Harley Davidson 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

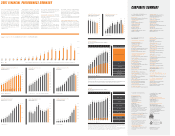

10-YEAR CAGR 18.3%

1,100

300

400

200

100

0

700

600

500

1,000

900

800

1,043

960

890

580

267

214

934

174

348

438

761

HARLEY-DAVI DSO N, I NC.

N ET INCOM E

Dollars in millions

06050402999897 00 01 03 07

HARLEY-DAVI DSO N, I NC.

N ET REV E NU E

Dollars in millions

5,801

5,342

5,015

4,091

2,453

2,064

1,763

2,943

3,407

4,624

10-YEAR CAGR 12.5%CAGR: COMPOUND ANNUAL GROWTH RATE

6,000

2,000

2,500

1,500

500

1

,000

0

4,000

3,500

3,000

5,500

5,000

4,500

5,727

06050402999897 00 01 03 07

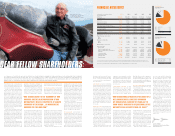

In 2007, the Company’s net revenue and net

income decreased 1.3% and 10.5%, respectively.

Net revenue of $5.7 billion was $74 million

lower than in 2006, while 2007 net income

of $934 million was $109 million lower than

last year.

Revenue from sales of Harley-Davidson

motorcycles decreased to $4.4 billion in 2007,

a decline of 2.3% from 2006. Buell motorcycle

revenue of $101 million was down 1.7%. Rev-

enue from Genuine Parts and Accessories in

2007 totaled $868 million, a 0.7% increase over

the previous year, and General Merchandise

revenue was $305 million, an increase of 10.1%

compared to 2006.

Harley-Davidson continues to effectively

manage its balance sheet and realized a return

on invested capital (ROIC) at the end of 2007 of

26.3%. The Company has maintained an ROIC

over 20% every year since 2000.

The Company’s share price declined 33.7%

during 2007. For the ten-year period ending on

December 31, 2007, compound annual total

return on Harley-Davidson stock was 13.9%.

The Company increased its dividend twice during

2007 and has increased the annual dividend

for 15 consecutive years. The dividend paid per

share in 2007 was up 30.9% compared to 2006.

Since the end of 1986, the year Harley-Davidson,

Inc. became a public company, shareholders

have enjoyed a compound annual total return

growth rate of 27.2%, which includes fi ve 2-for-1

stock splits during that time period.

HARLEY-DAVIDSON MOTORCYCLES Worldwide

retail sales of Harley-Davidson motorcycles

declined 1.8% in 2007.

In the United States, 2007 retail sales of

Harley-Davidson motorcycles decreased 6.2%

compared to 2006 and the overall U.S. heavy-

weight market declined 5.0%.

For the full year 2007, retail sales of

Harley-Davidson motorcycles in our international

markets increased 13.7%. In Europe, sales of

Harley-Davidson motorcycles increased 15.0%,

and in Japan, retail sales of Harley-Davidson

motorcycles increased 3.6% compared to 2006.

Annual retail sales increased 9.4% in Canada,

and increased 23.7% in the remaining interna-

tional markets combined.

In 2007, Harley-Davidson motorcycle ship-

ments were 330,619 units, down 5.3% from 2006.

HARLEY-DAVIDSON FINANCIAL SERVICES

Harley-Davidson Financial Services (HDFS)

continued a 14 -year run of earnings growth.

Operating income increased from $211 mil-

lion in 2006 to $212 million in 2007 as HDFS

benefi ted from increased wholesale and retail

lending activity.

