Intel 1996 Annual Report Download - page 55

Download and view the complete annual report

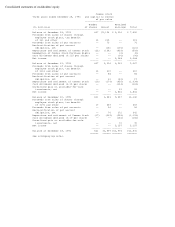

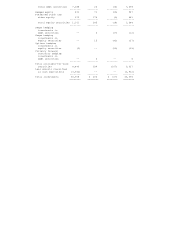

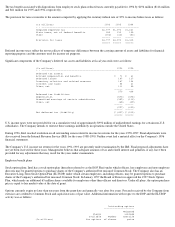

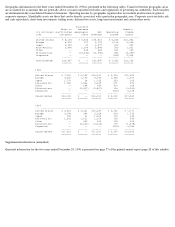

Please find page 55 of the 1996 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Weighted average pay and receive rates, average maturities and range of maturities on swaps at December 28, 1996 were as follows:

Note: Pay and receive rates are based on the reset rates that were in effect at December 28, 1996.

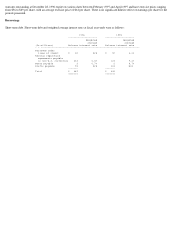

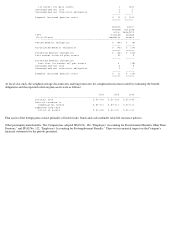

Other foreign currency instruments. Intel transacts business in various foreign currencies, primarily Japanese yen and certain European

currencies. The Company has established revenue and balance sheet hedging programs to protect against reductions in value and volatility of

future cash flows caused by changes in foreign exchange rates. The Company utilizes currency forward contracts and currency options in these

hedging programs. The maturities on these instruments are less than 12 months. Deferred gains or losses attributable to foreign currency

instruments are not material.

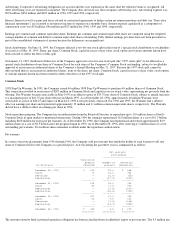

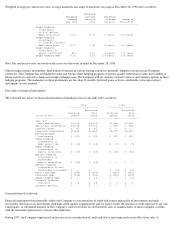

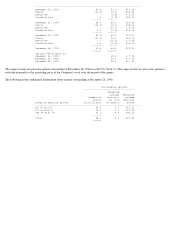

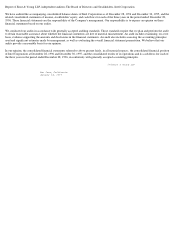

Fair values of financial instruments

The estimated fair values of financial instruments outstanding at fiscal year-ends were as follows:

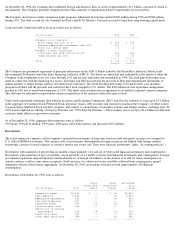

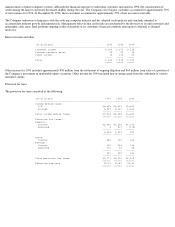

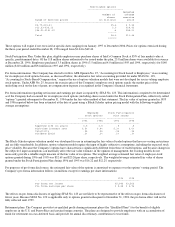

Concentrations of credit risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of investments and trade

receivables. Intel places its investments with high-credit-quality counterparties and, by policy, limits the amount of credit exposure to any one

counterparty. A substantial majority of the Company's trade receivables are derived from sales to manufacturers of microcomputer systems,

with the remainder spread across various other industries.

During 1995, the Company experienced an increase in its concentration of credit risk due to increasing trade receivables from sales to

Weighted

Weighted average Weighted

average receive average Range of

pay rate rate maturity maturities

- - -----------------------------------------------------------------------

Swaps hedging

investments

in U.S. dollar

debt securities 6.3% 5.7% .7 years 0-2 years

Swaps hedging

investments

in foreign currency

debt securities 8.7% 7.4% .8 years 0-3 years

Swaps hedging

investments in

equity securities N/A 5.6% .4 years 0-1 years

Swaps hedging debt 5.6% 6.9% 3.9 years 2-5 years

1996 1995

--------------------- --------------------

Estimated Estimated

Carrying fair Carrying fair

(In millions) amount value amount value

- - ------------------------------------------------------------------------

Cash and

cash equivalents $4,165 $4,165 $1,463 $1,463

Short-term investments $3,736 $3,736 $ 995 $ 995

Trading assets $ 87 $ 87 $ -- $ --

Long-term investments $1,418 $1,418 $1,699 $1,699

Non-marketable

instruments $ 119 $ 194 $ 239 $ 259

Swaps hedging

investments in

debt securities $ (12) $ (12) $ (7) $ (7)

Swaps hedging

investments in

equity securities $ (27) $ (27) $ (42) $ (42)

Options hedging

investments in

marketable

equity securities $ (25) $ (25) $ -- $ --

Options hedging

investments in non-

marketable instruments $ -- $ -- $ (9) $ (13)

Short-term debt $ (389) $ (389) $ (346) $ (346)

Long-term debt $ (728) $ (731) $ (400) $ (399)

Swaps hedging debt $ -- $ 13 $ -- $ (1)

Currency forward

contracts $ 5 $ 18 $ 3 $ 4

Currency options $ -- $ -- $ -- $ --