Entergy 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries

Notes to Financial Statements

109

Indian Point 2, Indian Point 3, and Palisades

$4.5 million weekly indemnity

$490 million maximum indemnity

Deductible: 12 week waiting period

FitzPatrick and Pilgrim

$4.0 million weekly indemnity

$490 million maximum indemnity

Deductible: 12 week waiting period

Vermont Yankee

$3.5 million weekly indemnity

$435 million maximum indemnity

Deductible: 12 week waiting period

Under the property damage and accidental outage insurance programs, all NEIL insured plants could be

subject to assessments should losses exceed the accumulated funds available from NEIL. Effective April 1, 2009,

the maximum amounts of such possible assessments per occurrence were as follows:

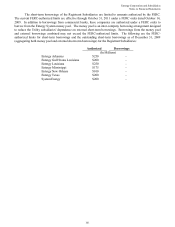

Assessments

(In Millions)

Utility:

Entergy Arkansas $21.3

Entergy Gulf States Louisiana $17.1

Entergy Louisiana $19.0

Entergy Mississippi $0.07

Entergy New Orleans $0.07

Entergy Texas N/A

System Energy $15.1

Non-Utility Nuclear $-

Effective April 1, 2009, potential assessments for the Non-Utility Nuclear plants are covered by insurance obtained

through NEIL's reinsurers.

Entergy maintains property insurance for its nuclear units in excess of the NRC's minimum requirement of

$1.06 billion per site for nuclear power plant licensees. NRC regulations provide that the proceeds of this insurance

must be used, first, to render the reactor safe and stable, and second, to complete decontamination operations. Only

after proceeds are dedicated for such use and regulatory approval is secured would any remaining proceeds be made

available for the benefit of plant owners or their creditors.

In the event that one or more acts of terrorism causes property damage under one or more or all nuclear

insurance policies issued by NEIL (including, but not limited to, those described above) within 12 months from the

date the first property damage occurs, the maximum recovery under all such nuclear insurance policies shall be an

aggregate of $3.24 billion plus the additional amounts recovered for such losses from reinsurance, indemnity, and any

other sources applicable to such losses. The Terrorism Risk Insurance Reauthorization Act of 2007 created a

government program that provides for up to $100 billion in coverage in excess of existing coverage for a terrorist

event.

111