to present... -

Page 68

... 2 Level 3 Total Assets Cash equivalents: Bank deposits Commercial paper Corporate bonds Government bonds Money market fund deposits Reverse repurchase agreements Short-term investments: Bank deposits Commercial paper Corporate bonds Government bonds Trading assets: Asset-backed securities Bank... -

Page 69

... as asset-backed securities, bank deposits, commercial paper, corporate bonds, government bonds, money market fund deposits, municipal bonds, and reverse repurchase agreements classified as cash equivalents. When we use observable market prices for identical securities that are traded in less active... -

Page 70

... end of each period were as follows: December 28, 2013 (In Millions) Carrying Amount Fair Value Measured Using Level 1 Level 2 Level 3 Fair Value Non-marketable cost method investments Loans receivable Reverse repurchase agreements Grants receivable Long-term debt Short-term debt NVIDIA Corporation... -

Page 71

... Cash and Investments Cash and investments at the end of each period were as follows: (In Millions) Dec 28, 2013 Dec 29, 2012 Available-for-sale investments Cash Equity method investments Loans receivable Non-marketable cost method investments Reverse repurchase agreements Trading assets Total cash... -

Page 72

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Available-for-Sale Investments Available-for-sale investments at the end of each period were as follows: December 28, 2013 Gross Gross Unrealized Unrealized Gains Losses December 29, 2012 Gross Gross ... -

Page 73

... at the end of each period were as follows: December 28, 2013 (Dollars In Millions) Carrying Value Ownership Percentage December 29, 2012 Carrying Value Ownership Percentage IM Flash Technologies, LLC Intel-GE Care Innovations, LLC Clearwire Communications, LLC Other equity method investments Total... -

Page 74

...Care Innovations), an equally owned joint venture in the healthcare industry, that focuses on independent living and delivery of health-related services by means of telecommunications. The company was formed by combining assets of GE Healthcare's Home Health division and Intel's Digital Health Group... -

Page 75

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Our currency risk management programs include: • Currency derivatives with cash flow hedge accounting designation that utilize currency forward contracts and currency options to hedge exposures to the ... -

Page 76

Table of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) In 2010, we sold our ownership interest in Numonyx B.V. to Micron for consideration consisting of shares of Micron. We also entered into equity option transactions that economically hedged a portion of the ... -

Page 77

... 2013 2012 2011 Currency forwards Other Total $ $ (167) $ 1 (166) $ 4 9 13 $ $ 20 - 20 Gains and losses on derivative instruments in cash flow hedging relationships related to hedge ineffectiveness and amounts excluded from effectiveness testing were insignificant during all periods presented... -

Page 78

... customers accounted for 34% of our accounts receivable as of December 28, 2013 (33% as of December 29, 2012). We believe that the receivable balances from these largest customers do not represent a significant credit risk based on cash flow forecasts, balance sheet analysis, and past collection... -

Page 79

... consumer and mobile security. In addition to managing the existing McAfee business, the objective of the acquisition was to accelerate and enhance Intel's combination of hardware and software security solutions, thereby improving the overall security of our platforms. Total consideration to acquire... -

Page 80

... Trade names Total identified intangible assets $ $ $ 1,221 1,418 2,639 92 821 3,552 4 2 - 7 Acquired developed technology represents the fair value of McAfee products that have reached technological feasibility and were part of McAfee's product offerings at the date of acquisition. Customer... -

Page 81

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The identified intangible assets assumed in the acquisitions completed during 2011, excluding McAfee, were recognized as follows: Estimated Useful Life (In Years) Fair Value (In Millions) Developed technology Customer relationships Other... -

Page 82

... owned joint venture to create a new healthcare company focused on independent living and delivery of health-related services via telecommunications. The new company, Care Innovations, was formed by combining assets of GE Healthcare's Home Health division and Intel's Digital Health Group. During... -

Page 83

... and acquisition-related customer relationships of $60 million with a weighted average useful life of seven years. During 2013, we purchased licensed technology and patents of $36 million with a weighted average useful life of 10 years. Identified intangible assets at the end of December 29, 2012... -

Page 84

... the companies, as well as broad mutual general releases. We agreed to make payments totaling $1.5 billion to NVIDIA over six years ($300 million in each of January 2011, 2012, and 2013; and $200 million in each of January 2014, 2015, and 2016), which resulted in a liability totaling approximately... -

Page 85

... by the end of 2014. These targeted reductions will enable the company to better align our resources in areas providing the greatest benefit in the changing market. Restructuring and asset impairment charges for each period were as follows: (In Millions) 2013 2012 2011 Employee severance and... -

Page 86

...of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Note 15: Chipset Design Issue In January 2011, as part of our ongoing quality assurance procedures, we identified a design issue with the Intel® 6 Series Express Chipset family. The issue affected chipsets sold in... -