2007 FINANCIAL PERFORMANCE SUMMARY

30,000

0

20,000

10,000

06

23

,

191

930

981

07

15

,

687

93

242

1

,

686

95

337

2

,

224

96

414

3

,

650

97

553

4

,

257

98

710

7

,

434

99

860

10

,

084

00

782

12

,

544

01

689

17

,

169

02

537

14

,

645

03

690

15

,

133

04

766

19

,

476

05

803

16

,

709

94

245

2

,

152

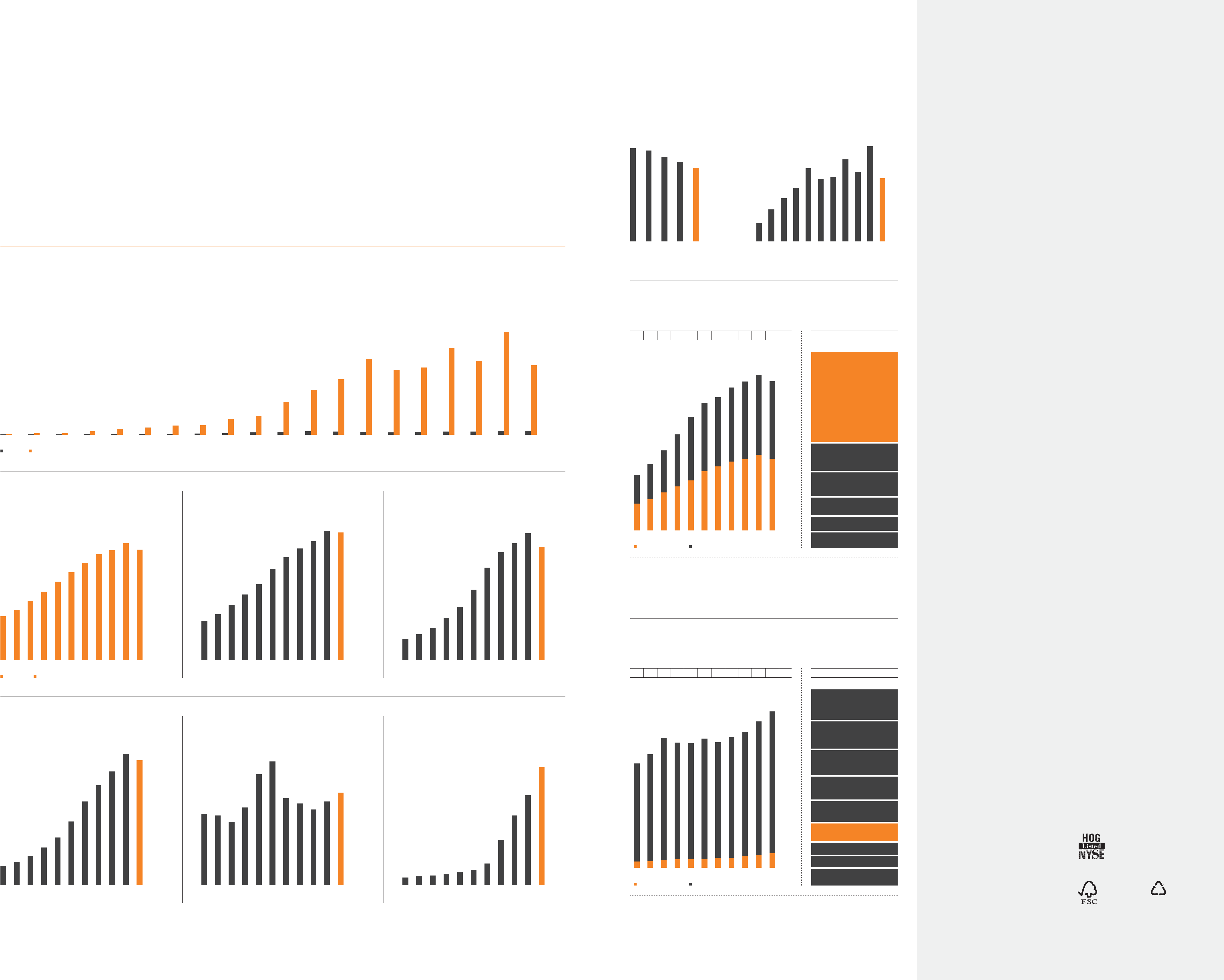

20 -YEAR COMPARISON OF YE AR -END VALUE OF $100 INVESTED DEC. 31, 1987. ASSUMES FOR BOTH HARLEY-DAVIDSON AND S&P THAT ALL DIVIDENDS ARE REINVESTED.

