Intel 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our financial results are substantially dependent on sales of microprocessors and related components by the Intel Architecture operating segment. Revenues are partly a function of the

mix of microprocessor types and speeds sold, as well as the mix of related chipsets, motherboards, purchased components and other semiconductor products, all of which are difficult to

forecast. Because of the wide price difference among performance desktop, value desktop, mobile and server microprocessors, the mix of types of microprocessors sold affects the average

price that we will realize and has a large impact on our revenues and gross margin. Microprocessor revenues are dependent on the availability of other parts of the system platform, including

chipsets, motherboards, operating system software and application software. Our expectations regarding conditions in the worldwide computing industry are dependent in part on the growth

in Internet use and the expansion of Internet product offerings. Our expectations are also subject to the impact of economic conditions in various geographic regions.

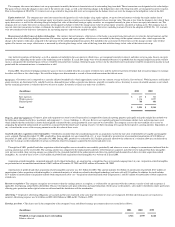

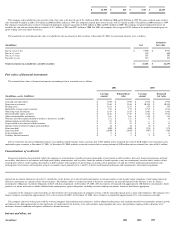

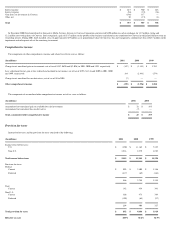

Our gross margin expectation for 2002 is 51% plus or minus a few points, and 51% is two points higher than the 2001 gross margin of 49%. The gross margin percentage should benefit

from revenue growth and expected cost savings as we ramp the 0.13-

micron manufacturing process in 2001. Our gross margin varies, depending on unit volumes, the mix of types and speeds

of processors sold, as well as the mix of microprocessors, related chipsets and motherboards, and other semiconductor and non-

semiconductor products. Our policy for valuation of inventory,

including the determination of obsolete or excess inventory, requires us to estimate the future demand for our products within specific time horizons, generally six months or less. The

estimates of future demand that we use in the valuation of inventory are also used for near-term factory planning, and are consistent with our published revenue forecast. If our demand

forecast is greater than actual demand and we fail to reduce manufacturing output accordingly, we would likely be required to record additional inventory reserves, which would have a

negative impact on our gross margin. Various other factors—including unit volumes, yield issues associated with production at factories, ramp of new technologies, excess or shortage of

manufacturing capacity and the reusability of factory equipment—will also continue to affect cost of sales and the variability of gross margin percentages.

We have significantly expanded our semiconductor manufacturing and assembly and test capacity over the last few years, and we continue to plan capacity based on the assumed

continued success of our strategy as well as the acceptance of our products in specific market segments. However, we expect that capital spending will decrease to approximately $5.5 billion

in 2002 from $7.3 billion in 2001. The reduction is primarily the result of expected improvements in capital efficiency as we transition to the larger, 300-millimeter wafer manufacturing

process and the timing of manufacturing process technology cycles. If market demand does not grow and move rapidly toward higher performance products in the various market segments,

revenues and gross margin may be adversely affected, manufacturing capacity could be under-utilized, and the rate of capital spending could be reduced. Revenues and gross margin may

also be affected if we do not add capacity fast enough to meet market demand. This capital spending plan is dependent on expectations regarding production efficiencies and delivery times of

various machinery and equipment, and construction schedules for new facilities. Depreciation for 2002 is expected to be approximately $4.6 billion, compared to $4.1 billion in 2001. Most

of this increase would be included in cost of sales and research and development spending.

Our industry is characterized by very short product life cycles, and our continued success is dependent on technological advances, including the development and implementation of new

processes and new strategic products for specific market segments. Because we consider it imperative to maintain a strong research and development

program, spending for research and development in 2002, excluding purchased in-

process research and development, is expected to increase to approximately $4.1 billion from $3.8 billion in

2001. The higher spending is primarily for next-generation manufacturing technology, including development of 90-nanometer (0.09-micron) manufacturing process technology on 300-

millimeter wafer manufacturing. We also intend to continue spending to promote our products and to increase the value of our product brands.

In March 2001, we announced that we expected to reduce our employee base by approximately 5,000 people over the remainder of 2001, primarily through attrition and a voluntary

separation plan. We had exceeded this goal by the end of 2001.