Page 87

... options are not accounted for separately as derivatives. 2009 Debentures (In Millions, Except Per Share Amounts) Dec 28, 2013 Dec 29, 2012 2005 Debentures Dec 28, 2013 Dec 29, 2012 Outstanding principal Equity component carrying amount Unamortized discount Net debt carrying amount Conversion rate... -

Page 88

... investment managers. The discretionary employer contributions made to the Intel 401(k) Savings Plan are participant-directed. For the benefit of eligible U.S. employees, we also provide a non-tax-qualified supplemental deferred compensation plan for certain highly compensated employees. This plan... -

Page 89

...June 20, 2012, Ireland closed its pension plan to employees hired on or after this date. U.S. Postretirement Medical Benefits. Upon retirement, eligible U.S. employees who were hired prior to January 1, 2014, are credited with a defined dollar amount, based on years of service, into a U.S. Sheltered... -

Page 90

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The amounts recognized on the consolidated balance sheets at the end of each period were as follows: Non-U.S. Pension Benefits Dec 28, 2013 Dec 29, 2012 U.S. Postretirement Medical Benefits Dec 28, 2013 Dec 29... -

Page 91

... conditions, such as volatility and liquidity concerns, and will typically be rebalanced when outside the target ranges, which are 60% for fixed-income debt instrument investments and 40% for equity investments in 2013. The expected long-term rate of return for the U.S. Intel Minimum Pension Plan... -

Page 92

... CONSOLIDATED FINANCIAL STATEMENTS (Continued) U.S. Intel Minimum Pension Plan assets measured at fair value on a recurring basis consisted of the following investment categories at the end of each period were as follows: Dec 29, 2012 Total Total December 28, 2013 Fair Value Measured at Reporting... -

Page 93

...and emerging markets throughout the world. The expected long-term rate of return for the U.S. postretirement medical benefits plan assets is 7.4%. As of December 28, 2013, substantially all of the U.S. postretirement medical benefits plan assets were invested in exchange-traded equity securities and... -

Page 94

..., we do not grant additional shares under those plans. In connection with our completed acquisition of McAfee in 2011, we assumed McAfee's equity incentive plan and issued replacement awards. The stock options and restricted stock units issued generally retain similar terms and conditions of the... -

Page 95

... follows: 2013 2012 2011 Estimated values Risk-free interest rate Dividend yield Volatility $ 21.45 $ 0.2% 3.8% 25% 25.32 $ 0.3% 3.3% 26% 19.86 0.7% 3.4% 27% We use the Black-Scholes option pricing model to estimate the fair value of options granted under our equity incentive plans and rights... -

Page 96

...Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Restricted Stock Unit Awards Information with respect to outstanding RSU activity for each period was as follows: Weighted Average Grant-Date Fair Value Number of RSUs (In Millions) December 25, 2010 Granted Assumed... -

Page 97

... price and the value of Intel common stock at the time of exercise. The following table summarizes information about options outstanding as of December 28, 2013: Outstanding Options Weighted Average Remaining Contractual Life (In Years) Exercisable Options Range of Exercise Prices Number of Shares... -

Page 98

... of Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Stock Purchase Plan Approximately 76% of our employees were participating in our 2006 Stock Purchase Plan as of December 28, 2013 (72% in 2012 and 70% in 2011). Employees purchased 20.5 million shares in 2013 for... -

Page 99

... in 2012 and $150 million in 2011). In 2011, we recognized a gain upon forming the Intel and GE joint venture, Care Innovations, of $164 million, which is included within "other, net," in the preceding table. For further information, see "Note 5: Cash and Investments." Note 23: Earnings Per Share We... -

Page 100

...$0.04 impact on diluted earnings per share ($0.05 for 2012 and $0.10 for 2011). During 2013, net income tax benefits attributable to equity-based compensation transactions that were allocated to stockholders' equity totaled $3 million (net benefits of $137 million in 2012 and net deficiencies of $18... -

Page 101

...28, 2013 Dec 29, 2012 (In Millions) Deferred tax assets: Accrued compensation and other benefits Share-based compensation Deferred income Inventory Unrealized losses on investments and derivatives State credits and net operating losses Other, net Gross deferred tax assets Valuation allowance Total... -

Page 102

... years presented, we recognized interest and penalties related to unrecognized tax benefits within the provision for taxes on the consolidated statements of income. Interest and penalties related to unrecognized tax benefits were insignificant in 2013 (insignificant in 2012 and $24 million in 2011... -

Page 103

... Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Note 25: Other Comprehensive Income (Loss) The components of other comprehensive income (loss) and related tax effects for each period were as follows: 2013 (In Millions) Before Tax Tax Net of Tax Before Tax 2012 Tax... -

