Harley Davidson 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

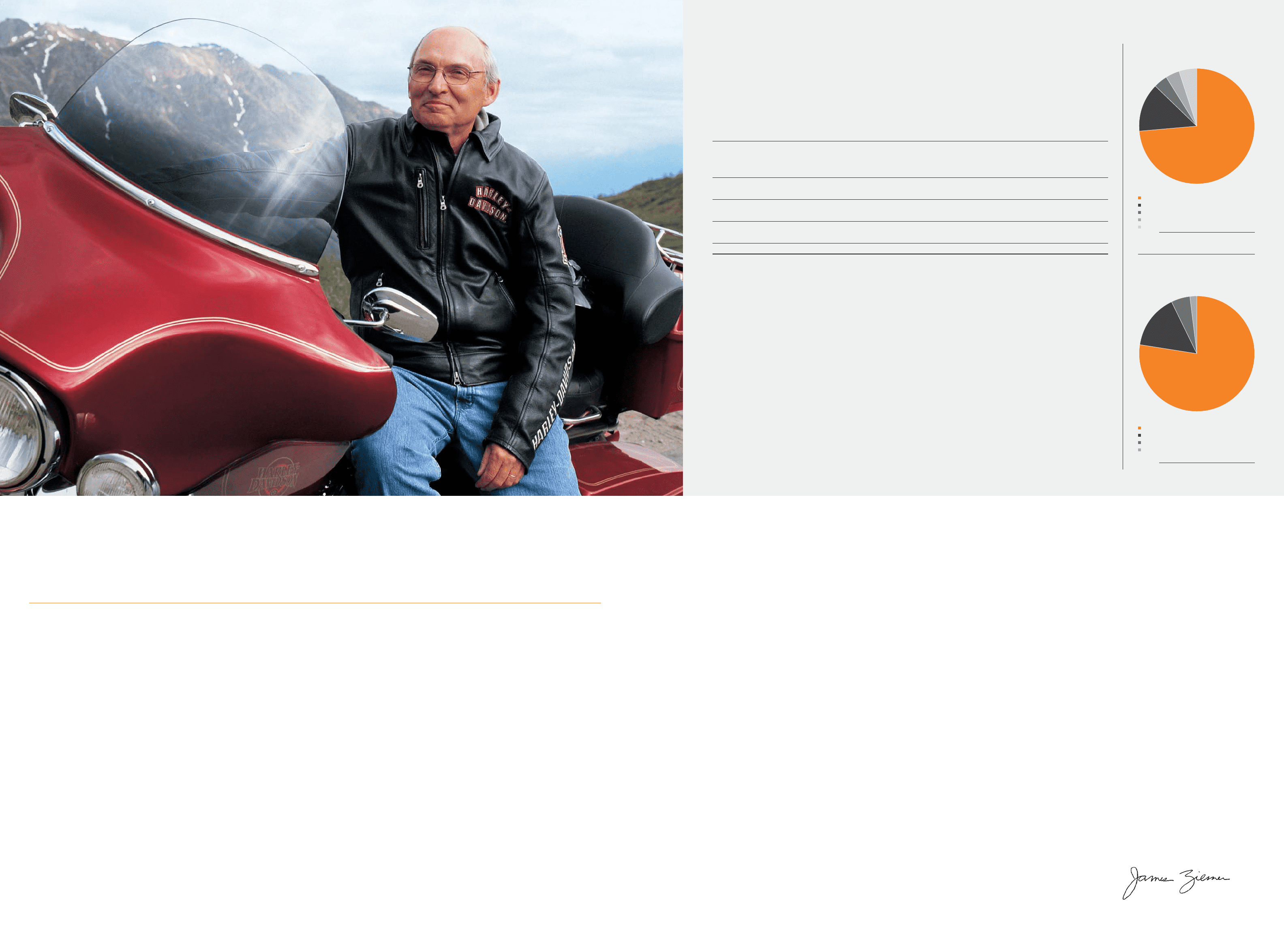

Harley-Davidson, Inc. President

and Chief Executive Officer, Jim Ziemer,

on a ride to Fairbanks, Alaska

for the 2007 Alaska State H.O.G. Rally.

Harley-Davidson had a challenging year

in

2007

as growing troubles in the

U.S.

economy increasingly impacted major dis-

cretionary purchases like motorcycles.

