Eli Lilly 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

LE T TER TO SHARE HOLDERS

Sidney Taurel

Chairman of the Board and Chief Executive Officer

Prepared for the Future

The intense pressures on the pharmaceutical industry

that I have discussed with you over the past few years

continued unabated in 2005. Several factors are at play.

First, payers around the world are struggling with

the costs of health care in general and drugs in particular.

In the European Union and Japan, aging populations

are straining health care budgets, and governments are

pursuing policies that hold down prices of and access to

innovative medicines.

In the U.S., pressure on payers—whether employers,

states or the federal government—is also intense. The new

Medicare Modernization Act will profoundly change how

drugs are paid for in the U.S. Starting in January, Medicare

for the first time began providing prescription drug cover-

age for more than 42 million people over age 65 or with

disabilities. As a result, the percentage of Lilly’s drugs paid

for by federal and state governments in the U.S. will rise

from 33 percent to about 50 percent. While we may see

some modest near-term benefit from the MMA, we antici-

pate ongoing pressure on our prices over the long term.

Second, in the wake of some antidepressants being

associated with suicidal thoughts as well as the with-

drawal of Vioxx®, concerns over safety are overwhelming

any sense of balance with efficacy in the media and

among politicians—and this in turn has made regulatory

agencies more cautious. For example, in 2005 the FDA

required 60 black box warnings be added to product

labels—nearly triple the 21 it required in 2003.

Third, these challenges come during a period when

the industry is struggling to produce new drugs. For

example, in the five years from 2001 to 2005, the FDA

approved nearly 40 percent fewer new molecular enti-

ties than in the preceding five-year period. In addition,

in this decade the industry will lose patent exclusivity

on products with annual sales of some $100 billion. As

a result, global pharmaceutical sales growth has slowed

from the strong double-digits in the late ’90s to the single

digits today and into the foreseeable future.

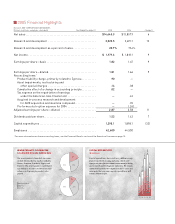

In this industry environment, Lilly delivered adjusted

earnings-per-share of $2.87, up 11 percent over 2004.

This compares with about 7 percent EPS growth average

for large pharmaceutical companies as a whole. (For a

reconciliation of our adjusted EPS to the reported EPS of

$1.81, please see page 1.) This performance was the result

of 6 percent sales growth, disciplined expense control and

increased productivity.

In addition, in 2005 we moved past major uncer-

tainties—several involving Zyprexa®, our top-selling

product. The U.S. district court in Indianapolis emphati-

cally reaffirmed the validity of our Zyprexa patent and

we announced a tentative settlement of the bulk of our

U.S. product liability litigation involving this important

product. The CATIE study—a seminal comparison of

antipsychotics conducted by the National Institute of

Mental Health—concluded that patients in the study tak-

ing Zyprexa were more likely to stay on their medication

than patients taking other antipsychotics studied, and

were less likely to be hospitalized for a psychotic relapse.

In addition, after a series of successful inspections of

our global manufacturing sites, the FDA has strongly

endorsed our manufacturing and quality improvements.

Focus on innovation bears fruit

Lilly has distinguished itself with the innovation-

driven strategy we have implemented for the past decade.

We chose to remain independent; to invest in R&D at the

top of the industry with the goal of delivering a steady

flow of innovative products; to build the capabilities to

manufacture these products and market them effectively