Hamilton Beach 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction

Key profitability and growth programs in place at NACCO

Materials Handling Group (“NMHG”), Hamilton Beach Brands

(“HBB”), Kitchen Collection (“KC”) and North American Coal

(“NACoal”) delivered substantial benefits in 2007. However,

this progress was hindered by external forces, including a

slowing U.S. economy, the continued

challenges of higher material costs,

unfavorable shifts in currency

exchange rates and weakening retail

housewares markets. As a result, 2007

income before extraordinary gain,

excluding restructuring charges,

remained comparable to 2006.

Specific action plans have been

put in place to address many of the

external challenges experienced in

2007, including restructuring

programs at NMHG, so each subsidiary is in a position to

adapt quickly to changing conditions while continuing to work

toward ambitious financial goals.

We continue to believe each subsidiary’s core profitability

and growth programs, combined with longer-term market and

economic factors, will, over time, deliver improved financial

performance, particularly in 2009 and beyond.

At each subsidiary, strategies and key programs have been

established to address specific industry dynamics and trends,

with the objective of competing effectively, achieving established

financial targets and generating substantial cash flow before

financing activities. Programs to enhance profitability are

designed to achieve performance in line with minimum

financial targets, and programs to generate growth are intended

to drive long-term profit growth.

The stakes involved in executing the Company’s

profit enhancement and growth

programs remain high, particularly

at NMHG, where substantial

improvement in operating profit

margin is still required to meet

financial targets. Assuming NACCO’s

subsidiary companies had achieved at

least their minimum financial targets

in 2007, the Company would have

generated additional net income of

$126.7 million, or $15.32 in additional

diluted earnings per share, approxi-

mately 88 percent of which represents improvement at

NMHG. (See reconciliation of these non-GAAP amounts on

page 42.) In order to realize this significant potential, NMHG

continues to place an intense focus on profit improvement

programs and is expected to continue this focus in the coming

months and years.

HBB and KC were advancing toward their financial targets

until retail market conditions turned downward. The current

state of the U.S. consumer markets suggests a period of cautious

growth in the years ahead, with the possibility of a decline in

A letter from

Alfred M. Rankin, Jr.

Chairman,

President and Chief

Executive Officer of

NACCO Industries, Inc.

[4]

To Our Stockholders

Managing for long-term profit growth

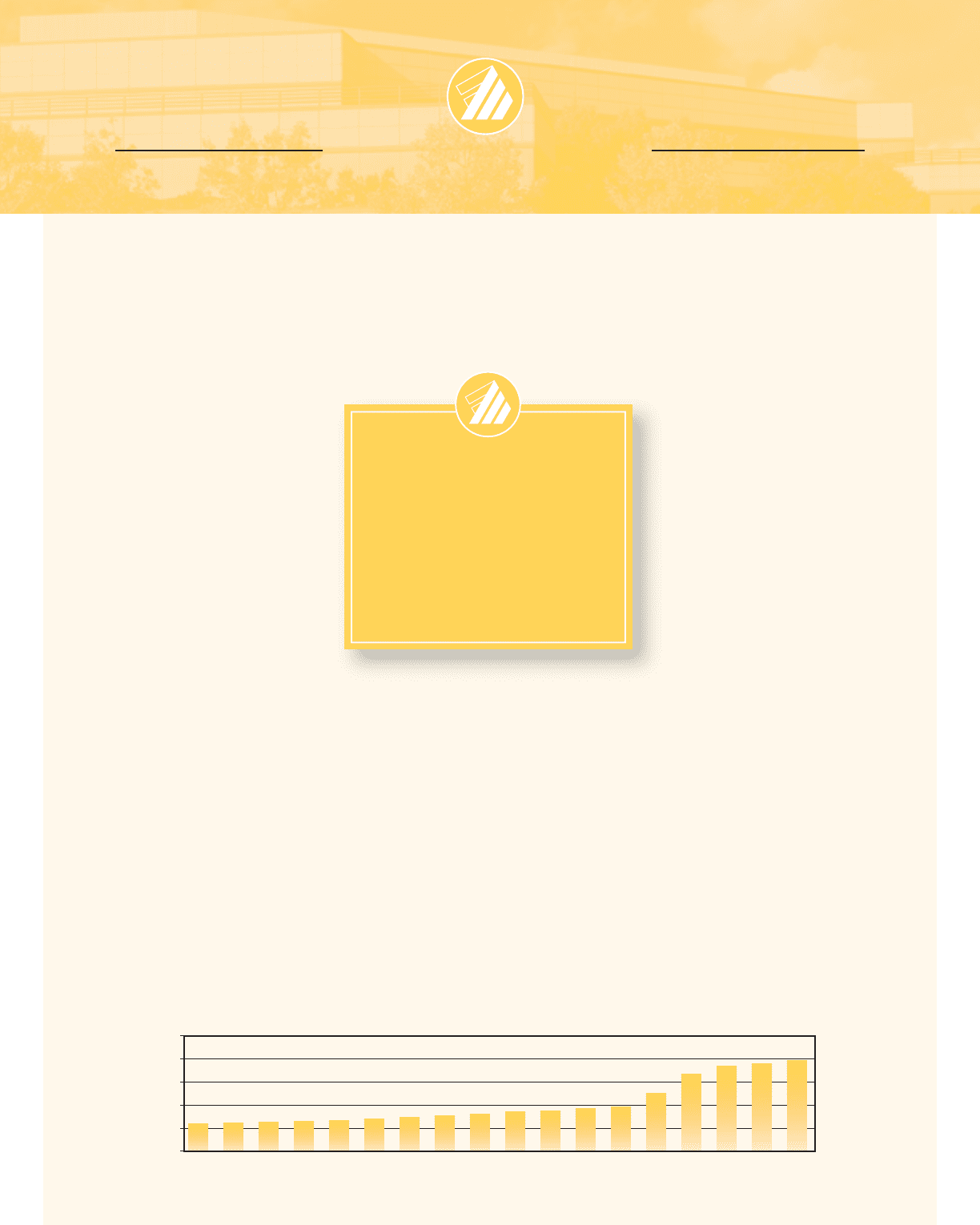

Dividends Paid Per Share

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07

$0. 0

$0. 5

$1. 0

$1. 5

$2. 0

$2. 5

$.595 $.615 $.635 $.655 $.675 $.710 $.743 $.773

$.810 $.850 $.890 $.930 $.970

$1.260

$1.675

$1.848 $1.905 $1.980