Entergy 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

128

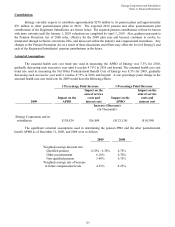

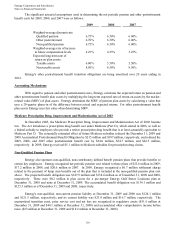

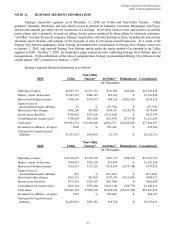

The significant actuarial assumptions used in determining the net periodic pension and other postretirement

benefit costs for 2009, 2008, and 2007 were as follows:

2009 2008 2007

Weighted-average discount rate:

Qualified pension 6.75% 6.50% 6.00%

Other postretirement 6.70% 6.50% 6.00%

Non-qualified pension 6.75% 6.50% 6.00%

Weighted-average rate of increase

in future compensation levels 4.23% 4.23% 3.25%

Expected long-term rate of

return on plan assets:

Taxable assets 6.00% 5.50% 5.50%

Non-taxable assets 8.50% 8.50% 8.50%

Entergy's other postretirement benefit transition obligations are being amortized over 20 years ending in

2012.

Accounting Mechanisms

With regard to pension and other postretirement costs, Entergy calculates the expected return on pension and

other postretirement benefit plan assets by multiplying the long-term expected rate of return on assets by the market-

related value (MRV) of plan assets. Entergy determines the MRV of pension plan assets by calculating a value that

uses a 20-quarter phase-in of the difference between actual and expected returns. For other postretirement benefit

plan assets Entergy uses fair value when determining MRV.

Medicare Prescription Drug, Improvement and Modernization Act of 2003

In December 2003, the Medicare Prescription Drug, Improvement and Modernization Act of 2003 became

law. The Act introduces a prescription drug benefit cost under Medicare (Part D), which started in 2006, as well as

a federal subsidy to employers who provide a retiree prescription drug benefit that is at least actuarially equivalent to

Medicare Part D. The actuarially estimated effect of future Medicare subsidies reduced the December 31, 2009 and

2008 Accumulated Postretirement Benefit Obligation by $215 million and $187 million, respectively, and reduced the

2009, 2008, and 2007 other postretirement benefit cost by $24.0 million, $24.7 million, and $26.5 million,

respectively. In 2009, Entergy received $5.1 million in Medicare subsidies for prescription drug claims.

Non-Qualified Pension Plans

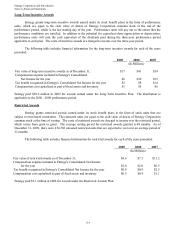

Entergy also sponsors non-qualified, non-contributory defined benefit pension plans that provide benefits to

certain key employees. Entergy recognized net periodic pension cost related to these plans of $23.6 million in 2009,

$17.2 million in 2008, and $20.6 million in 2007. In 2009, Entergy recognized a $6.7 million settlement charge

related to the payment of lump sum benefits out of the plan that is included in the non-qualified pension plan cost

above. The projected benefit obligation was $147.9 million and $138.4 million as of December 31, 2009 and 2008,

respectively. There were $0.2 million in plan assets for a pre-merger Entergy Gulf States Louisiana plan at

December 31, 2008 and none at December 31, 2009. The accumulated benefit obligation was $134.1 million and

$125.5 million as of December 31, 2009 and 2008, respectively.

Entergy's non-qualified, non-current pension liability at December 31, 2009 and 2008 was $124.1 million

and $121.5 million, respectively; and its current liability was $23.8 million and $16.7 million, respectively. The

unamortized transition asset, prior service cost and net loss are recognized in regulatory assets ($51.6 million at

December 31, 2009 and $44.1 million at December 31, 2008) and accumulated other comprehensive income before

taxes ($23 million at December 31, 2009 and $18.2 million at December 31, 2008).

130