We are completing the adoption of the FASB Statements of Financial Accounting Standards Nos. 141 and 142 on accounting for business combinations and goodwill as of the beginning

of 2002. Accordingly, we will no longer amortize goodwill from acquisitions, but will continue to amortize other acquisition-related intangibles and costs. Consequently, we expect

amortization of acquisition-related intangibles and costs to be approximately $440 million for 2002, down from $2.3 billion of amortized goodwill and acquisition-related intangibles and

costs in 2001.

In conjunction with the implementation of the new accounting rules for goodwill, as of the beginning of fiscal 2002, we have completed a goodwill impairment review for the Intel

Communications Group and the Wireless Communications and Computing Group, the reporting units that have substantially all of our recorded goodwill, and found no impairment.

According to our accounting policy under the new rules, we will perform a similar review annually, or earlier if indicators of potential impairment exist. Our impairment review is based on a

discounted cash flow approach that uses our estimates of future market share and revenues and costs for these groups as well as appropriate discount rates. The estimates we have used are

consistent with the plans and estimates that we are using to manage the underlying businesses. If we fail to deliver new products for these groups, if the products fail to gain expected market

acceptance, or if market conditions in the communications businesses fail to improve, our revenue and cost forecasts may not be achieved, and we may incur charges for impairment of

goodwill.

During 2000 and 2001, we sold most of our portfolio of marketable strategic equity securities; however, at the end of 2001, we held $1.3 billion in non-marketable equity securities. Our

ability to recover our investments in non-marketable equity securities and to earn a return on these investments is largely dependent on equity market conditions and the occurrence of

liquidity events, such as initial public offerings, mergers and private sales. All of these factors are difficult to predict, particularly in the current economic environment. In addition, under our

accounting policy, we are required to review all of our investments for impairment. For non-marketable equity securities, this requires significant judgment, including assessment of the

investees' financial condition, the existence of subsequent rounds of financing and the impact of any relevant contractual preferences, as well as the investees' historical results of operations,

and projected results and cash flows. If the actual outcomes for the investees are significantly different from our projections, our recorded impairments may be understated, and we may incur

additional charges in future periods.

We currently expect our tax rate to be approximately 28.4% for 2002, excluding the impact of costs from prior and any future acquisitions. This estimate is based on current tax law, the

current estimate of earnings and the expected distribution of income among various tax jurisdictions, and is subject to change.

On January 1, 2002, the national currencies of 12 European countries were replaced with the Euro. During the three-year transition period, our conversion of systems and processes was

successfully completed with no material impact on our operations. The introduction of the Euro has not materially affected our currency exchange and hedging activities, and has not resulted

in any material increase in costs.

We are currently a party to various legal proceedings. Although litigation is subject to inherent uncertainties, management, including internal counsel, does not believe that the ultimate

outcome of these legal proceedings will have a material adverse effect on our financial position or overall trends in results of operations. However, if an unfavorable ruling were to occur in

any specific period, there exists the possibility of a material adverse impact on the results of operations of that period. Management believes, given our current liquidity and cash and

investment balances, that even an adverse judgment would not have a material impact on cash and investments or liquidity.

Our future results of operations and the other forward-looking statements contained in this outlook and in our strategy discussion involve a number of risks and uncertainties—in

particular the statements regarding our goals and strategies, expectations regarding new product introductions, plans to cultivate new business to expand the Internet, future economic

conditions, revenues, pricing, gross margin and costs, capital spending, depreciation and amortization, research and development expenses, potential impairment of investments, the tax rate

and pending legal proceedings. In addition to the factors discussed above, among the other factors that could cause actual results to differ materially are the following: business and economic

conditions and trends in the computing and communications industries in various geographic regions; possible disruption in commercial activities related to terrorist activity and armed

conflict, such as changes in logistics and security arrangements, and reduced end-user purchases relative to expectations; the impact of events outside the United States, such as the business

impact of fluctuating currency rates, unrest or political instability in a locale, such as unrest in Israel; changes in customer order patterns; competitive factors such as competing chip

architectures and manufacturing technologies, competing software-compatible microprocessors and acceptance of new products in specific market segments; pricing pressures; development

and timing of the introduction of compelling software applications; excess or obsolete inventory and variations in inventory valuation; continued success in technological advances, including

development and implementation of new processes and strategic products for specific market segments; execution of the manufacturing ramp, including the transition to 0.13

-

micron