Page 104

... INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The changes in accumulated other comprehensive income (loss) by component and related tax effects for each period were as follows: (In Millions) Unrealized Holding Gains (Losses) on Availablefor-Sale Investments Deferred... -

Page 105

... income into the consolidated statements of income, with presentation location, for each period were as follows: 2013 Comprehensive Income Components 2012 2011 Location Income Before Taxes Impact (In Millions) Unrealized holding gains (losses) on available-for-sale investments $ 8 138 146... -

Page 106

... marketing, business, intellectual property, and other challenged practices benefit our customers and our stockholders, and we will continue to conduct a vigorous defense in the remaining proceedings. Government Competition Matters and Related Consumer Class Actions In 2001, the European Commission... -

Page 107

... of Delaware (AMD litigation). Like the AMD litigation, these class-action lawsuits allege that we engaged in various actions in violation of the Sherman Act and other laws by, among other things: providing discounts and rebates to our manufacturer and distributor customers conditioned on exclusive... -

Page 108

... per share. Four McAfee shareholders filed putative class-action lawsuits in Santa Clara County, California Superior Court challenging the proposed transaction. The cases were ordered consolidated in September 2010. Plaintiffs filed an amended complaint that named former McAfee board members, McAfee... -

Page 109

... • Phone Group • Service Provider Group • Tablet Group • Netbook Group • New Devices Group • Software and services operating segments: • McAfee • Wind River Software Group • Software and Services Group All other: • Non-Volatile Memory Solutions Group • In 2013, we completed... -

Page 110

... consumer and mobile security from our McAfee business; software optimized products for the embedded and mobile market segments; and software products and services that promote Intel architecture as the platform of choice for software development. We have sales and marketing, manufacturing, finance... -

Page 111

... Contents INTEL CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Net revenue and operating income (loss) for each period were as follows: (In Millions) 2013 2012 2011 Net revenue: PC Client Group Data Center Group Other Intel architecture operating segments Software and services... -

Page 112

... Contents REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders of Intel Corporation We have audited the accompanying consolidated balance sheets of Intel Corporation as of December 28, 2013 and December 29, 2012, and the related consolidated statements of... -

Page 113

... audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the 2013 consolidated financial statements of Intel Corporation and our report dated February 14, 2014 expressed an unqualified opinion thereon. San Jose, California February 14, 2014 108 -

Page 114

... (UNAUDITED) 2013 for Quarter Ended (In Millions, Except Per Share Amounts) December 28 September 28 June 29 March 30 Net revenue Gross margin Net income Basic earnings per common share Diluted earnings per common share Dividends per common share: Declared Paid Market price range common stock1... -

Page 115

... and the preparation of consolidated financial statements for external purposes in accordance with U.S. generally accepted accounting principles. Management assessed our internal control over financial reporting as of December 28, 2013, the end of our fiscal year. Management based its assessment on... -

Page 116

... "Corporate Governance" in our 2014 Proxy Statement is incorporated by reference in this section. The Intel Code of Conduct (the Code) is our code of ethics document applicable to all employees, including all officers, and including our independent directors, who are not employees of the company... -

Page 117

... the year ended December 28, 2013, which is 3.4 million lower because the financial statement footnote reports restricted stock units outstanding without regard to the number of shares that ultimately may be issued under those awards. 2 3 4 5 The 1997 Stock Option Plan (1997 Plan) provided for... -

Page 118

... our 2014 Proxy Statement under the headings "Corporate Governance" and "Certain Relationships and Related Transactions" is incorporated by reference in this section. ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES The information appearing in our 2014 Proxy Statement under the headings "Report of... -

Page 119

... warranties were made or at any other time. Investors should not rely on them as statements of fact. Intel, the Intel logo, Intel Core, Intel Atom, Intel Inside, the Intel Inside logo, Iris, Intel vPro, Intel Xeon, Intel Xeon Phi, Itanium, Pentium, and Ultrabook are trademarks of Intel Corporation... -

Page 120

... INTEL CORPORATION SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS Three Years Ended December 28, 2013 (In Millions) Balance at Beginning of Year Additions Charged to Expenses/ Other Accounts Net (Deductions) Recoveries Balance at End of Year Allowance for doubtful receivables 2013 2012 2011... -

Page 121

... Terms and Conditions Relating to NonQualified Stock Options granted to U.S. employees on and after May 19, 2004 under the Intel Corporation 2004 Equity Incentive Plan Standard International Non-Qualified Stock Option Agreement under the Intel Corporation 2004 Equity Incentive Plan Intel Corporation... -