HARLEY-DAVIDSON, INC. VS. STANDARD & POOR’S 500 COMPOSITE INDEX

In dollars

S&P 500 H-D

88

123

242

89

161

374

90

156

367

91

204

852

220

1

,

433

92

400

50

0

200

150

100

350

300

250

349.2

06

329.0

05

317.3

04

263.7

02

177.2

99

150.8

98

132.3

97

204.6

00

234.5

01

291.1

03

HARLEY-DAVIDSON MOTORCYCLE

W O R L DW I DE S H I P MENTS

Units in thousands

330.6

07

DOM EST IC INTERNAT IONAL

HARLEY-DAVI DSO N, I NC.

DILUTED EARNINGS PER SHARE

In dollars

3.93

3.41

3.00

1.90

0.86

0.69

0.57

1.13

1.43

2.50

4.00

0

3.00

2.00

1.00

3.74

10-YEAR CAGR 20.7%

06050402999897 00 01 03 07

HARLEY-DAVI DSO N, I NC.

C AP I TAL E X PENDI TURES

Dollars in millions

219.6

198.4

213.6

323.9

165.8

182.8

186.2

203.6

290.4

227.2

350

0

150

100

50

300

250

200

242.1

06050402999897 00 01 03 07

HARLEY-DAVI DSO N, I NC.