In that environment, Harley-Davidson

full-year revenue and earnings declined

year-over-year, as did the number of new

Harley-Davidson

®

motorcycles our

U.S.

dealers sold at retail. Even so, except for

2006

, it was the biggest year in our history

for revenue, earnings and worldwide retail

motorcycle sales. Revenue for the year was

$5.73

billion, compared to

$5.80

billion in

2006

and

$5.34

billion in

2005

. Dealers sold

337,774

new Harley-Davidson motorcycles

worldwide in

2007

, compared to

343,981

in

2006

and

317,169

in

2005

. Diluted earnings

per share were

$3.74

, compared to

$3.93

in

2006

and

$3.41

in

2005

.

A major factor affecting revenue and

earnings in

2007

was our decision to reduce

fourth-quarter motorcycle shipments, in

keeping with our commitment to ship fewer

Harley-Davidson motorcycles than we antic-

ipated dealers would sell at retail worldwide.

For the full year

2007

, we shipped

330,619

Harley-Davidson motorcycles, which was

5.3%

less than the prior year.

Our decision to reduce shipments under-

scores the priority we place on brand strength.

Our strong brand is the backbone of our

business and the value proposition of our

motorcycles. We will continue to be careful

guardians of the brand by managing the

relationship between supply and demand

and managing the business for the long term.

Turning to Harley-Davidson Financial

Services, we all know what a challenging

year

2007

was in the consumer credit

industry. However,

HDFS

is a premier finan-

cial services company with a reputation

for a disciplined and prudent approach to

lending, and for the full year,

HDFS

realized

a

0.7%

increase in operating income com-

pared to

2006

.

HDFS

also grew its market

share for loans for new Harley-Davidson

motorcycles in the

U.S.

to

55%

in

2007

,

up from

49%

in

2006

.

HDFS

continues

to serve a broad range of customers,

lending across all credit tiers and appro-

priately balancing for risk and reward.

And although

HDFS

was not immune to

some of the pressures in the credit

markets in

2007

, its results demonstrate its

understanding of how to effectively serve the

needs of dealers and their retail customers.

INTERNATIONAL STRENGTH A major bright

spot in

2007

was the continued success of

Harley-Davidson on the international stage,

where dealers’ retail sales grew

13.7%

compared to the prior year. Our international

strength is the result of a well-orchestrated,

strategic approach we embarked on a num-

ber of years ago to grow Harley-Davidson’s

international retail motorcycle sales faster

than

U.S.

sales. Our international strategy has

resulted in sound investments in marketing

and products that are attuned to local cus-

tomer preferences, improved distribution at

the wholesale level, dealer network strength,

and assuming ownership and management

of business operations in an increasing

number of key markets.

Perhaps more than anything, our inter-

national growth is a sign of the incredible

strength of the Harley-Davidson brand

abroad

—

and the ability of the brand to

transcend cultures and languages. As you’ll

see from the examples in this annual report,

Harley-Davidson consistently delivers

culturally-relevant experiences in the

72

international countries in which we sell our

motorcycles. Our international employees

—

the vast majority of whom are local market

nationals

—

and our dealers understand the

challenges and opportunities and how

to fine tune our approach to the cultural

expectations of each market.

Going forward, we believe international

markets will continue to be an area of

strength and we are continuing to refine our

business and marketing strategies for

Europe, Asia, Australia, Latin America and

Africa to leverage those opportunities.

THE ROAD AHEAD Looking ahead, we

anticipate that weakness in the

U.S.

econ-

omy will continue to make

2008

challenging

for Harley-Davidson and we have again

committed to ship fewer Harley-Davidson

motorcycles than we expect dealers to sell

worldwide. At this time, we believe this is

the right course for the brand, our business,

for dealers and for customers.

At the same time, we continue to devote

major resources to drive our business for-

ward, investing heavily in marketing, product

“ OUR STRONG BRAND IS THE BACKBONE OF OUR

BUSINESS AND THE VALUE PROPOSITION OF OUR

MOTORCYCLES. WE WILL CONTINUE TO BE CAREFUL

GUARDIANS OF THE BRAND…BY MANAGING THE

BUSINESS FOR THE LONG TERM.”

DEAR FELLOW SHAREHOLDERS:

2007

WAS A LOT LIKE THAT MOTORCYCLE TRIP YOU TAKE IN EARLY SUMMER IN THE MOUNTAINS

—

THE ONE WHERE THE FORECAST

IS FOR BLUE SKIES AND DRY ROADS AND, ALL OF A SUDDEN AT

9,500

FEET OF ELEVATION, YOU FIND YOURSELF IN THE MIDDLE OF A

SNOWSTORM. YOU KNOW THAT WITH CAUTION AND PERSEVERANCE YOU’LL REACH YOUR DESTINATION. BUT IN THE MEANTIME, IT’S

SURE TOUGH TO GET MUCH TRACTION AND IT MAKES FOR SOME UNCOMFORTABLE RIDING!

