Exxon 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Exxon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

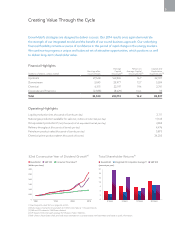

Results & Highlights

• Strong environmental results and best-ever safety performance supported by effective risk management

• Earnings of $32.5 billion and industry-leading return on average capital employed

(1)

of 16.2 percent

• Capital and exploration expenditures

(1)

of $38.5 billion

• Free cash flow

(1)

of $17.9 billion, up $7. 3 billion compared to 2013

• Dividends per share increased 9.5 percent in the second quarter of 2014, the 32nd consecutive year

of dividend-per-share increases

• Total shareholder distributions

(1)

of $23.6 billion

• Proved oil and natural gas reserves

(1)

additions of 1.5 billion oil-equivalent barrels, replacing more

than 100 percent of production for the 21st consecutive year

• Completed eight major Upstream projects with working interest production capacity of more than 250 thousand

oil-equivalent barrels per day, highlighted by the Papua New Guinea Liquefied Natural Gas project

• Began construction of a world-scale steam cracker at our integrated complex in Baytown, Texas, to capitalize

on abundant supplies of American natural gas liquids

• Investing in a new delayed coker unit at our refinery in Antwerp, Belgium, to convert lower-value

bunker fuel oil into higher-value diesel products

• Successfully drilled the first ExxonMobil-Rosneft Joint Venture Kara Sea exploration well

in the Russian Arctic

• Exploration discoveries totaling 2.7 billion oil-equivalent barrels

(1) See Frequently Used Terms on pages 44 and 45.

(2) Net income attributable to ExxonMobil.

(3) Competitor data estimated on a consistent basis with ExxonMobil and based on public information.

Eric Whetstone • Whetstone Design

EDITOR

Nick Berthiaux • Investor Relations

Exxon Mobil Corporation, Irving, TX

Carol Zuber-Mallison • ZM Graphics, Inc.

studio/cell: 214-906-4162 • fax: 817-924-7784

ATTENTION: OWNER VERSION

APPROVED BY

Feb. 13, 2015

FILE INFO

LAST FILE CHANGE MADE BY

C S04A 14XOM-

FuncEarnings.ai

IN F&O ON PAGE

IN SAR ON PAGE

Includes link file

50

40

30

20

10

0

–3 2010 2011 201420132012

Functional Earnings and Net Income

(billions of dollars)

Upstream Downstream Chemical Corporate

and Financing

Net

Income(2)

25

20

15

10

5

0

Return on Average Capital Employed(1)(3)

ExxonMobil ShellChevron BPTotal

(percent)

2014 2010–2014 average

Eric Whetstone • Whetstone Design

EDITOR

Nick Berthiaux • Investor Relations

Exxon Mobil Corporation, Irving, TX

Carol Zuber-Mallison • ZM Graphics, Inc.

studio/cell: 214-906-4162 • fax: 817-924-7784

ATTENTION: OWNER VERSION

APPROVED BY

Feb. 19, 2015

FILE INFO

LAST FILE CHANGE MADE BY

C S04B 14XOM-

ROCE.ai

IN F&O ON PAGE

IN SAR ON PAGE

Includes link file

2014: Financial & Operating Summary

4EXXONMOBIL 2014 SUMMARY ANNUAL REPORT