DIV I DENDS P E R S HARE

In dollars, adjusted for splits

1.200

0

1.000

0.800

0.600

0.400

0.200

0.810

0.625

0.405

0.135

0.088

0.078

0.068

0.098

0.115

0.195

1.060

10-YEAR CAGR 31.6%

06050402999897 00 01 03 07

2007 HARLEY-DAVIDSON

LEADERSHIP

CORPORATE OFFICERS

THOMAS E. BERGMANN

Executive Vice President and

Chief Financial Offi cer

PERRY A. GLASSGOW

Vice President and Treasurer

GAIL A. LIONE

Executive Vice President, General Counsel,

Secretary and Chief Compliance Offi cer

JAMES L. ZIEMER

President and Chief Executive Offi cer

HARLEY

-DAVID S ON M OTOR

COMPANY LEADERSHIP

JOANNE M. BISCHMANN

Vice President, Licensing and Special Events

DAVID P. BOZEMAN

Vice President, Advanced Manufacturing

RODNEY J. COPES

Vice President, Asia Pacifi c

WILLIAM B. DANNEHL

Executive Vice President,

Chief Organizational Transformation Offi cer

WILLIAM G. DAVIDSON

Senior Vice President and

Chief Styling Offi cer

WILLIAM J. DAVIDSON

Vice President, Core Customer Marketing

KARL M. EBERLE

Senior Vice President, Manufacturing

ROBERT S. FARCHIONE

Vice President, Engineering Platform Teams

FRED C. GATES

Vice President and General Manager,

York Vehicle Operations

JAMES E. HANEY

Vice President and Chief Information Offi cer

MICHAEL P. HEERHOLD

Vice President and General Manager,

Powertrain Operations, Pilgrim Road

TIMOTHY K. HOELTER

Vice President, Government Affairs

RONALD M. HUTCHINSON

Senior Vice President, Product Development

M ICHAEL D. KEEFE

Vice President, Harley Owners Group

PATRICK D. KELLER

Vice President,

Engineering Centers of Expertise

KATHLEEN A. LAWLER

Vice President, Communication

MATTHEW S. LEVATICH

Vice President, Parts and Accessories

JAMES A. MCCASLIN

President and Chief Operating Offi cer

JEFFREY A. MERTEN

Vice President, North American Sales

LOUIS N. NETZ

Vice President and Director, Styling

JOHN A. OLIN

Vice President and Controller

STEVEN R. PHILLIPS

Vice President, Quality, Operational Excellence

and Technical Service

MARK-HANS RICHER

Senior Vice President and

Chief Marketing Offi cer

HAROLD A. SCOTT

Vice President, Human Resources

PATRICK SMITH

Vice President, General Merchandise

MICHAEL VAN DER SANDE

Vice President and Managing Director,

Harley-Davidson Europe

JERRY G. WILKE

Vice President

2007 HARLEY-DAVIDSON

FINANCIAL SERVICES LEADERSHIP

SAIYID T. NAQVI

President, Harley-Davidson Financial Services

2007 BUELL MOTORCYCLE

COMPANY LEADERSHIP

ERIK F. BUELL

Chairman and Chief Technical Offi cer,

Buell Motorcycle Company

JON R. FLICKINGER

President and Chief Operating Offi cer,

Buell Motorcycle Company

2007 BOARD OF D I R ECTOR S,

HARLEY-DAVIDSON, I NC.

BARRY K. ALLEN

Senior Advisor, Providence Equity Partners

President, Allen Enterprises, LLC

RICHARD I. BEATTIE

Chairman,

Simpson Thacher & Bartlett LLP

JEFFREY L. BLEUSTEIN

Chairman of the Board,

Harley-Davidson, Inc.

GEORGE H. CONRADES

Executive Chairman,

Akamai Technologies, Inc.

JUDSON C. GREEN

President and Chief Executive Offi cer,

NAVTEQ Corporation

DONALD A. JAMES

Chairman and Chief Executive Offi cer,

Deeley Harley-Davidson/Canada

Fred Deeley Imports Ltd.

SARA L. LEVINSON

Chairperson, ClubMom, Inc.

GEORGE L. MILES, JR.

President and Chief Executive Offi cer,

WQED Multimedia

JAMES A. NORLING

Chairman of the Board,

Chartered Semiconductor Manufacturing Ltd.

JOCHEN ZEITZ

Chairman and

Chief Executive Offi cer, Puma AG

JAMES L. ZIEMER

President and Chief Executive Offi cer,

Harley-Davidson, Inc.

COMPANY INFORMATION

HARLEY-DAVIDSON, INC.

3700 West Juneau Avenue

P.O. Box 653

Milwaukee, WI 53201-0653

Internet Addresses:

www.harley-davidson.com

www.buell.com

PLANT TOUR INFORMATION:

877-883-1450

York, Pa. motorcycles

Kansas City, Mo. motorcycles

Milwaukee, Wis. engines

The following is a representative sample of trademarks

of H-D Michigan, Inc.: Harley-Davidson, Harley,

the Bar & Shield Logo, MotorClothes, Harley Owners

Group, H.O.G., Nightster, V-Rod, Harley-Davidson

Museum and Buell.

SHAREHOLDER INFORMATION

ANNUAL SHAREHOLDER MEETING

The Annual Meeting of Shareholders will convene

at 10:30 a.m., CT, on Saturday, April 26, 2008, at

the Pfi ster Hotel, 424 East Wisconsin, Milwaukee,

Wisconsin, 53202.

SEC FORM 10-K

A copy of the Annual Report to the Securities and

Exchange Commission on Form 10-K may be

obtained from the Company without charge to

shareholders or via the Company’s website

on or about February 22, 2008.

D IV I D E N D R E I NV E S T M E N T A N D

STOCK PURCHASE PLAN

To obtain information on our Dividend Reinvestment

and Direct Stock Purchase plans, please contact

ComputerShare.

ComputerShare Trust Company

2 North LaSalle Street

Chicago, IL 60602

866-360-5339 toll-free

REGISTRAR AND TRANSFER AGENT

COMPUTERSHARE INVESTOR SERVICES, LLC

P.O. Box A3504

Chicago, IL 60690-3504

866-360-5339 toll-free

or 312-360-5339

CONTACT INVESTOR RELATIONS AT:

877- HDSTOCK toll-free

414-343-4782, or try our e-mail:

investor[email protected]

Corporate Governance materials may be obtained via

our website at www.harley-davidson.com

Communication with the Board

c/o the Secretary of Harley-Davidson, Inc.

