Google 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents Alphabet Inc. and Google Inc.

60

evidence of fair value (VSOE), (ii) third-party evidence of selling price, and (iii) best estimate of the selling price (ESP).

VSOE generally exists only when we sell the deliverable separately and is the price actually charged by us for that

deliverable. ESPs reflect our best estimates of what the selling price of the deliverable would be if it was sold regularly

on a stand-alone basis.

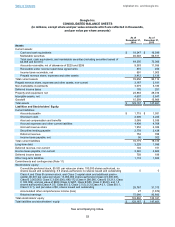

We record deferred revenues when cash payments are received in advance of our performance in the underlying

agreement on the accompanying Consolidated Balance Sheets.

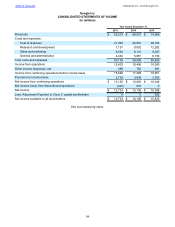

Cost of Revenues

Cost of revenues consists of traffic acquisition costs which are the advertising revenues shared with our Google

Network Members and the amounts paid to our distribution partners who distribute our browser or otherwise direct

search queries to our website.

Additionally, other costs of revenues includes the following:

• The expenses associated with the operation of our data centers (including depreciation, labor, energy, and

bandwidth costs);

• Content acquisition costs primarily related to payments to certain content providers from whom we license

their video and other content for distribution on YouTube and Google Play (we share most of the fees these

sales generate with content providers or pay a fixed fee to these content providers);

• Credit card and other transaction fees related to processing customer transactions;

• Stock-based compensation expense;

• Revenue share payments to mobile carriers;

• Inventory costs for hardware we sell; and

• Amortization of certain intangible assets.

Stock-based Compensation

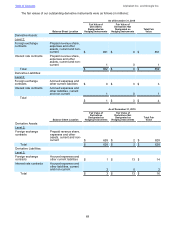

Restricted stock units (RSUs) are measured based on the fair market value of the underlying stock on the date

of grant. Shares are issued on the vesting dates net of the minimum statutory tax withholding to be paid by us on

behalf of our employees. As a result, the actual number of shares issued will be fewer than the actual number of RSUs

outstanding. We record the liability for withholding amounts to be paid by us primarily as a reduction to additional paid-

in capital when paid.

For stock option awards, we determined fair value using the Black-Scholes-Merton (BSM) option pricing model

on the date of grant.

Stock-based compensation includes awards we expect to settle in Alphabet stock as well as awards we will

ultimately settle in cash. We recognize stock-based compensation, less an estimate for forfeitures, using the straight-

line method over the requisite service period. Additionally, stock-based compensation for liability classified awards

reflect changes in fair value during the requisite service period.

We include as part of cash flows from financing activities the benefits of tax deductions in excess of the tax-

effected compensation of the related stock-based awards for options exercised and RSUs vested during the period.

During the years ended December 31, 2013, 2014, and 2015, the amount of cash received from the exercise of stock

options was $1,174 million, $465 million, and $393 million, respectively.

We have elected to account for the indirect effects of stock-based awards -- primarily the research and

development tax credit -- through the Consolidated Statements of Income. Total direct tax benefit realized, including

the excess tax benefit, from stock-based award activities during the years ended December 31, 2013, 2014, and 2015,

was $1,195 million, $1,356 million, and $1,544 million, respectively.

Certain Risks and Concentrations

Our revenues are primarily derived from online advertising, the market for which is highly competitive and rapidly

changing. In addition, our revenues are generated from a multitude of vertical market segments in countries around

the world. Significant changes in this industry or changes in customer buying or advertiser spending behavior could

adversely affect our operating results.

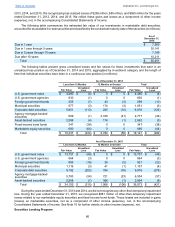

We are subject to concentrations of credit risk principally from cash and cash equivalents, marketable securities,

foreign exchange contracts, and accounts receivable. Cash equivalents and marketable securities consist primarily

of time deposits, money market and other funds, including cash collateral received related to our securities lending

program, highly liquid debt instruments of the U.S. government and its agencies, debt instruments issued by foreign

governments and municipalities in the U.S., corporate securities, agency mortgage-backed securities, and asset-

backed securities. Foreign exchange contracts are transacted with various financial institutions with high credit standing.