Energy Transfer 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Energy Transfer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Unitholders:

In looking back at 2012, it was a time of remarkable change for

Energy Transfer Partners -- the transformation from a leading natural

gas transmission company to one of the largest and most diversified

midstream energy companies in the country -- all while

remaining focused on delivering value for our Unitholders. With

incredible focus and fortitude, we delivered to the marketplace an

energy partnership with an unmatched logistics and transportation

services platform for natural gas, natural gas liquids, crude oil and

refined products.

A Strategic Transformation

Energy Transfer commenced several initiatives to expand services

in response to changing market dynamics with an emphasis on

geographic, business-line and fee-based diversification.

Key 2012 Milestones include:

• Exited a noncore business through the contribution of our

propane business to AmeriGas at an attractive valuation; the

transaction also reduced our exposure to the weather-sensitive

propane business.

• In connection with Energy Transfer Equity’s acquisition of

Southern Union, we acquired Southern Union’s 50% interest

in Florida Gas Transmission. This strategic acquisition expanded

our geographic reach into Florida with an emphasis on regu-

lated, stable fee-based income.

• Completed the Sunoco acquisition, which included the general

partner interests, Incentive Distribution Rights, a 32.4% limited

partner interest in Sunoco Logistics Partners (SXL), and the

Sunoco-branded gasoline and convenience store retail business.

• Expanded our business platform to include transporting

heavier hydrocarbons

• Retail business generates stable cash flows from

approximately 5,000 retail locations in the United States

• Assumed control of Southern Union assets through the

formation of ETP Holdco to maximize commercial and

operational strategies

• Announced an agreement to sell the regulated utilities, which

continues efforts to streamline our asset portfolio through the

divestiture of noncore assets.

• Eagle Ford Shale and Permian Basin NGL build-out of more than

$2.1 billion of predominantly fee-based projects, on time and

on budget, to diversify Energy Transfer into higher margin rich

gas and liquids business. Projects included:

• Red River Pipeline

• Mont Belvieu Fractionator I

• West Texas Gateway Pipeline

• Justice Pipeline

• Kenedy Processing Plant (Karnes County Processing Plant)

Looking Ahead

Having completed several major transactions in 2012, our core

focus is to continue delivering on our promise to simplify our

structure to provide greater transparency, while optimizing our

assets and resuming distribution growth.

Simplify Structure: The announced sale of Southern Union’s

regulated utilities (expected to close in third quarter of 2013), the

contribution of Southern Union Gathering Company to Regency

Energy Partners in second quarter of 2013, and ETP's acquisition

of Energy Transfer Equity's interest in ETP Holdco in the second

quarter of 2013 have set the stage for simplifying our partnership

structure, which in turn provides greater transparency for our

Unitholders.

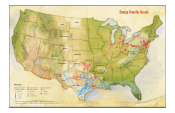

Optimize Our Assets: We have a significant number of strategic

initiatives in progress, including the continued infrastructure

build-out in the Eagle Ford Shale and Permian Basin, the Trunkline

pipeline conversion from natural gas to crude oil service, and the

Trunkline LNG export project. In addition, an extremely important

growth target for our partnership is the exportation of liquefied

petroleum gas (LPG) in response to the continued growth in

North American LPG production and the increasing demand

internationally for LPG supplies. In order to capitalize on this

business opportunity, we intend to construct an LPG export/import

facility on the Gulf Coast as a joint project between our affiliate

partnership, SXL, and our Lone Star NGL joint venture with Regency.

Resume Distribution Growth: In closing, it is important to take this

opportunity to emphasize again our commitment to providing

increased value by returning to an environment of distribution

growth for our Unitholders. Even though we have been able to

maintain a strong payout of distributions to our Unitholders

($3.575 per common unit on an annualized basis) during a time

when many have not, we understand that increasing distributions is

a must for us going forward.

We thank you for believing in us.

Unitholder Letter

Kelcy L. Warren

Chairman of the Board and Chief Executive Officer