3700 West Juneau Avenue

P.O. Box 653

Milwaukee, WI 53201-0653

© 2008 Harley-Davidson, Inc.

Design: VSA Partners, Inc., Chicago

Printing: Anderson Lithograph

Paper: Sappi Opus Matte Text

D`o\[JfliZ\j

Gif[lZk^iflg]ifdn\cc$dXeX^\[

]fi\jkj#Zfekifcc\[jfliZ\jXe[

i\ZpZc\[nff[fi]`Y\i

nnn%]jZ%fi^:\ikef%J:J$:F:$,**

(00-=fi\jkJk\nXi[j_`g:fleZ`c

('

CORPORATE SUMMARY

10-YEAR CAGR 13.1%

70.47

06

51.49

05

60.75

04

46.20

02

32.03

99

23.69

98

13.63

97

39.75

00

54.31

01

47.53

03

HARLEY-DAVI DSO N, I NC.

YEA R -END STOCK PRICES

In dollars, adjusted for splits

46.71

07

0

80

10

40

30

20

70

60

50

HARLEY-DAVI DSO N, I NC.

COMMON SH A R ES OU TSTANDING

Shares outstanding, in millions

258.1

06

274.0

05

294.3

04

350

0

150

100

50

300

250

200

238.5

07

301.5

03

%

48.048.647.848.248.146.443.944.647.248.2

Data includes U.S. and Canada.

U.S. Source: Motorcycle Industry Council (MIC). Canada Source: Moped & Motorcycle Industry of Canada.

The Company must rely on data compiled by independent agencies to obtain retail registrations data necessary for calculating market share. The retail

registrations data for Harley-Davidson motorcycles included in these tables may differ slightly from the Harley-Davidson retail sales data presented elsewhere

by the Company. The differences are not significant and generally relate to the timing of data submissions to the independent sources.

206.1

97

246.2

98

116.1

297.9

99

142.0

365.4

00

163.1

422.8

01

185.6

475.0

02

220.1

495.4

03

238.2

530.8

04

255.8

553.6

05

264.7

578.8

06

281.6

555.0

07

266.3

MARKET SHARE

NORTH AMERICA

651 + CC M O TOR C Y L E R E G I S T RATIONS H - D VS. INDUST R Y *

Units in thousands

0

650

250

300

200

100

50

150

450

400

350

600

550

500

*

99.3

48.0% HARLEY-DAVIDSON

14.3% HONDA

12.7% SUZUKI

9.2% YAMAHA

7.5% K AWA SAKI

8.3% OTHER

47.7

H-D MOTORCYCLES INDUSTRY

450

50

100

0

250

200

150

400

350

300

403.0

268.7

292.8

335.4

322.6

321.3

333.2

323.9

337.1

350.7

376.8

38.7

17.2

18.1

20.5

23.2

22.8

23.5

26.3

25.9

29.7

34.3

EUROPE

651 + CC M O TOR C Y L E R E G I S T RATIONS H - D VS. INDUST R Y *

Units in thousands

H-D MOTORCYCLES

%

9.69.18.57.78.17.17.15.95.96.1

Data includes Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

The Company derives its market registration data and market share calculations from information provided by Giral S.A.

The Company must rely on data compiled by independent agencies to obtain retail registrations data necessary for calculating market share. The retail

registrations data for Harley-Davidson motorcycles included in these tables may differ slightly from the Harley-Davidson retail sales data presented elsewhere

by the Company. The differences are not significant and generally relate to the timing of data submissions to the independent sources.

MARKET SHARE

INDUSTRY

*

97 98 99 00 01 02 03 04 05 06 07

16.5% SUZUKI

15.1% BMW

13.6% YAMAHA

12.3% HONDA

11.3% KAWASAKI

9.6% HARLEY-DAV IDSON

6.5% TR IUMPH

5.9% DUCATI

9.2% OTHER

6.9