Fluor 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Fluor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FLUOR CORPORATION 2001 ANNUAL REPORT

ALAN L. BOECKMANN

DEAR FELLOW SHAREHOLDERS

OUTSTANDING PROGRESS HAS BEEN MADE OVER THE PAST TWO YEARS IN STRENGTHENING

FLUOR’S BUSINESS OPERATIONS AND ESTABLISHING A SOLID FOUNDATION FOR EARN-

INGS GROWTH AND CREATION OF SHAREHOLDER VALUE. DURING 2001, WE INITIATED

THE STRATEGIC ACTIONS TO COMPLETE OUR EXIT FROM NON-CORE BUSINESSES AND

REFOCUS THE COMPANY ON STRENGTHENING NEW BUSINESS OPPORTUNITIES WITHIN

OUR CORE COMPETENCIES OF ENGINEERING, PROCUREMENT, CONSTRUCTION AND

MAINTENANCE, OR EPCM AS WE CALL IT.

Importantly, the market for engineering and construction services is in the early stages of

a long-term upcycle. We firmly believe that our capabilities and experience position us

better than any other competitor to capitalize on this major investment cycle that is just

now getting underway.

In December, I was extremely honored to be appointed by the Board to the position

of Chairman and Chief Executive Officer, effective February 6, 2002, succeeding Philip J.

Carroll, Jr., who is retiring. We are grateful to Phil for his significant contributions in

repositioning the company for improved future performance.

Importantly, the transition to the next generation of leadership throughout the com-

pany has been accomplished, our financial strength is excellent and our strategic focus

is clear. I am looking forward with great enthusiasm to leading our highly capable man-

agement team and talented global work force in achieving the kind of performance that

will make Fluor the undeniable leader in the global building and services marketplace

as well as a superior investment for shareholders.

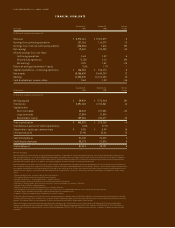

FINANCIAL PERFORMANCE

Fluor’s financial performance in 2001 provides solid evidence that we are beginning

to achieve our goal to deliver sustainable long-term earnings growth. Earnings from con-

tinuing operations, excluding unusual items, increased 23 percent to $143.0 million, or $1.81

per share, compared with earnings from continuing operations of $116.3 million, or $1.52

per share in fiscal 2000. New awards and backlog, which are leading indicators of future

performance, also posted encouraging

growth. New awards increased 12 percent to

$10.8 billion for the year, while backlog grew

15 percent to $11.5 billion. Importantly, back-

log gross margin increased to $764 million

or 6.6 percent, a 24 percent increase

in backlog gross margin compared with a

year ago.

Despite these accomplishments and the

positive investor reaction to the strategic

actions taken, Fluor’s stock price experi-

enced significant volatility during the year.

Highly optimistic investor sentiment early

in 2001, fueled in large part by expectations

for an extremely robust power market, was

replaced with increasing pessimism in the

latter half of the year. This was primarily due

to growing concerns over slowing economic

conditions that were exacerbated by the

tragic events of September 11. Investor fears

were then further heightened by the financial

collapse of Enron, a major power producer,

and its negative implications on the outlook

for the power market, which was an area of

strength for Fluor and others in our industry

during the year.

PAGE 2