Equifax 2002 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2002 Equifax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OUR BUSINESS DESCRIPTION

CONTENTS

Equifax, a 104-year-old S&P 500 company, enables and secures global commerce through its information management, marketing,

consumer direct, and fraud, safety and security solutions. As a leader in information technology, Equifax serves customers across a wide

range of industries and markets, including: financial services, retail, telecommunications, utilities, mortgage, brokerage, insurance, auto-

motive, healthcare, direct marketing, government, security and transportation. Equifax also enlightens, enables and empowers consumers

to manage and protect their financial health with consumer direct services offered at www.equifax.com. Equifax employs approximately

5,000 people in 13 countries: the United States, Canada, England, Ireland, Italy, Spain, Portugal, Argentina, Brazil, Chile, El Salvador, Peru

and Uruguay. Revenue was $1.1 billion for 2002.

Equifax Financial Highlights IFC

A Look At Equifax Foldout

Letter to Shareholders 2

The Equifax Difference at Work 6

Information Services 8

Marketing Services 10

Consumer Direct 12

Fraud, Safety & Security 14

Board of Directors 16

Financials 18

Corporate Information IBC

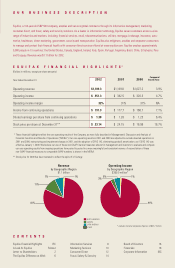

Year Ended December 31

Operating revenue $1,109.3 $1,109.8 $1,027.2 3.9%

Operating income $351.3 $342.5 $ 320.3 4.7%

Operating income margin 32% 31% 31% NA

Income from continuing operations $191.3 $177.7 $ 166.7 7.1%

Diluted earnings per share from continuing operations $1.38 $1.28 $ 1.23 6.4%

Stock price per share at December 31** $23.14 $24.15 $ 16.98 16.7%

Compound

Growth Rate

2001 2000

** These financial highlights reflect the core operating results of the Company, as more fully described in Management’s Discussion and Analysis of

Financial Condition and Results of Operations (“MD&A”). Our core operating results in 2001 and 2000 are adjusted to exclude divested operations in

2001 and 2000, restructuring and impairment charges in 2001, and the adoption of SFAS 142, eliminating goodwill amortization, as if SFAS 142 was

effective January 1, 2000. We believe our use of these non-GAAP financial measures allows for management and investors to evaluate and compare

our core operating results from ongoing operations from period to period in a more meaningful and consistent manner. A reconciliation of these

non-GAAP financial measures to comparable GAAP numbers is shown in the MD&A.

** Stock price for 2000 has been restated to reflect the spin-off of Certegy.

EQUIFAX FINANCIAL HIGHLIGHTS

*

(Dollars in millions, except per share amounts)

2002

Revenue

by Geographic Region

$1.1 billion

Operating Income

by Geographic Region

$399.0 million*

NORTH AMERICA

EUROPE

LATIN AMERICA

OTHER

1%

* excludes General Corporate Expense of $47.7 million

91%

5%

3%

7%

11%

81%

1%