Equifax 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>By any measure, Equifax drove extraordinary performance for its

shareholders in 2012. Our strategy of bringing together diverse data

assets, developing valuable insights through analytics, and delivering

the results through our proprietary decisioning applications continues

to be successful. As has been proven now through diverse economic

conditions, enabling critical business decisions with confidence in a

world of increased opportunity and risk is highly valued by our

customers.

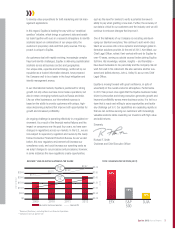

As a result of rigorous execution of our long-term strategy, revenues

of $2.2 billion in 2012 topped the previous year by 10%. Indicative

of the success of our growth initiatives and expense management,

including LEAN and other process improvements, our Adjusted

Earnings per Share grew 18%. The Company’s dividend payout was

increased by 22% − the third increase in the past four years −

consistent with our policy of returning 25%-35% of net income to

shareholders.

For the year, Equifax generated $1.8 billion in shareholder wealth, with

our stock price appreciating 40% over the past 12 months, reaching a

new all-time high. This combination of growth, operating performance

and shareholder return earned us a 24th ranking in the Bloomberg

Businessweek listing of the top 50 performing companies in 2012.

These results were accomplished through aggressive and successful

pursuit of new business with existing and new customers, and further

penetration of our targeted vertical markets through innovative solu-

tions. The Equifax story is one of a successful and resilient business

strategy, created and implemented by an exceptional management

team, achieving robust results year-over-year through service to an

expanding and increasingly diverse base of customers. We enter 2013 with great

optimism about the opportunities for growth and improved returns on our investments.

Sustaining Robust Growth

Broad-based and diverse growth drove 2012 gains across our business units and geographic

markets. We achieved growth in three ways: by extending our existing portfolio of products and

services to more customers; by developing new solutions and expanding share-of-wallet; and by

implementing compelling new decisioning tools for our customers. The range of customer needs that

Equifax addresses has broadened immensely in recent years. Our solid strategic foundation guides

our efforts: expanding an unmatched array of differentiated data assets and customized

analytics; delivering relevant, high-value products to the marketplace that reflect constant listening

to the voice of the customer; strengthening our capabilities in vertical markets with focused expertise

and dedicated resources; making strategic acquisitions and integrating them with a rigorous

discipline; driving relentless process improvement; and recruiting and developing the strongest

possible management and professional talent.

To Our

Shareholders

“As has been proven

now through diverse

economic conditions,

enabling critical

business decisions with

confidence in a world of

increased opportunity

and risk is highly valued

by our customers.”

1Equifax 2012 Annual Report

1