ICICI Bank 2003 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

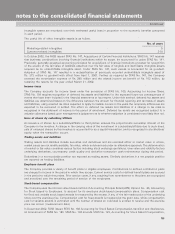

F68

Continued

notes to the consolidated financial statements

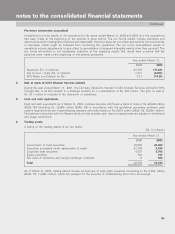

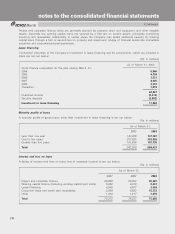

(Rs. in millions)

Assets

Cash and cash equivalents 53,183

Investments 113,725

Loans 39,102

Property and equipment 2,609

Intangible assets 5,470

Other assets 11,093

Total assets acquired 225,182

Liabilities

Deposits 176,018

Borrowings 16,174

Other liabilities 19,745

Total liabilities assumed 211,937

Net tangible and intangible assets 13,245

Goodwill 819

Total 14,064

The goodwill recognized above is not deductible for tax purposes.

The intangible assets relate to customer and deposit relationships and would be amortized over a period of 10 years.

Consequent to the acquisition, the 46% ownership interest held by the Company in the acquiree was recorded as

treasury stock at its historical carrying value. In September 2002, the treasury stock was sold to institutional investors

for Rs. 13,154 million. The difference between the sale proceeds and the carrying value, net of related tax effects

of Rs. 599 million, was recognized in the statement of stockholders equity as a capital transaction.

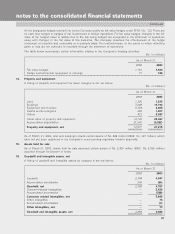

Step-acquisition of Tricolour Infotech Services Limited

In September 2002, the Company acquired the remaining 50% ownership interest in Tricolor Infotech International

Inc., Mauritius for a cash consideration of Rs. 110million. The total purchase price has been allocated to the

acquired assets and assumed liabilities based on management estimates as follows:

(Rs. in millions)

Net tangible assets 16

Marketing-related intangibles 76

Goodwill 18

Total 110

The goodwill recognized above is not deductible for tax purposes.

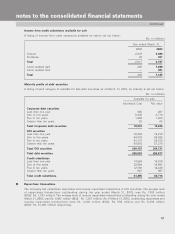

Acquisition of Customer Asset India Private Limited

In April 2002, the Company acquired a 100% ownership interest in Customer Asset India Private Limited, a company

engaged in the business of providing contact center services through its offshore contact center at Bangalore, for

a cash consideration aggregating Rs. 959million. The acquisition would enable the Company to enter the IT enabled

services market. The total purchase price has been allocated to the acquired assets and assumed liabilities based

on management estimates as follows:

(Rs. in millions)

Net tangible assets 177

Customer-related intangibles 165

Goodwill 617

Total 959

The goodwill recognized above is not deductible for tax purposes.