First Data 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

First Data Corporation (“FDC” or “the Company”) is a provider of electronic commerce and payment solutions for merchants, financial institutions

and card issuers globally and has operations in 35 countries, serving approximately 6.1 million merchant locations. FDC was incorporated in Delaware in

1989 and was the subject of an initial public offering in connection with a spin-off from American Express in 1992. On September 24, 2007, the Company

was acquired through a merger transaction (the “merger”) with an entity controlled by affiliates of Kohlberg Kravis Roberts & Co. (“KKR”). The merger

resulted in the equity of FDC becoming privately held.

The Company has acquired multiple domestic and international businesses over the last five years with the most significant acquisition being the

formation of the Banc of America Merchant Services, LLC (“BAMS”) alliance on June 26, 2009. The Company owns 51% of BAMS and Bank of America

N.A. owns 49%.

The Company has domestic and international operations and regional or country offices where sales, customer service and/or

administrative personnel are based. The international operations generate revenues from customers located and operating outside of the U.S. Revenues generated

from processing transactions at locations within the U.S. (domestic) and outside of the U.S. (international), regardless of the segments to which the associated

revenues applied, were 85% and 15% of FDC’s consolidated revenues for the year ended December 31, 2013, respectively. Long-lived assets attributable to

domestic and international operations as percentages of FDC’s total long-lived assets as of December 31, 2013 were 87% and 13%, respectively. No individual

foreign country is material to the Company’s total revenues or long-lived assets. Further financial information relating to the Company’s international and

domestic revenues and long-lived assets is set forth in Note 15 to the Company’s Consolidated Financial Statements in Item 8 of this Form 10-K.

The Company is organized in three segments: Retail and Alliance Services, Financial Services and International.

Financial information relating to each of the Company’s segments is set forth in Note 15 to the Company’s Consolidated Financial Statements in Item 8

of this Form 10-K. The Retail and Alliance Services segment is reported on a proportionate consolidation basis. Proportionate consolidation reflects the

Company’s proportionate share of the results of non-wholly owned alliances based on equity ownership, net of a proportionate share of eliminations for

amounts charged between the Company and the alliances. The segments’ profit measure is a form of EBITDA (earnings before net interest expense, income

taxes, depreciation and amortization). A discussion of factors potentially affecting the Company’s operations is set forth in Item 7 “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” of this Form 10-K. The Company does not have any significant customers that account for

10% or more of total consolidated revenues. Refer to the following segment discussions, which address significant customer relationships within each segment.

The Retail and Alliance Services segment is comprised of merchant acquiring and processing services, prepaid

services and check verification, settlement and guarantee services.

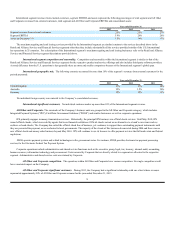

Retail and Alliance Services segment revenues from external customers, segment EBITDA and assets represent the following percentages of total segment

and All Other and Corporate revenues from external customers, total segment and All Other and Corporate EBITDA, and consolidated assets:

Segment revenues from external customers 53%53%51%

Segment EBITDA 67%65%63%

Assets (at December 31) 68%68%69%

Description of Retail and Alliance Services segment operations. In the Retail and Alliance Services segment, revenues are derived

primarily from providing merchant acquiring and processing services, prepaid services and check verification, settlement and guarantee services. Retail and

Alliance Services businesses facilitate the acceptance of consumer transactions at the point of sale (“POS”), whether it is a transaction at a physical merchant

location or over the internet. A brief explanation of the segment’s service and product offerings is presented below.

Merchant acquiring and processing services. Merchant acquiring services facilitate the merchants’ ability to accept credit, debit, stored-

value and loyalty cards by authorizing, capturing and settling the merchants’ transactions. Acquiring services also

2