Hess 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Hess annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2008, our company delivered another year of

strong fi nancial and operational performance as we

executed our strategy to invest in the sustainable

growth of reserves and production in Exploration and

Production and manage for near-term earnings and

free cash fl ow in Marketing and Refi ning.

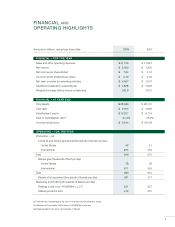

For the year, our company achieved record earnings

of $2.36 billion, or $7.24 per share, on the strength

of high crude oil prices and growth in our worldwide

crude oil and natural gas production. By the end

of 2008, we had lowered our ratio of debt to

capitalization to 24.3 percent from 28.9 percent in

the prior year.

Exploration and Production, which earned $2.4 billion,

delivered outstanding operational performance:

• Proved reserves grew to 1.43 billion barrels of oil

equivalent, an increase of 8 percent.

• Reserve life increased to 10 years, marking the

sixth consecutive year of improvement.

• We replaced 171 percent of production at a fi nding,

development and acquisition cost of $19 per barrel

of oil equivalent.

• Worldwide crude oil and natural gas production

grew to an average of 381,000 barrels of oil

equivalent per day.

Marketing and Refi ning, which earned $277 million,

continued to contribute to our company:

• Refi ning was negatively impacted by signifi cant

declines in refi ning margins due to the challenging

economic environment.

• Energy Marketing results benefi ted from strong

margins and volume growth.

• Retail Marketing experienced higher average

margins, which more than offset lower sales for

gasoline and convenience stores on a per site basis.

We continue to build a global franchise in Exploration

and Production with world class technical

expertise and a portfolio of assets that is balanced

geographically between the United States, Europe,

Africa and Asia. Our exploration program had a

successful year, which positions the company for

future growth in reserves and production.

As we manage our business through a severe

period of economic weakness, we are committed

to maintaining fi nancial strength while protecting

our long-term growth options. We have responded

to the reduction in global energy demand and the

precipitous drop in crude oil and natural gas prices by

sizing our 2009 capital and exploratory expenditure

program to $3.2 billion compared with $4.8 billion

in 2008. As in previous years, nearly all of our

2009 spending will be targeted to Exploration and

Production, with $1.4 billion budgeted for production

operations, $900 million for developments and $800

million for exploration.

EXPLORATION AND PRODUCTION

Crude oil and natural gas production in 2008 was

up one percent versus the prior year despite the

impact of devastating hurricanes in the Gulf of

Mexico, which reduced our full year production

by about 7,000 barrels of oil equivalent per day.

Production growth was underpinned by strong

performance at the Hess operated Okume Complex

in Equatorial Guinea and the commencement of

Phase 2 natural gas sales at the Malaysia/Thailand

Joint Development Area (JDA).

Throughout the year, we advanced several key

developments in our global portfolio, including

the JDA, the Shenzi Field in the deepwater Gulf

of Mexico, Ujung Pangkah crude oil and liquefied

petroleum gas in Indonesia and the Valhall Field

redevelopment in Norway.

TO OUR SHAREHOLDERS

2

JOHN B. HESS

Chairman of the Board

and Chief Executive Officer