Hamilton Beach 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[35]

2007 Results

North American Coal (“NACoal”) had a very good year

in 2007, despite slightly lower lignite coal and limerock

deliveries than in 2006. NACoal’s six lignite coal mining

operations delivered 33.7 million tons of lignite coal in 2007

compared with 35.4 million tons in 2006, maintaining

NACoal’s position as the nation’s largest lignite coal producer

and one of the top ten coal producers nationwide. The

company’s lignite coal reserve position remains strong with

a total of 2.3 billion tons, of which 1.2 billion tons are

committed to current customers.

NACoal’s limerock dragline

mining operations delivered 37.6

million cubic yards during 2007

compared with 39.2 million cubic

yards in 2006.

NACoal’s 2007 net income

was $31.0 million compared with

$39.7 million in 2006. However, a

significant portion of 2006 net

income resulted from a gain of

$21.5 million, or $13.1 million net

of taxes of $8.4 million, from the sale

of two electric draglines. Excluding the dragline sales, 2007

net income improved compared with 2006, mainly from

improved results from operations and the receipt of an

arbitration award of $3.7 million pre-tax to recover costs

related to a power plant and mine development project in

Turkey, which was undertaken and cancelled several years ago.

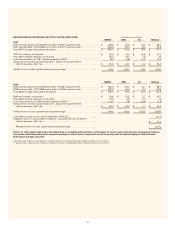

As a result of this performance, NACoal produced a

strong return on equity (1) of 46.8 percent and a return on

total capital employed (“ROTCE”) of 19.9 percent in 2007

compared with 25.6 percent in 2006, or 18.1 percent without

the impact of the dragline sales. (See reconciliations of

non-GAAP ROTCE on page 43.)

NACoal generated cash flow before financing activities

of $26.7 million in 2007 compared with $42.9 million in

2006, or $12.9 million in 2006, excluding proceeds of

approximately $30 million from the sale of two draglines.

Vision and Goals

NACoal’s vision is to be the

leading low-cost miner of lignite coal

used in power generation, coal

gasification and coal-to-liquids plants

and to provide selected value-added

mining services for companies in the

aggregates business. NACoal’s goals

are to earn a minimum ROTCE of 13

percent and deliver positive Economic

Value Income (“EVI”) from all existing

consolidated mining operations and

any new projects; maintain or increase the profitability of all

existing unconsolidated project mining operations; generate

substantial consolidated cash flow before financing activities

from existing operations; and achieve substantial income

growth by developing new mining ventures. NACoal is

making good progress toward achieving all of its goals.

North American Coal

mined over 30 million

tons of lignite coal in 2007,

once again making it

the largest lignite coal

producer in the nation.

*Includes gain on sale of $21.5 million, or $13.1 million after

taxes of $8.4 million, from the sale of two electric draglines.

(1) Return on equity = 2007 net income divided by 2007 average equity (a five-point average of equity at December 31, 2006 and each of 2007’s quarter ends).

Left: Daybreak across the mining pit at the Sabine Mining Company in Texas.

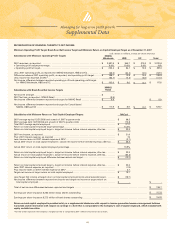

Net Income

(In millions)

03

04

05

06

07

$0 $10 $20 $30 $40

$14.3

$18.6

$16.2

$39.7*

Lignite Coal Tons & Limerock

Cubic Yards Delivered

(In millions)

03

04

05

06

07

0 10 20 30 40

37.6

33.7

25.2

34.7

18.9

34.4

39.2

35.4

11. 0

35.5

■ Lignite Coal Tons ■ Limerock Cubic Yards

Revenues

(In millions)

03

04

05

06

07

$0 $20 $40 $60 $80 $100 $120 $140 $160

$149.0

$118.4

$110.8

$94.1

$31.0

$137.1