Hamilton Beach 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

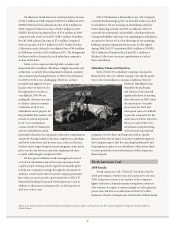

particularly good performance at the Red River Mining

Company compared with 2007 and the extension of The

Sabine Mining Company contract through 2035.

Nevertheless, 2008 was still challenging for NACoal as net

income was negatively affected by Mississippi Lignite Mining

Company’s customer’s planned extended power plant outage,

which reduced lignite coal tons delivered and also resulted in

increased costs of sales due to the capitalization of fixed costs

over lower production levels. NACoal’s limerock mining

operations in southern Florida also experienced significant

declines in deliveries as customer requirements were reduced

by the downturn in the housing and construction markets in

that region. Contractual price escalation at most of the mines

partially offset these declines.

Market Outlook for 2009

NACoal expects improved

performance at its lignite coal

mining operations in 2009

provided that customers

achieve currently planned

power plant operating levels.

Tons delivered at the lignite

coal mines are expected to

increase in 2009 compared

with 2008, especially at the

Mississippi Lignite Mining

Company as a result of

fewer planned outages and

improved operating efficiencies at the customer’s power plant.

In addition, recently reduced costs for certain commodities,

such as diesel fuel, are helping the company manage mine

operating costs.

Limerock customer 2009 deliveries will be down

significantly due to an unfavorable U.S. District Court

ruling for the Florida lake belt region that terminated our

customers’, and others’, existing mining permits at most

of the limerock dragline mining operations. As a result,

deliveries from the limerock dragline mining operations

are expected to be significantly lower in 2009. Customers

will be reducing stockpiled inventory levels until their

limerock mining operations return to production under

new permits that are expected to be issued toward the end

of 2009. However, demand for limerock remains severely

depressed due to the significant decline in the southern

Florida housing and construction markets.

Actions Being Taken to Move Forward in 2009

NACoal prides itself on its intense focus on safety,

efficiency and its continuous cost reduction programs.

Because these programs have been in place for many years,

operations are projected to be relatively stable at all of

NACoal’s lignite coal mines in 2009 given that no significant

power plant outages are planned at any of its customers.

However, contractual price escalation at all mines is not

expected to affect results as favorably in 2009 as it did in 2008

because of recent declines in commodity costs. High levels of

productivity are expected to continue at all of the mining

locations. At the Mississippi Lignite Mining Company, the

company expects to increase mine tonnage as a result of

improved operating efficiency at the customer’s power plant.

In early 2009, in light of

the U.S. District Court ruling

shutting down Florida lake belt

mining operations, NACoal’s

limerock dragline mining

operations took significant

action to reduce costs, including

layoffs for many employees.

These measures will remain in

place at all of the Florida lake

belt facilities during 2009

until limerock production is

resumed, which is expected to

be in late 2009. The company

also mitigated its financial

exposure to these limerock operations by transitioning

to new cost reimbursable management fee contracts with

almost all of its customers. Only one Florida limerock

operation, which is not in the lake belt area, will be in

production for all of 2009.

NACoal has a number of potential new projects and

opportunities under consideration or in progress, and expects

to incur additional expenses related to these opportunities in

2009. Permitting is taking place in the Otter Creek Reserve in

North Dakota in expectation of construction of a new mine.

Construction is continuing on coal dryers and a coal load-out

facility adjacent to the Falkirk Mine, which, when complete,

will improve market potential by extending practical

transportation distances for shipping lignite coal. In addition,

NACoal is working on a project with Mississippi Power to

provide lignite coal to a new plant in Mississippi and is

optimistic about concluding other new agreements in 2009.

Above: Yale’s next generation of electric rider lift trucks, the Yale® ERC-VG three- and four-wheel cushion tire models, have lifting capacities of up to 4,000 pounds.

These trucks have been designed to increase overall productivity at higher levels of efficiency.