Page 122

... File Number Exhibit Filing Date Filed or Furnished Herewith 10.2.8** 10.2.9** Intel Corporation Nonqualified Stock Option Agreement under the 2004 Equity Incentive Plan Intel Corporation 2004 Equity Incentive Plan Standard Terms and Conditions relating to NonQualified Stock Options granted on... -

Page 123

...Plan (standard option program) Standard Terms and Conditions relating to Restricted Stock Units granted on and after January 22, 2010 and before January 20, 2011 under the Intel Corporation Equity Incentive Plan (standard OSU program) Intel Corporation Restricted Stock Unit Agreement under the Intel... -

Page 124

... July 1, 1998 Form of Indemnification Agreement with Directors and Executive Officers Listed Officer Compensation Intel Corporation Sheltered Employee Retirement Plan Plus, as amended and restated, effective January 1, 2009 Intel Corporation 2006 Stock Purchase Plan, approved May 17, 2006 and... -

Page 125

... Acquisition Corporation and McAfee, Inc. dated August 18, 2010 Patent Cross License Agreement between NVIDIA Corporation and Intel Corporation, dated January 10, 2011. Portions of this exhibit have been omitted pursuant to a request for confidential treatment. Offer Letter from Intel Corporation... -

Page 126

..., thereunto duly authorized. INTEL CORPORATION Registrant By: /S/ STACY J. SMITH Stacy J. Smith Executive Vice President, Chief Financial Officer, and Principal Accounting Officer February 14, 2014 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed... -

Page 127

... Officer Incentive Plan, is to motivate and reward eligible employees by making a portion of their cash compensation (the "Annual Incentive Payments") dependent on (i) Intel Corporation (the "Company") performance, and (ii) individual performance, including, without limitation, performance related... -

Page 128

..., the recommendations or advice of any director, officer or employee of the Company and such attorneys, consultants and accountants as it may select. 4. AMOUNT OF INCENTIVE (a) A Covered Individual's Annual Incentive Payment shall be the product of (i) the Plan Multiplier, as described in paragraph... -

Page 129

... such payments shall be made. (b) If the Company's financial statements are the subject of a restatement due to error or misconduct, to the extent permitted by governing law, in all appropriate cases, the Company will seek reimbursement of excess incentive cash compensation paid under the Plan to... -

Page 130

... to award Covered Individuals an additional Annual Incentive Payment should the restated financial statements result in a higher Annual Incentive Payment. 6. AMENDMENT AND TERMINATION The Company reserves the right to amend or terminate this Plan at any time by action of the Board of Directors or... -

Page 131

... desirable, including, without limitation, cash or equity-based compensation arrangements, either tied to performance or otherwise, and any such other arrangements as may be either generally applicable or applicable only in specific cases. 11. EMPLOYMENT AT WILL Neither the Plan, the selection of... -

Page 132

...INTEL CORPORATION STATEMENT SETTING FORTH THE COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES Years Ended (Dollars in Millions, Except Ratios) Dec 28, 2013 Dec 29, 2012 Dec 31, 2011... of Regulation S-K. Interest within provision for taxes on the consolidated statements of income is not included. -

Page 133

... Intel Electronics Ltd. Intel European Finance Corporation Intel Finance B.V. Intel Holdings B.V. Intel International Finance CVBA Intel International, Inc. Intel Investment Management Limited Intel Ireland Limited Intel Malaysia Sdn. Berhad Intel Massachusetts, Inc. Intel Mobile Communications GmbH... -

Page 134

... of our reports dated February 14, 2014, with respect to the consolidated financial statements and schedule of Intel Corporation and the effectiveness of internal control over financial reporting of Intel Corporation included in this Annual Report (Form 10-K) of Intel Corporation for the year ended... -

Page 135

... the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about... -

Page 136

... the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about... -

Page 137

...period ended December 28, 2013, fully complies with the requirements of Section 13(a) of the Securities Exchange Act of 1934 and that the information contained in such report fairly presents, in all material respects, the financial condition and results of operations of Intel. This written statement... -

Page 138

..., General Manager, Technology and Manufacturing Group Andy D. Bryant 4 Chairman of the Board Susan L. Decker 1 3†4†Principal Deck3 Ventures LLC A consulting and advisory firm Renee J. James President Thomas M. Kilroy Executive Vice President, General Manager, Sales and Marketing Group... -

Page 139

... strategic priorities and performance on a range of environmental, social, and governance factors, including workplace practices, community engagement, and supply chain responsibility. The report and supporting materials are available at www.intel.com/go/responsibility. Caring for our people. At the... -

Page 140

www.intel.com News and information about Intel® products and technologies, customer support, careers, worldwide locations, and more. www.intc.com Stock information, earnings and conference webcasts, annual reports, and corporate governance and historical financial information.