Google 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents Alphabet Inc. and Google Inc.

71

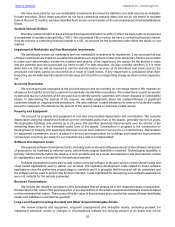

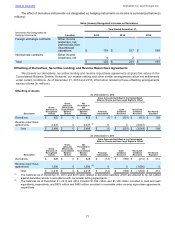

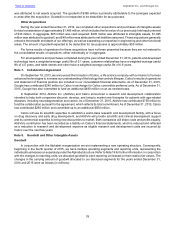

The effect of derivative instruments not designated as hedging instruments on income is summarized below (in

millions):

Gains (Losses) Recognized in Income on Derivatives

Year Ended December 31,

Derivatives Not Designated As

Hedging Instruments Location 2013 2014 2015

Foreign exchange contracts Other income

(expense), net,

and net loss from

discontinued

operations $ 118 $ 237 $ 198

Interest rate contracts Other income

(expense), net 42 1

Total $ 122 $ 239 $ 199

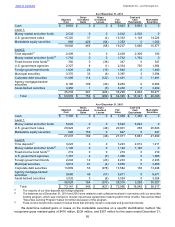

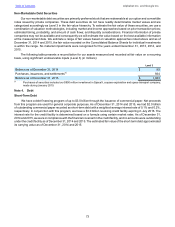

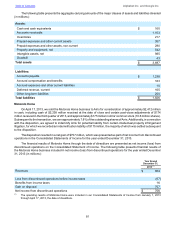

Offsetting of Derivatives, Securities Lending, and Reverse Repurchase Agreements

We present our derivatives, securities lending and reverse repurchase agreements at gross fair values in the

Consolidated Balance Sheets. However, our master netting and other similar arrangements allow net settlements

under certain conditions. As of December 31, 2014 and 2015, information related to these offsetting arrangements

was as follows (in millions):

Offsetting of Assets

As of December 31, 2014

Gross Amounts Not Offset in the Consolidated

Balance Sheets, but Have Legal Rights to Offset

Description

Gross

Amounts of

Recognized

Assets

Gross

Amounts

Offset in the

Consolidated

Balance

Sheets

Net

Presented in

the

Consolidated

Balance

Sheets Financial

Instruments

Cash

Collateral

Received

Non-Cash

Collateral

Received Net Assets

Exposed

Derivatives $ 852 $ 0 $ 852 $ (1) (1) $ (251) $ (412) $ 188

Reverse repurchase

agreements 2,637 0 2,637 (2) 0 0 (2,637) 0

Total $ 3,489 $ 0 $ 3,489 $ (1) $ (251) $ (3,049) $ 188

As of December 31, 2015

Gross Amounts Not Offset in the Consolidated

Balance Sheets, but Have Legal Rights to Offset

Description

Gross

Amounts of

Recognized

Assets

Gross

Amounts

Offset in the

Consolidated

Balance

Sheets

Net

Presented in

the

Consolidated

Balance

Sheets Financial

Instruments

Cash

Collateral

Received

Non-Cash

Collateral

Received Net Assets

Exposed

Derivatives $ 628 $ 0 $ 628 $ (13) (1) $ (189) $ (214) $ 212

Reverse repurchase

agreements 1,590 0 1,590 (2) 0 0 (1,590) 0

Total $ 2,218 $ 0 $ 2,218 $ (13) $ (189) $ (1,804) $ 212

(1) The balances as of December 31, 2014 and 2015 were related to derivative liabilities which are allowed to be net settled

against derivative assets in accordance with our master netting agreements.

(2) The balances as of December 31, 2014 and 2015 included $1,762 million and $1,140 million recorded in cash and cash

equivalents, respectively, and $875 million and $450 million recorded in receivable under reverse repurchase agreements,

respectively.