FINANCIAL HIGHLIGHTS

development and our people. We believe

there will be solid opportunities to grow when

the

U.S.

economy rebounds and we intend

to be well-positioned to take advantage of

those opportunities.

CUSTOMER FOCUS Customer relationships,

market-defining products and extraordinary

customer experiences are the not-so secrets

to our success. We intend to keep it that

way through a continued focus on these

strengths, connecting with core customers,

crossover prospects and non-riders like never

before, and staying ten steps ahead of our

competitors. From unmatched events like

our upcoming

105

th Anniversary Celebration

or an exclusive Nightster

®

motorcycle

launch party for young adults to our Dark

Custom™ family of motorcycles (check them

out at www.Harley-Davidson.com), we con-

tinue to make our brand more relevant to

more people.

LEADERSHIP FOCUS Harley-Davidson has

achieved its success over the years through

the talent and dedication of our employees,

growing the Company from less than

$2

billion

in revenue a decade ago to nearly

$6

billion

in

2007

. Today, more than ever, having cap-

able leaders is crucial to our success.

We are currently in the process of

transforming our internal culture to maximize

the talent and contributions of our existing

workforce, making leadership development

a key priority. And we’re bringing in new

people for the fresh perspectives and

capabilities they can provide.

I want to make sure that our people

—

and

especially our leaders at all levels of the

organization

—

are well-prepared to meet the

challenges we face and to make the most of

Harley-Davidson’s many business opportu-

nities. My goal is to make sure that we are

world class when it comes to leadership,

just as we’re world class when it comes to

our motorcycles.

ORGANIZATIONAL STRUCTURE To make

Harley-Davidson more agile and adept

going forward, we made major changes

in our organizational structure in

2007

.

Our new, more streamlined structure pro-

motes faster decision making, greater

responsiveness to rapid change, and clearer

accountability and responsibility for results.

Karl Eberle now serves in the newly-

created position of Senior Vice President,

Manufacturing, responsible for company-

wide manufacturing strategy and operations.

Ron Hutchinson is now in the newly-created

position of Senior Vice President, Product

Development, responsible for engineering,

materials management and Parts & Acces-

sories. They bring

47

combined years of

experience at Harley-Davidson to these

key operational areas. And mid-year,

Mark-Hans Richer joined the organization in

the newly-established role of Senior Vice

President and Chief Marketing Officer, with

overall responsibility for the brand and motor-

cycle product planning, and for

U.S.

marketing

and customer relationships.

2008–AN EXCITING YEAR I’m expecting a

challenging year in

2008

but it’s also going

to be an incredible year.

Anticipation is building for the opening of

the Harley-Davidson Museum this summer.

The Museum is much more than our collection

of memorabilia and bikes. It will be an

exciting destination for connecting, sharing a

road story or a meal, celebrating and fueling

Harley-Davidson dreams!

This summer,

H.O.G.®

celebrates its

25

th

anniversary. So does Buell Motorcycle Com-

pany. Our police motorcycles business marks

its

100

th anniversary. Buell is also pumping

out lots of excitement and reaching new

customers with the launch of its all-new,

liquid-cooled

1125R

motorcycle, delivering

a true balance of street and track perfor-

mance in the superbike category.

What else is going on? Way more than I

can cover in this letter! We’ve doubled the

size of our demo motorcycle fleet, bringing

the Harley-Davidson experience to more

riders than ever. Our event teams will be

putting on more and better consumer events

around the globe. And in July, we’ll have

a major injection of adrenaline with the

introduction of the

2009

motorcycles.

A few weeks later we celebrate our

great future, not to mention

105

years of

riding proud, with the biggest anniversary

ride in company history and four days of

celebration in Milwaukee. With the enter-

tainment and activities we’ve got in store,

our

105

th Anniversary Celebration will

deepen the passion of current customers

and ignite the dreams of new ones like only

Harley-Davidson can.

I can’t think of another consumer products

company that can lay claim to that level of

customer activity and excitement in one year.

So even though the economy has hit a

rough patch, I am very enthusiastic about our

future. With the most passionate employees,

customers and dealers anywhere, our

powerful brand and our great motorcycles, I

believe there is outstanding opportunity for

Harley-Davidson throughout the world for

years to come.

