Freeport-McMoRan 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

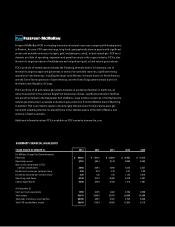

OIL & GAS

UNITED STATES

Oil 350 MMBbls

Natural Gas 562 Bcf

Natural Gas Liquids 20 MMBbls

MMBOE 464

Oil 26.6 MMBbls

Natural Gas 54.2 Bcf

Natural Gas Liquids 2.4 MMBbls

MMBOE 38.1

TO OUR SHAREHOLDERS

We are pleased to present our 2013 Annual Report to showcase our assets, report our financial

and operating results and share our company’s enthusiasm for future profitable growth. The

theme of this year’s annual report, “Strength in Resources,” highlights our portfolio of large-scale,

geographically diverse natural resource assets in the mining and oil and gas sectors, which provide

strong margins and cash flows and financially attractive growth opportunities.

Following the completion of our oil and gas acquisitions during 2013, our organization

maintained a clear focus on executing a strategy firmly rooted in maximizing shareholder returns

through effective management of our existing production base, executing on our return-driven

growth plans, maintaining a strong balance sheet and providing cash returns to shareholders.

We reported strong operational performance globally and increased our copper production in each of

the four geographic regions of our mining business. We also benefited from a significant contribution

from oil and gas assets acquired during 2013, which provide a high-quality addition to our asset base

with strong margins and cash flows, and a highly attractive and exciting new growth profile.

We faced volatile commodity market conditions during 2013 and into 2014. While copper and gold

prices declined during the year, Brent crude oil prices remained firm and natural gas prices improved

during 2013. We took steps to reduce costs and capital spending in response to market conditions

and will continue to maintain financial flexibility in a dynamic global economic environment.

As a significant producer of copper and oil, we are positive about the long-term outlook for these

commodities given their important roles in the global economy and limited supplies.

During the year, we advanced several large projects in our minerals and oil and gas businesses

that pave the way for future growth. Important milestones achieved during 2013, and continuing

in 2014, provide confidence that these initiatives will enable us to grow our cash flows and

resource base. We also continued active exploration activities and are enthusiastic about future

reserve additions in our minerals and oil and gas businesses. We look forward to reporting on the

progress of these activities in 2014.

LETTER TO OUR SHAREHOLDERS

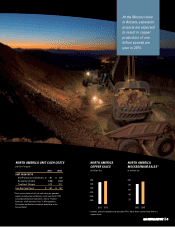

GRASBERG, INDONESIA

TENKE FUNGURUME, DEMOCRATIC REPUBLIC OF CONGO

3