Intel 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

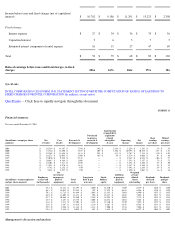

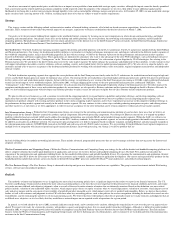

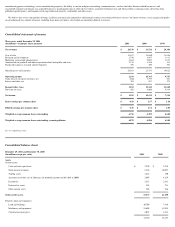

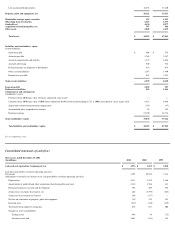

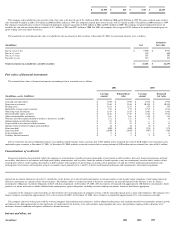

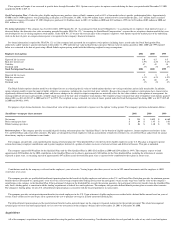

See accompanying notes.

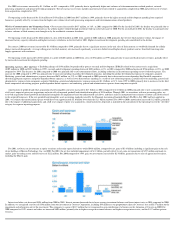

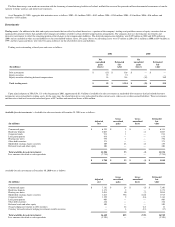

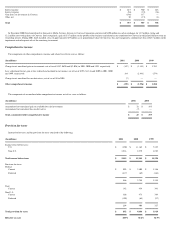

Notes to consolidated financial statements

Accounting policies

Fiscal year > Intel Corporation has a fiscal year that ends on the last Saturday in December. Fiscal year 2001, a 52-week year, ended on December 29, 2001. Fiscal year 2000 was a 53-week

year that ended on December 30, while 1999, a 52

-week year, ended on December 25. The next 53-week year will end on December 31, 2005.

Basis of presentation >

The consolidated financial statements include the accounts of Intel and its wholly owned subsidiaries. Intercompany accounts and transactions have been eliminated.

Partially owned equity affiliates are accounted for under the equity method. Accounts denominated in non-U.S. currencies have been remeasured using the U.S. dollar as the functional

currency.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and judgments that affect

the amounts reported in the financial statements and accompanying notes. The critical accounting policies that require management's most significant estimates and judgments include

valuation of non-marketable equity securities, valuation of inventory, and the assessment of recoverability of goodwill and other intangible assets. The actual results experienced by the

company may differ materially from management's estimates.

Recent accounting pronouncements >

In July 2001, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 141, "Business

Combinations," and SFAS No. 142, "Goodwill and Other Intangible Assets." Beginning in the first quarter of fiscal 2002, the company will no longer amortize goodwill, but will perform

impairment tests annually, or earlier if indicators of potential impairment exist. All other intangible assets continue to be amortized over their estimated useful lives. In conjunction with the

implementation of SFAS No. 142, the company has completed a goodwill impairment review as of the beginning of fiscal 2002 using a fair-value based approach in accordance with

provisions of that standard and found no impairment. Based on acquisitions completed as of June 30, 2001, application of the goodwill non-amortization provisions is expected to result in a

decrease in amortization of approximately $1.6 billion for fiscal year 2002.

Accounting change >

Effective as of the beginning of 2001, the company adopted SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities," as amended, which

requires the company to recognize all derivative instruments as either assets or liabilities on the balance sheet at fair value. The accounting for gains or losses from changes in fair value of a

derivative instrument depends on whether it has been designated and qualifies as part of a hedging relationship, as well as on the type of hedging relationship.

The cumulative effect of the adoption of SFAS No. 133 was an increase in income before taxes of $45 million, which is included in interest and other, net for 2001. The adoption did not

have a material effect on other comprehensive income.

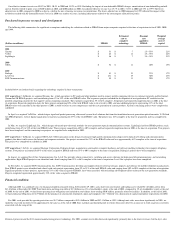

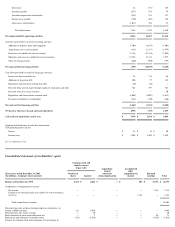

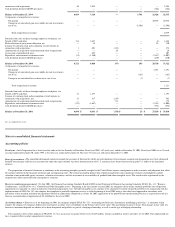

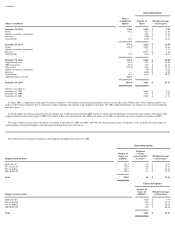

connection with acquisitions

69

2,494

— — —

2,494

Cash dividends declared ($0.055 per share)

—

—

—

—

(

366

)

(366

)

Balance at December 25, 1999

6,669

7,316

—

3,791

21,428

32,535

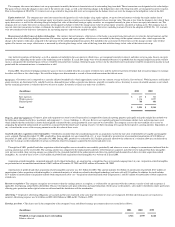

Components of comprehensive income:

Net income

— — — —

10,535

10,535

Change in net unrealized gain on available-for-sale investments,

net of tax — — — (

3,596

) — (

3,596

)

Total comprehensive income

6,939

Proceeds from sales of shares through employee stock plans, tax

benefit of $887 and other

116

1,687

— — (

3

)

1,684

Reclassification of put warrant obligation, net —

35

— —

95

130

Issuance of common stock and assumption of stock options in

connection with acquisitions

3

401

(123

) — —

278

Amortization of acquisition-related unearned stock compensation — —

26

— —

26

Conversion of subordinated notes

7

207

— — —

207

Repurchase and retirement of common stock

(74

)

(1,160

)

—

—

(

2,847

)

(4,007

)

Cash dividends declared ($0.070 per share) — — — — (

470

)

(470

)

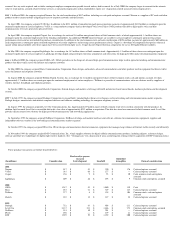

Balance at December 30, 2000

6,721

8,486

(97

)

195

28,738

37,322

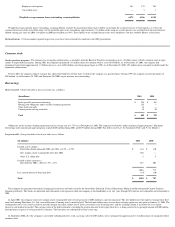

Components of comprehensive income:

Net income

— — — —

1,291

1,291

Change in net unrealized gain on available-for-sale investments,

net of tax

—

—

—

(

163

)

—

(

163

)

Change in net unrealized loss on derivatives, net of tax

—

—

—

(

7

)

—

(

7

)

Total comprehensive income

1,121

Proceeds from sales of shares through employee stock plans, tax

benefit of $435 and other

81

1,197

—

—

—

1,197

Issuance of common stock and aassumption of stock options in

connection with acquisitions, net

21

817

(255

) — —

562

Amortization of acquisition-related unearned stock compensation — —

174

— —

174

Repurchase and retirement of common stock

(133

)

(1,667

)

—

—

(

2,341

)

(4,008

)

Cash dividends declared ($0.080 per share) — — — — (

538

)

(538

)

Balance at December 29, 2001

6,690

$

8,833

$

(178

) $

25

$

27,150

$

35,830