Henry Schein 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Henry Schein annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

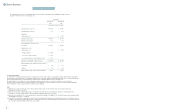

The following table sets forth, for the applicable periods, a reconciliation of operating income attributable to Henry Schein, Inc.

adjusted to reflect the effects of restructuring costs.

USE OF NON-GAAP MEASURES:

The above information includes financial measures that are not calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”).

The above table reconciles operating income, income attributable to Henry Schein, Inc., and diluted earnings per share attributable to Henry Schein, Inc., our most directly comparable

measure calculated and presented in accordance with GAAP, to comparable amounts as adjusted to eliminate the effect of restructuring costs.

We eliminated the effect of restructuring costs to assist in evaluating the underlying operational performance of our business, excluding such costs, over the periods

presented. We believe that this presentation is appropriate and facilitates such an evaluation by us, investors and analysts. These measures should be considered supplemental to,

and not a substitute for or superior to, financial measures calculated in accordance with GAAP.

NOTES:

(1) During 2012, we recorded restructuring costs of $15.2 million pre-tax ($10.5 million post-tax). The effect that these charges had on earnings per diluted share

attributable to Henry Schein, Inc. was ($0.12).

(2) During 2013, we reduced the remaining valuation allowance of $13.4 million on the deferred tax asset associated with a net operating loss carryforward outside of the

United States. The effect that this transaction had on earnings per diluted share attributed to Henry Schein, Inc. was $0.15.

(3) Represents a loss on divestiture in 2013 of a noncontrolling interest in a dental wholesale distributor in the Middle East. The effect that this transaction had on earnings per diluted

share attributable to Henry Schein, Inc. was ($0.14).

(4) In February 2013, we repaid the then outstanding debt related to the Henry Schein Animal Health, formerly Butler Schein Animal Health, transaction. As part of this transaction, we

recorded a one-time interest charge of $6.2 million pre-tax ($2.7 million post-tax) related to the accelerated amortization of deferred financing costs. The effect that this transaction

had on earnings per diluted share attributed to Henry Schein, Inc. was ($0.03).

NON-GAAP DISCLOSURES

(in thousands, except per share data)

Years Ended

December 28, December 29,

2013 2012

Operating income, as reported $ 677,054 $ 618,961

Operating margin, as reported 7.1% 6.9%

Adjustments:

Restructuring costs (1) – $ 15,192

Adjusted operating income $ 677,054 $ 634,153

Adjusted operating margin 7.1% 7.1%

Income attributable to Henry Schein, Inc.:

As reported $ 431,554 $ 388,076

Adjustments, net of tax:

Restructuring costs (1) – $ 10,537

Foreign tax benet (2) $ (13,398) –

Loss on sale of equity investment (3) $ 12,535 –

Accelerated amortization of deferred nancing costs (4) $ 2,679 –

Adjusted income attributable to Henry Schein, Inc.: $ 433,370 $ 398,613

Diluted earnings per share attributable to Henry Schein, Inc.:

As reported $ 4.93 $ 4.32

Adjusted $ 4.95 $ 4.44

Diluted weighted-average common shares outstanding: 87,622 89,823