ICICI Bank 2003 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2003 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F63

Continued

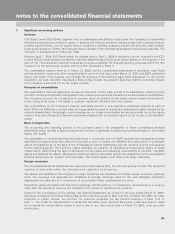

notes to the consolidated financial statements

When a fair value hedge is discontinued, the hedged asset or liability is no longer adjusted for changes in fair value

and the existing basis adjustment is amortized or accreted over the remaining life of the asset or liability. When a

cash flow hedge is discontinued but the hedged cash flow or forecasted transaction is still expected to occur, gains

and losses that were accumulated in other comprehensive income are amortized or accreted into the statement of

income. Gains and losses are recognized in the statement of income immediately if the cash flow hedge was

discontinued because a forecasted transaction did not occur.

The Company may occasionally enter into a contract (host contract) that contains a derivative that is embedded in

the financial instrument. If applicable, an embedded derivative is separated from the host contract and can be

designated as a hedge; otherwise, the derivative is recorded as a freestanding derivative.

Prior to the adoption of SFAS No. 133, derivatives used for interest rate risk management were not recorded at fair

value. Rather, the net interest settlement on designated derivatives that either effectively altered the interest rate

characteristics of assets and liabilities or hedged exposures to risk was treated as an adjustment to the interest

income or interest expense of the related assets or liabilities. The effect of adopting SFAS No. 133 at April 1, 2001

did not result in any impact on the statement of operations.

Variable interest entities

In January 2003, the FASB issued FASB Interpretation No. (FIN) 46, Consolidation of Variable Interest Entities.

FIN 46 changes the method of determining whether certain entities, including securitization entities, should be

included in the Company’s consolidated financial statements. An entity is subject to FIN 46 and is called a

variable interest entity (VIE) if it has (1) equity that is insufficient to permit the entity to finance its activities without

additional subordinated financial support from other parties, (2) equity investors that cannot make significant decisions

about the entity’s operations, or (3) equity that does not absorb the expected losses or receive the expected returns

of the entity. A VIE is consolidated by its primary beneficiary, which is the party involved with the VIE that has a

majority of the expected losses or a majority of the expected residual returns or both. The provisions of FIN 46 are

to be applied immediately to VIEs created after January 31, 2003, and to VIEs in which an enterprise obtains

an interest after that date. For VIEs in which an enterprise holds a variable interest that it acquired before

February 1, 2003, FIN 46 applies in the first fiscal period beginning after June 15, 2003. For any VIEs that must be

consolidated under FIN 46 that were created before February 1, 2003, the assets, liabilities and noncontrolling

interest of the VIE would be initially measured at their carrying amounts with any difference between the net amount

added to the balance sheet and any previously unrecognized interest being recognized as the cumulative effect of

an accounting change. If determining the carrying amounts is not practicable, fair value at the date FIN 46 first

applies may be used to measure the assets, liabilities and noncontrolling interest of the VIE. FIN 46 also mandates

new disclosures about VIEs, some of which are required to be presented in financial statements issued after January

31, 2003.

There are no VIEs that require disclosure under FIN 46. Further, there are no VIEs created after January 31, 2003 that

are required to be consolidated under FIN 46.

Guarantees and indemnifications

In November 2002, the FASB issued FIN 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees,

including Indirect Guarantees of Indebtedness of Others, which requires that, for guarantees within the scope of

FIN 45 issued or amended after December31,2002, a liability for the fair value of the obligation undertaken in

issuing the guarantee be recognized. FIN 45 also requires additional disclosures in financial statements for periods

ending after December 15, 2002. Accordingly, the required disclosures are included in Note 29 to the consolidated

financial statements of the Company. The recognition and measurement provisions of FIN 45 were adopted effective

January 1, 2003 and did not have a material impact on the consolidated financial statements of the Company.

Property and equipment

Property and equipment are stated at cost, less accumulated depreciation. The cost of additions, capital improvements

and interest during the construction period are capitalized, while maintenance and repairs are charged to expense

when incurred. Property and equipment held to be disposed off are reported as assets held for sale at the lower

of carrying amount or fair value, less cost to sell.

Depreciation is provided over the estimated useful lives of the assets or lease term whichever is shorter.

Property under construction and advances paid towards acquisition of property and equipment are disclosed as

capital work in progress. The interest costs incurred for funding an asset during its construction period are capitalized

based on the average outstanding investment in the asset and the average cost of funds. The capitalized interest

cost is included in the cost of the relevant asset and is depreciated over the estimated useful life of the asset.