Ingram Micro 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES

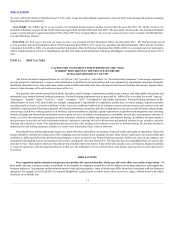

Common Stock. Our Common Stock is traded on the New York Stock Exchange under the symbol IM. The following table sets forth the high and low

price per share, based on closing price, of our Common Stock for the periods indicated.

HIGH

LOW

Fiscal Year 2013 First Quarter $20.14

$16.92

Second Quarter 19.61

17.23

Third Quarter 23.46

19.21

Fourth Quarter 24.21

22.90

Fiscal Year 2012 First Quarter $19.72

$ 18.09

Second Quarter 19.53

16.86

Third Quarter 17.55

14.46

Fourth Quarter 17.37

14.83

As of December 28, 2013 there were 459 holders of record of our Common Stock. Because many of such shares are held by brokers and other

institutions, on behalf of shareowners, we are unable to estimate the total number of shareowners represented by these record holders.

Dividend Policy. We have neither declared nor paid any dividends on our Common Stock in the preceding two fiscal years. We currently intend to

retain future earnings to fund ongoing operations and finance the growth and development of our business. Any future decision to declare or pay dividends will

be at the discretion of the Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, and such other

factors as the Board of Directors deems relevant. In addition, certain of our debt facilities contain restrictions on the declaration and payment of dividends.

Equity Compensation Plan Information. The following table provides information, as of December 28, 2013, with respect to equity compensation

plans under which equity securities of our company are authorized for issuance, aggregated as follows: (i) all compensation plans previously approved by our

shareholders and (ii) all compensation plans not previously approved by our shareholders.

Plan Category

(a) Number of securities

(in thousands) to be

issued upon exercise of

outstanding options,

warrants and rights(1)

(b) Weighted-average

exercise price of

outstanding options,

warrants and rights(1)

(c) Number of securities

(in thousands)

remaining available for

equity compensation plans

(excluding securities

reflected in column (a))(2)

Equity compensation plans approved by shareholders 4,187

$20.56

13,805

Equity compensation plans not approved by shareholders None

None

None

TOTAL 4,187

$20.56

13,805

(1) Does not reflect unvested awards of time and performance restricted stock units/award of 6,854 at 100% target and an additional 818 shares at

maximum achievement.

(2) Balance reflects shares available to issue, taking into account granted options, time vested restricted stock units/awards and performance vested

restricted stock units assuming maximum achievement.

Share Repurchase Program. In October 2010, our Board of Directors authorized a $400,000 share repurchase program that has since been extended

to October 27, 2015, of which $124,095 was remaining for repurchase at December 28, 2013. Under the program, we may repurchase shares in the open

market and through privately negotiated transactions. Our repurchases are funded with available borrowing capacity and cash. The timing and amount of

specific repurchase transactions will depend upon market conditions, corporate considerations and applicable legal and regulatory requirements. There was no

share repurchase activity during the fourth quarter of 2013.

21