Equifax 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PSOL has made great strides in understanding our customers’

needs. As a result, we can test and deploy products more rapidly

and engage consumers in ways that increase loyalty and lifetime

value. Our marketing insights also allow us to optimize the

PSOL solutions that our partners extend to their customers.

A major success of 2012 was PSOL’s extension of the U.S.

platform and product set to our Canada and United Kingdom

markets. These markets offer opportunity for strong growth,

which we saw in 2012 as each country grew its direct-to-con-

sumer solutions revenue double-digits. In each of these markets,

PSOL is positioning Equifax as the premier provider of informa-

tion services consumers can trust for quality and value.

North America Commercial Solutions

The NACS business unit delivers deep business intelligence

on more than 30 million small- and mid-sized North American

businesses, empowering its customers with decisions about

marketing, credit risk and commercial relationships. Serving an

increasingly diverse customer base, NACS solutions are built on

high-quality data assets, analytics and proprietary decisioning

technology. Facing a very weak economic environment in 2012,

the business unit generated $90 million in revenues with an

operating margin of 22.0%.

The NACS database includes firm-specific financial and non-

financial information, plus the ability in many cases to map

relationships with other businesses and owners. Banks and

telecommunications are our core customer segments, with

expansion underway to other verticals.

New Product Innovation played a significant role in NACS market

penetration in 2012. The launch of QTC Advantage™, a cloud-

based decisioning platform, provided customers with greater

integration and visibility across the sales, credit and collections

functions for improved account development and management.

For financial institutions, EFX Link™ was introduced to enable

lenders to securely consolidate their own business portfolio data

with the unique data assets of Equifax. This solution provides

a comprehensive view for our customers that enables faster

and more accurate identification of business-to-business

opportunities.

Leveraging the strong customer and market segment expertise

of USCIS, we have broadened and deepened the NACS customer

base and have driven significant new revenue growth utilizing its

sales organization. The synergy and impact of these two busi-

ness units working together will become even stronger going

forward. This expanded distribution capacity, coupled with an

unparalleled emphasis on new product innovation, is expected to

drive continued share gains and position NACS for accelerated

growth in 2013.

North America Commercial Solutions (NACS) serves banks,

telcos and manufacturing businesses with information

on small- and medium-sized companies, helping them to

intelligently protect and grow their businesses by providing

data and capabilities to better manage risk, fraud and

credit; integrate data; and improve marketing and account

acquisition decisions.

Alex Gonzalez, President, North America Commercial Solutions

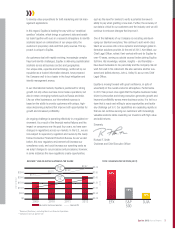

COMMERCIAL REVENUE (2012)

(in millions)

Q1 Q2 Q3 Q4

$21

$28

$21

$20

8 Equifax 2012 Annual Report