Experian 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 Experian Annual Report 2008

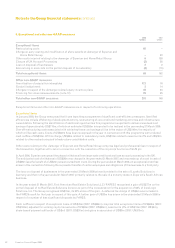

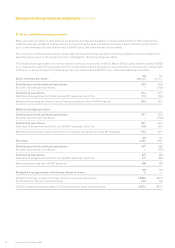

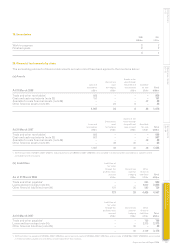

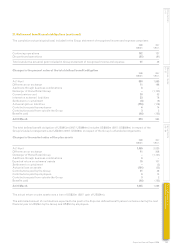

21. Trade and other receivables

(a) The analysis of trade and other receivables disclosed in the Group balance sheet is as follows:

Current Non-current Current Non-current

2008 2008 2007 2007

US$m US$m US$m US$m

Trade receivables 768 – 604 –

Less: provision for impairment of trade receivables (24) – (14) –

Less: other provisions in respect of trade receivables (19) – (16) –

Trade receivables – net 725 – 574 –

Amounts owed by associates 3 – 3 –

VAT recoverable 1 – 1 –

Other prepayments and accrued income 302 9 216 11

1,031 9 794 11

There is no material difference between the fair value of trade and other receivables and the book value stated above.

All non-current trade and other receivables are due within five years from the balance sheet date.

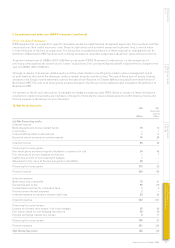

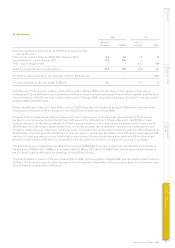

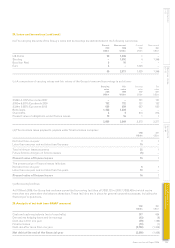

(b) The carrying amounts of the Group’s trade and other receivables are denominated in the following currencies:

Current Non-current Current Non-current

2008 2008 2007 2007

US$m US$m US$m US$m

US Dollar 327 4 335 7

Sterling 306 – 249 –

Brazilian Real 87 – 1 –

Euro 250 4 180 3

Other 61 1 29 1

1,031 9 794 11

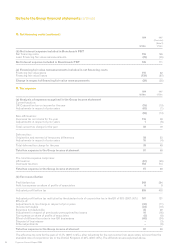

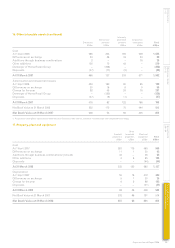

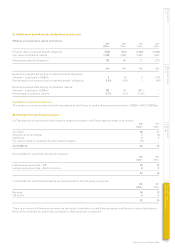

(c) Trade receivables of US$530m (2007: US$415m) were neither past due nor impaired and these are further analysed as follows:

Current Current

2008 2007

US$m US$m

New customers (of less than six months’ standing) 41 42

Existing customers (of more than six months’ standing)

with no defaults in the past 478 356

Existing customers (of more than six months’ standing)

with defaults in the past which were fully recovered 11 17

530 415

None of these trade receivables has been renegotiated in the year.

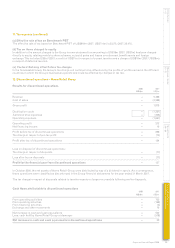

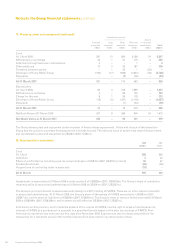

Notes to the Group financial statements continued