Eli Lilly 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FI NA NCI A L S

13

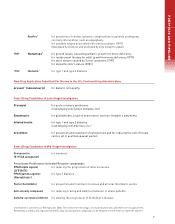

REVENUES

($ millions)

Twelve products exceeded $300

million in net revenues during

2005. Five of these products—

Zyprexa, Gemzar, Humalog,

Evista, and Humulin—exceeded

$1 billion in 2005. In addition,

the combined efforts of Lilly and

ICOS generated worldwide

Cialis sales of $747 million.

Zyprexa

Gemzar

Humalog

Evista

Humulin

Cymbalta

Strattera

Actos

Alimta

Prozac/Sarafem/

Prozac Weekly

Humatrope

Forteo

$1,036

$1,005

$680

$552

$493

$463

$453

$414

$389

$4,202

$1,335

$1,198

Review of Operations

EXECUTIVE OVERVIEW

This section provides an overview of our financial re-

sults, product launches and late-stage product pipeline

developments, and legal and governmental matters

affecting our company and the pharmaceutical industry.

Financial Results

We achieved worldwide sales growth of 6 percent, due in

part to the launch in 2004 of five new products as well as

six new indications or formulations for expanded use of

new and existing products in key markets. In addition, we

launched one new product in the U.S. and several new

products, new indications, or new formulations in key

markets in 2005. We continued our substantial invest-

ments in our manufacturing operations and research

and development activities, resulting in cost of products

sold and research and development costs increasing at

rates greater than sales. Despite product launch expen-

ditures, our cost-containment and productivity measures

contributed to marketing and administrative expenses

increasing at a rate less than sales. During 2005, we

began to expense stock options, which had the effect of

increasing our research and development and marketing

and administrative expenses. We also benefited from an

increase in net other income due primarily to increased

profitability of the Lilly ICOS joint venture and a decrease

in the tax rate in 2005. Net income was $1.98 billion, or

$1.81 per share, in 2005 as compared with $1.81 billion,

or $1.66 per share, in 2004, representing an increase

in net income and earnings per share of 9 percent. Net

income comparisons between 2005 and 2004 are also

affected by the impact of the following significant items

that are reflected in our financial results (see Notes 1, 2,

3, 4, 7, 11, and 13 to the consolidated financial statements

for additional information):

2005

•

We incurred a charge related to product liability litigation

matters, primarily related to Zyprexa®, of $1.07 billion

(pretax), which decreased earnings per share by $.90 in

the second quarter of 2005 (Notes 4 and 13).

• In 2005, we began to expense stock options in ac-

cordance with SFAS 123(R). Had we expensed stock

options in 2004, our 2004 net income would have been

lower by $266.4 million, which would have decreased

earnings per share by $.24 per share (Notes 1 and 7).

• We recognized asset impairment and other special

charges of $171.9 million (pretax) in the fourth quarter,

which decreased earnings per share by $.14 (Note 4).

• We adopted Financial Accounting Standards Board

(FASB) Interpretation (FIN) 47, Accounting for Condi-

tional Asset Retirement Obligations, an interpretation

of FASB Statement No. 143, in the fourth quarter of

2005. The adoption of FIN 47 resulted in an adjustment

for the cumulative effect of a change in accounting

principle of $22.0 million (after-tax), which decreased

earnings per share by $.02 (Note 2).

2004

•

We recognized asset impairment charges, streamlined

our infrastructure, and provided for the anticipated reso-

lution of the government investigation of Evista® market-

ing and promotional practices, resulting in charges of

$108.9 million (pretax) in the second quarter and $494.1

million (pretax) in the fourth quarter, which decreased

earnings per share by $.08 and $.30, respectively (Note 4).

• We incurred charges for acquired in-process research

and development (IPR&D) of $362.3 million (no tax ben-

efit) in the first quarter related to the acquisition

of Applied Molecular Evolution, Inc. (AME), and

$29.9 million (pretax) in the fourth quarter related to our

acquisition of a Phase I compound currently under de-

velopment as a potential treatment for insomnia, which

decreased earnings per share by $.33 in the first quarter

and $.02 in the fourth quarter (Note 3).

• As discussed further in Financial Condition, we rec-

ognized tax expenses of $465.0 million in the fourth

quarter associated with the anticipated repatriation in

2005 of $8.00 billion of our earnings reinvested outside

the U.S., as a result of the passage of the American Jobs

Creation Act of 2004 (AJCA). This tax expense decreased

earnings per share by $.43 in that quarter (Note 11).

Recent Product Launches and Late-Stage Product

Pipeline Developments

Our long-term success depends, to a great extent, on

our ability to continue to discover and develop innovative

pharmaceutical products and acquire or collaborate on

compounds currently in development by other biotech-

nology or pharmaceutical companies. We have achieved

a number of successes with recent product launches and

late-stage pipeline developments, including:

• We are in the process of rolling out the global launches

of a number of new products, including Alimta®, Byetta®,

Cialis®, Cymbalta®, Forteo®, Strattera®, Symbyax®, and

Yentreve®. In addition, we recently launched new indica-

tions or formulations of Alimta, Cymbalta, Gemzar®,