JAMES ZIEMER%

President and Chief Executive Officer,

Harley-Davidson, Inc.

“ OUR INTERNATIONAL STRENGTH IS THE RESULT OF A

WELL-ORCHESTRATED, STRATEGIC APPROACH

WE EMBARKED ON A NUMBER OF YEARS AGO TO

GROW HARLEY-DAVIDSON’S INTERNATIONAL RETAIL

MOTORCYCLE SALES FASTER THAN U.S. SALES.”

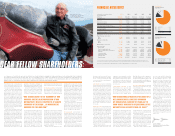

77.6 % HARLEY-DAVIDSON MOTORCYCLES $4,446.6

15.2 % PARTS & ACCESSORIES 868.3

5.3 % GENERAL MERCHANDISE 305.4

1.8 % BUELL M OTORCYC LES 100.5

OTHER 6.0

TOTAL NET R EVENUE $5,726.8

. .

. . . . . . . . . . . . . . .

. . . . . . . . . . . . .

. . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

WORLDWIDE

NET REVENUE BY PRODUCT LINE

Dollars in millions

WORLDWIDE

NET REVENUE BY REGION

Dollars in millions

73.5 % UNITED STATES $4,208.0

13.8 % EUROPE 790.2

4.0 % JAPAN 229.8

4.0 % CANADA 230.2

4.7 % REST OF WORLD 268.6

TOTAL NET REVENUE $5,726.8

. . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . .

In thousands, except per-share amounts 2007

(1)(2) 2006

(1)(2) 2005

(1) 2004 2003

Income statement data:

Net Revenue $ 5,726,848 $ 5,800,686 $ 5,342,214 $ 5,015,190 $ 4,624,274

Cost of goods sold 3,612,748 3,567,839 3 ,301,715 3 ,115,6 5 5 2,958,708

Gross Profit 2,114 ,100 2,232,847 2,040,499 1,899,535 1,66 5,566

Financial services income 416 ,196 384,891 331,618 305,262 279,459

Financial services expense 204,027 174 ,16 7 139,998 116,662 111,586

Operating income from financial services 212 ,169 210,724 191,620 188,600 16 7, 87 3

Selling, administrative and engineering expense 900,708 846, 418 767,157 731,750 690,492

Income from operations 1,425,561 1,5 97,15 3 1,464,962 1,356,385 1,142,947

Investment income, net 22,258 27, 087 22,797 23,101 23,088

Income before provision for income taxes 1,447,819 1, 62 4 , 240 1,487,759 1,379,486 1,166,035

Provision for income taxes 513,976 581,087 528,155 489,720 405,107

Net income $ 933,843 $ 1,043,153 $ 959,604 $ 889,766 $ 760,928

Weighted-average common shares:

Basic 249,205 264,453 280,303 295,008 302,271

Diluted 249,882 265,273 281,035 296,852 304,470

Earnings per common share:

Basic $ 3.75 $ 3.94 $ 3.42 $ 3.02 $ 2.52

Diluted $ 3.74 $ 3.93 $ 3.41 $ 3.00 $ 2.50

Dividends paid per common share $ 1.060 $ 0.810 $ 0.625 $ 0.405 $ 0.195

Balance sheet data:

Working capital $ 1,562,235 $ 1,954,956 $ 2,272,125 $ 2,510,490 $ 2,087,056

Finance receivables held for sale 781,280 5 47,106 299,373 456,516 3 4 7, 112

Finance receivables held for investment, net 2,420,327 2,280,217 1,943,224 1,655,784 1,390,737

Total assets 5,656,606 5,532,150 5,255,209 5,483,293 4,923,088

Current finance debt 1,119 ,955 832,491 204,973 495,441 324,305

Long-term finance debt 980,000 870,000 1,000,000 800,000 670,000

Total finance debt 2,099,955 1,702,491 1,204,973 1,295,441 994,305

Shareholder equity $ 2,375,491 $ 2,756,737 $ 3,083,605 $ 3,218,471 $ 2 ,957,692

(1) 2007, 2006 and 2005 results include the adoption of Statement of Financial Accounting Standards (SFAS) No. 12 3 ( R) , “Share-Based Payment” effective January 1, 2005.

(2) 2007 and 2006 results include the adoption of SFAS No. 158 , “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans” as of December 31, 2006.

As of Feb. 18 , 2008, there were 90,748 shareholders of record of Harley-Davidson, Inc. common stock.